Ethereum’s derivatives markets are flashing heightened activity as open interest climbs across futures and options, while liquidations reveal heavy pressure in recent trading sessions. Ethereum Open Interest and Options Activity Hit New Highs as August Comes to a Close Ethereum futures open interest has expanded sharply in recent weeks, climbing to more than $60 billion […]

Ethereum’s derivatives markets are flashing heightened activity as open interest climbs across futures and options, while liquidations reveal heavy pressure in recent trading sessions. Ethereum Open Interest and Options Activity Hit New Highs as August Comes to a Close Ethereum futures open interest has expanded sharply in recent weeks, climbing to more than $60 billion […]

Source link

Chain Articles > Blog > Bitcoin > Options Traders Pile Into Ethereum With Heavy December 2025 Call Positions

Options Traders Pile Into Ethereum With Heavy December 2025 Call Positions

posted on

You Might Also Like

Silent Onchain Shift: Coinbase Predicts Widespread Crypto Use Hidden in Everyday Apps

Jack DaviesOctober 19, 2025

Crypto’s future is charging toward mass adoption as seamless, invisible blockchain integration takes center stage, transforming digital experiences into effortless...

Coins.ph Cuts USDT/PHP Spread to 0.03% for High-Volume Traders, a Historic Low for the Exchange

Jack DaviesOctober 19, 2025

Disclaimer: This article is for informational purposes only and does not constitute financial advice. BitPinas has no commercial relationship with...

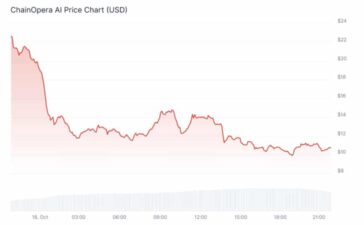

COAI Crypto Drops After Sprinting 100X: Is Chain Opera AI Run Finished?

Jack DaviesOctober 19, 2025

After a 100x sprint, COAI, once hyped as the best crypto to buy now, slumps over -52% in a day...

Schwab Sees 90% Crypto Surge, Plans 2026 Bitcoin Trading

Jack DaviesOctober 18, 2025

Charles Schwab is seeing booming engagement from retail investors in its crypto products. In an interview with CNBC, CEO Rick...