Bitcoin’s correlation with global markets—attributed by some to increased institutional investment and algorithmic trading—challenges the narrative of it being a safe-haven asset, similar to gold. Bitcoin’s ‘Safe Haven’ Claim Challenged Following the U.S. imposition of a 25% tariff on Canadian and Mexican imports, bitcoin (BTC) briefly plummeted below $93,000, dragging the crypto market down. The […]

Bitcoin’s correlation with global markets—attributed by some to increased institutional investment and algorithmic trading—challenges the narrative of it being a safe-haven asset, similar to gold. Bitcoin’s ‘Safe Haven’ Claim Challenged Following the U.S. imposition of a 25% tariff on Canadian and Mexican imports, bitcoin (BTC) briefly plummeted below $93,000, dragging the crypto market down. The […]

Source link

Chain Articles > Blog > Bitcoin > Bitcoin’s Correlation With Markets Grows, Challenging ‘Safe Haven’ Narrative

Bitcoin’s Correlation With Markets Grows, Challenging ‘Safe Haven’ Narrative

posted on

You Might Also Like

Bitcoin Breaks $123K as Momentum Builds

Jack DaviesAugust 13, 2025

Bitcoin blasted past the $123,000 mark on Wednesday, breaking that barrier for the first time since July 14, 2025. On...

Jeff Bezos’ Blue Origin Now Accepts Bitcoin for Spaceflights

Jack DaviesAugust 13, 2025

Blue Origin, the private spaceflight company founded by Amazon billionaire Jeff Bezos, is now letting customers pay for trips to...

Circle to Launch Arc Blockchain | Live Crypto Updates | Aug. 15, 2025

Jack DaviesAugust 13, 2025

Disclaimer: This article is for informational purposes only and does not constitute financial advice. BitPinas has no commercial relationship with...

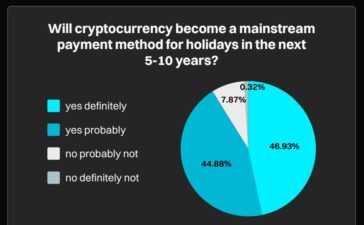

European Travelers Embrace Crypto: Bitget Survey Finds 85% Ready To Spend Crypto On Holidays

Jack DaviesAugust 13, 2025

Bitget’s recent survey has revealed that cryptocurrency is moving from investment portfolios to real-world spending quickly. A strong majority of...