The total crypto market cap dropped over 2% in the past 24 hours to $3.85 trillion on Sep. 26 as Bitcoin fell below $109,000 threshold and more than $1.2 billion in liquidations hit the market.

Summary

- The crypto market has fallen by over 2% in the past 24 hours.

- A fresh round of Trump tariffs contributed to the market downturn.

- Over $1 billion in long positions were liquidated from the crypto market.

According to data from CoinGecko, only around 10 of the top 100 cryptocurrencies by market cap managed to remain in the green today, with major altcoins such as BNB (BNB) and Solana (SOL) recording losses of over 4% on the day.

Today’s downturn extended weekly losses for major cryptocurrencies, with Bitcoin (BTC) down over 6.5% in the past 7 days, while other majors like Ethereum (ETH), XRP (XRP), and Dogecoin (DOGE) recorded double-digit losses of 13.2%, 10%, and 18.4% respectively, over the same period.

A number of bearish catalysts were at play that triggered the market-wide sell-offs.

Crypto markets were rattled today after United States President Donald Trump announced fresh tariffs this time on pharmaceuticals, big-rig trucks, home renovation fixtures, and furniture, which reignited concerns of a renewed global trade war and its spillover effects on risk assets.

Trump’s tariff-related announcements have consistently led to heightened volatility for the crypto markets, as seen on multiple occasions throughout this year. This time, the trader sentiment was already fragile over fears that the Federal Reserve may not cut interest rates as the investors are expecting.

In his latest appearance, Fed Chair Jerome Powell took a hawkish stance over the possibility of further rate cuts this year, while other Fed officials, including Beth Hammack and Austan Goolsbee, urged the bank to exercise caution when cutting rates.

Their remarks have worked as fertile ground for a risk-off environment, leaving traders with little reason to hold onto risk assets and steering liquidity toward traditional havens like gold.

Bitcoin options expiry

Traders are also concerned as roughly $22.3 billion in crypto options are set to expire today, including $17.06 billion tied to Bitcoin.

As expiry approaches, BTC’s price often gravitates toward the “max pain point,” the strike level where option buyers incur the largest losses and sellers benefit most.

For this month’s expiry, bearish positions are concentrated in the $95,000 to $110,000 range. If Bitcoin fails to reclaim the $110,000 level by 8:00 a.m. UTC, put options could gain an advantage of about $1 billion, potentially adding further downside pressure to the already bleeding market.

Crypto Fear and Greed Index hits Fear territory

At the same time, the current environment has weighed on market sentiment. Notably, the Crypto Fear and Greed Index has slipped into Fear territory at 29 after dropping from this month’s high of 73.

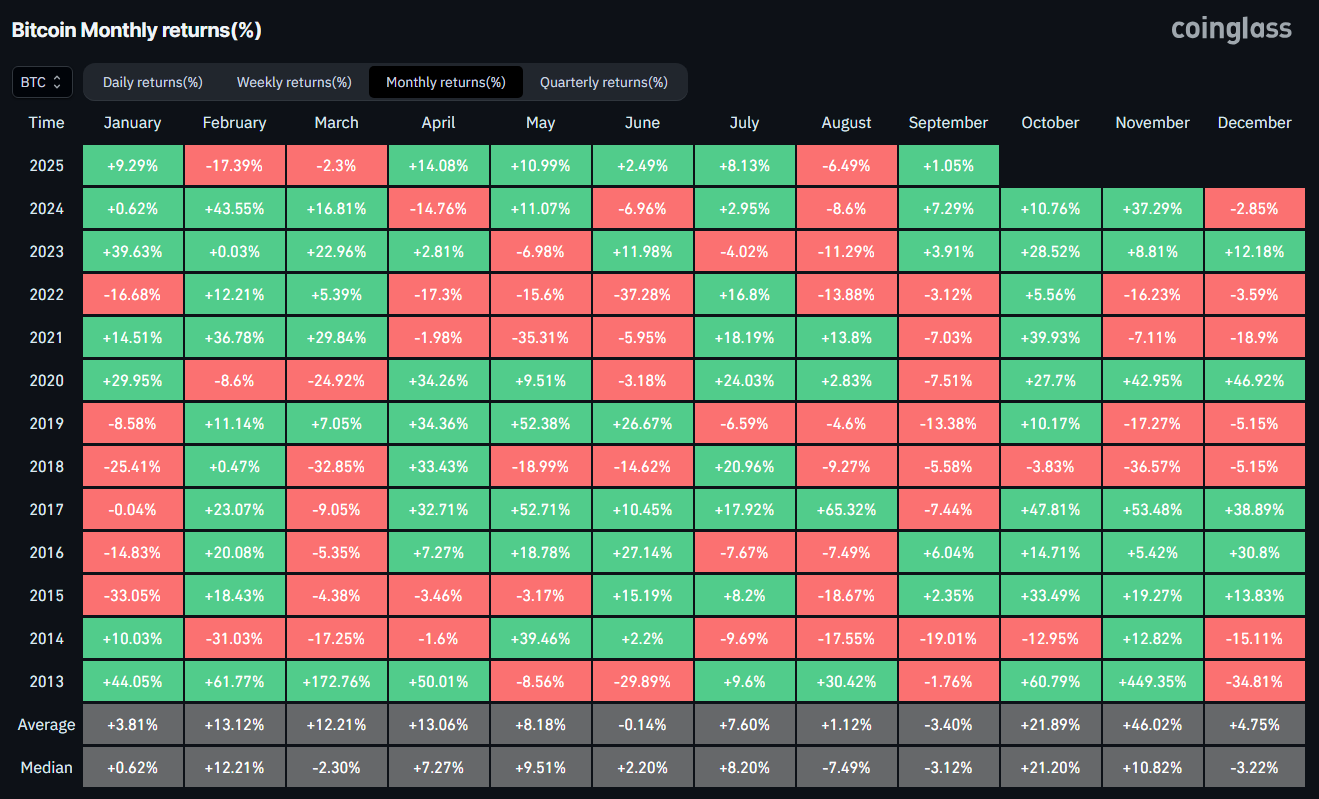

Traders are also weighing the fact that September is historically a bearish month for Bitcoin, which likely impacts the broader market sentiment. According to Coinglass data, Bitcoin’s average and median returns are roughly -3% as the flagship crypto has closed eight of the past twelve Septembers in losses.

Liquidations

Another reason for the crypto market slump today is the over $1.2 billion in liquidations hitting the market over the past day. Out of this, nearly $1.1 billion in liquidation came from long positions, data from CoinGlass show.

Such heavy, long liquidations are bearish for traders because they force leveraged buyers to exit their positions, which therefore drives increased selling pressure on prices, and encourages traders to stay on the sidelines until the situation cools off.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.