Retail Bitcoin trading has exploded on to the scene. However, some countries are recording more volume than others. Gemini in partnership with Glassnode published their report on 5 February 2025. As per this report, the Asia-Pacific region is ahead of the US and Europe in retail Bitcoin trading.

The largest digital asset by market capitalization – Bitcoin, grew 6.4$ YOY in January 2025 in the Asia Pacific region.

This data however excludes Exchange Traded Funds (ETFs).

As per the report, Bitcoin trading in the US fell 5.7% from a year ago. The dip was 0.7% in the European Union (EU).

NEW: Retail Bitcoin trading is growing faster in Asia-Pacific than in the

US and

EU, driven by non-institutional investors, according to Gemini and Glassnode. pic.twitter.com/o8kDXK0n3q

— Bitcoin News (@BitcoinNewsCom) February 6, 2025

Glassnode analyzed global transaction timestamps. They linked BTC activity to the working hours in different regions and found a surge in retail and individual trading outside of the US. This points to a possible shift in retail trading activity between the two regions.

With Donald Trump winning elections, there has been a lot of movement in the global crypto space. Trump ordered the creation of a cryptocurrency working group in January. The working group primarily worked on the creation of a national crypto stockpile and propose new digital asset regulations.

US lawmakers and regulators revealed the beginning of a cryptocurrency framework prioritizing stablecoin legislations to maintain and reinforce USDs global financial dominance.

Explore: SEC Rolls Back Crypto Enforcement: End Of SEC Crypto Task force, Golden Era For Crypto?

Clearer Regulations In Key Markets Supports Growth in Asia Pacific

According to Saad Ahmed, head of Gemini’s Asia Pacific business, the US market has seen strong institutional interest. However, the 5.7% decline in Bitcoin supply growth suggest a cautious approach by retail investors even though institutional investors remain optimistic. The retail investors might be waiting out in anticipation of clearer signals from US decision makers.

“In contrast, Asia-Pacific’s growth reflects increasing retail participation, likely supported by clearer regulations in key markets like Singapore. This regulatory certainty may be giving investors more confidence to enter the market,” said Ahmed.

Retail is coming back into crypto

With pro-crypto administration now in place, the industry is poised for growth

Don’t miss what’s next

We partnered with Glassnode to uncover 6 key onchain trends: pic.twitter.com/MMTgMDCHEm

— Gemini (@Gemini) February 5, 2025

The report found major cryptocurrencies like Bitcoin, Ethereum, Solana had a significant increase in their capital inflow in 2024. Solana however, emerged as the fastest growing digital asset ecosystem amongst them.

The report noted that since the industry low of 2022, the price of Solana outperformed both Ether and Bitcoin on 344 out of 727 trading days.

This shows a strong market demand and a substantial growth for the digital asset. Bitcoin however remains as the most traded asset with the largest share of capital inflow. As the market has matured along with the adoption of digital assets the derivatives markets too have grown significantly.

Explore: BlackRock’s Spot Bitcoin ETF Saw Over $37 Billion in Net Inflows in 2024

Bitcoin, Ethereum EFTs Emerge As Catalysts For Crypto Bull Run

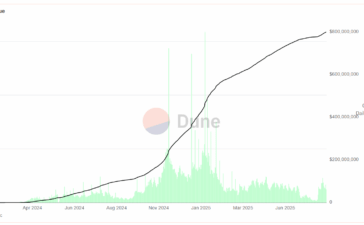

As per the report, launch of Bitcoin ETF and Ethereum ETF in 2024 were the main catalyst for the prevailing bull cycle. These ETF instruments provide institutional investors with spot exposure, unlocking untapped demand.

These two ETFs can be considered as two of the best performing ETFs in history. They have amassed a total of $111.2 Billion and $12.2 Billion for Bitcoin and Ethereum respectively.

The demand for Bitcoin and Ethereum ETF can be better understood when compared with gold ETFs. Gold ETF first started trading in March 28,2003. Since then, it currently, collectively holds $271 Billion assets under management (AUM). Compared to that, Bitcoin and Ethereum ETFs have accrued 47% of gold ETFs total AUM that is $126.4 Billion, in one year.

Explore: BTC Genesis Day 2025: What’s Going on With Bitcoin? Are Bitcoin ETFs Selling?

The post Asia Pacific Leads Retail Bitcoin Trading, Ahead Of USA And EU appeared first on 99Bitcoins.