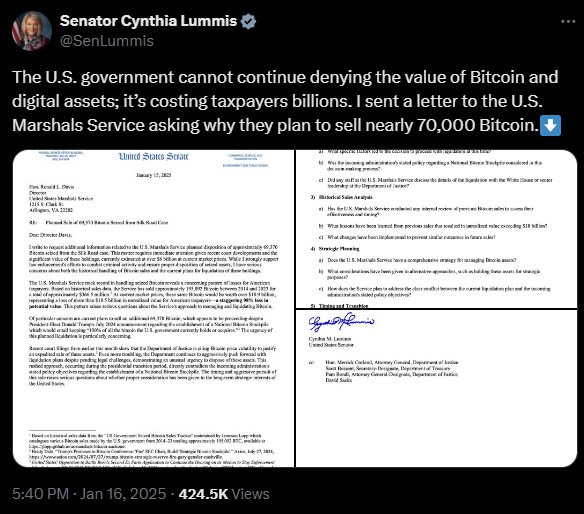

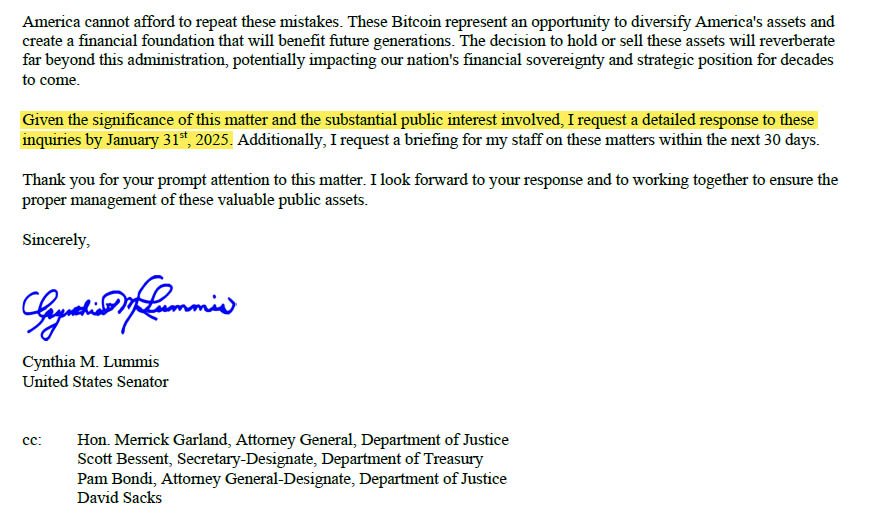

Senator Cynthia Lummis (R-WY) had previously asked the U.S. Marshals Service to explain what they’re doing with nearly 70,000 bitcoin seized from the Silk Road case, and now they missed the deadline to provide answers.

The government agency’s silence on the matter raises uncertainty about whether they are making decisions “in the best interest of taxpayers.”

The U.S. Marshals Service is responsible for the assets seized in criminal investigations, including bitcoin. Since 2014 they’ve sold off over 195,000 BTC—often for pennies on the dollar.

One big example was in 2017 when they sold 140,000 Silk Road bitcoin for $330 each. That huge stash is now worth over $14 billion.

Lummis is opposing the sale of another 69,370 bitcoin from Silk Road, worth around $6.9 billion. She thinks the U.S. is making a huge financial mistake by selling instead of holding them as an asset.

“The historical record of Bitcoin sales by the U.S. Marshals Service, resulting in over $17 billion in unrealized value for taxpayers, serves as a stark reminder of the cost of hasty liquidation decisions,” Lummis wrote to the agency.

Lummis’ concerns come as U.S. President Donald Trump has announced a National Digital Asset Stockpile plan. He wants the U.S. government to keep all the bitcoin it has or acquires—instead of selling it.

She noted that the sale of 69,370 bitcoin contradicts Trump’s plan, “The timing and aggressive pursuit of this sale raises serious questions about whether proper consideration has been given to the long-term strategic interest of the United States.”

The Republican senator is not just opposing the sale—she wants the U.S. to buy more. She introduced the BITCOIN Act which would require the U.S. Treasury to buy 200,000 bitcoin per year until it has 1 million BTC. That would give the government 5% of the total bitcoin in the world.

Senator Lummis and other lawmakers think Bitcoin could help the U.S. economy and hedge against inflation and national debt which is now over $36 trillion.

Other countries are already looking into this. El Salvador has gone a step further and made bitcoin legal tender while building an actual bitcoin reserve. Some U.S. states like Texas and Oklahoma are considering state-level bitcoin reserves to protect against the devaluation of the U.S. dollar.

Lummis is going after the U.S. Marshals Service but she’s also taking on the FDIC for allegedly targeting Bitcoin businesses.

The FDIC is reportedly pressuring banks to cut ties with Bitcoin companies just like it did during the Obama era’s Operation Chokepoint. Whistleblowers say the agency destroyed important documents related to its oversight of digital assets.

Lummis is demanding transparency, saying if documents were destroyed intentionally, criminal referrals would be made.

“The FDIC’s alleged actions are unacceptable and illegal,” she wrote, emphasizing all digital asset records dated 2022 and later should be preserved.

Lummis is leading the charge in Washington and is chair of the new Senate Subcommittee on Digital Assets. With Senator Tim Scott, she looks to introduce bipartisan bills to regulate the Bitcoin industry, protect consumers and build a national bitcoin reserve.