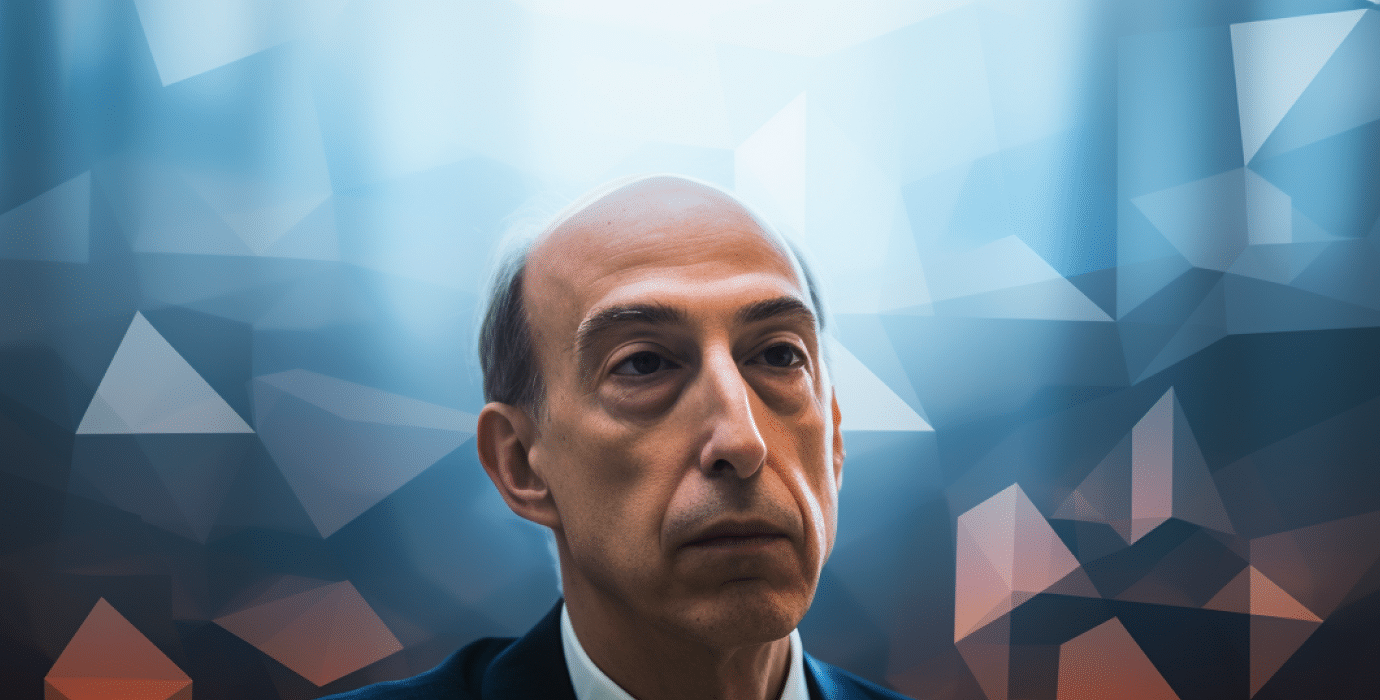

Gary Gensler, the former Chair of the U.S. Securities and Exchange Commission, is rejoining MIT’s Sloan School of Management as a Professor of the Practice.

Gary Gensler will be a member of both the Global Economics and Management Group and the Finance Group, where he will work on artificial intelligence, finance, financial technology, and public policy, says the MIT press release, dated on Jan. 27.

In addition to being a professor, he will also be the co-director of the FinTechAI at the Computer Science and Artificial Intelligence Laboratory, MIT’s largest research lab.

Before taking on the role of SEC Chair during the Biden administration and overseeing the $120 trillion U.S. capital markets, Gensler served as a Professor of the Practice at MIT Sloan from 2018 to 2021. He also served as Chairman of the Commodity Futures Trading Commission under President Obama, overseeing the implementation of the post-2008 reforms of the $400 trillion swaps market.

Gensler’s anti-crypto stance

Within the crypto industry, however, Gensler has been famous for his harsh “Everything is a Security” stance. Gensler has had a contentious relationship with Congress and other U.S. regulators and criticized bills that would codify a clearer crypto regulatory framework.

He’s repeatedly said that most cryptos other than Bitcoin (BTC) should qualify as securities, thereby falling under SEC jurisdiction. In Jan. 2022, Gensler said, “The fact is, most crypto tokens involve a group of entrepreneurs raising money from the public in anticipation of profits—the hallmark of an investment contract or a security under our jurisdiction.” at Penn Law Capital Markets Association Annual Conference.

The result of such strict regulations has left projects working in the U.S. in legal limbo, which President Donald Trump is now rolling back.

Gensler had also resisted the approval of spot Bitcoin ETFs, pointing to the need for investor protection and concerns about market manipulation. A three-judge panel from the U.S. Court of Appeals for the D.C. Circuit in August 2023 ruled against the SEC, saying the agency’s refusal to allow Grayscale to convert its Bitcoin Trust into an ETF was “arbitrary and capricious.” It was not until January 2024 — under this legal and political pressure — that the SEC approved them.

MIT graduate Devin Walsh didn’t hold back his frustration over Gensler’s return, calling it a “waste of time, tuition funds, and energy.” Walsh, who fell in love with crypto through MIT’s Digital Currency Initiative, slammed the move as a disappointment for students wanting to support innovation.