Betly transforms prediction markets into an intuitive mobile experience, letting users trade real-world events with simple swipes while connecting directly to Polymarket and Kalshi for secure, high-liquidity betting. In this article, we will explore the Betly review.

- Betly is a mobile-first prediction market interface that lets users trade on real-world events through a simple swipe action instead of complex trading tools.

- It connects directly to major platforms like Polymarket and Kalshi, giving users access to billions in volume without needing multiple apps.

- The platform is non-custodial, meaning Betly never holds user funds—trades settle securely on the underlying regulated or decentralized markets.

- Onboarding is effortless: users can start predicting with just an X (Twitter) login, no crypto wallet or prior trading experience required.

- Betly makes prediction markets accessible to everyone, allowing users to trade on politics, sports, crypto, tech, and major global events through an intuitive, frictionless interface.

Betly Review: Features and Products

- Swipe-based trading lets users swipe right for “yes” or left for “no,” replacing charts, order books, and technical trading complexity with a familiar gesture.

- Native integration with Polymarket and Kalshi gives users unified access to global crypto markets and U.S.-regulated event markets in one app.

- Supports a wide variety of event categories including politics, sports, crypto pricing, technology, macroeconomics, and trending news.

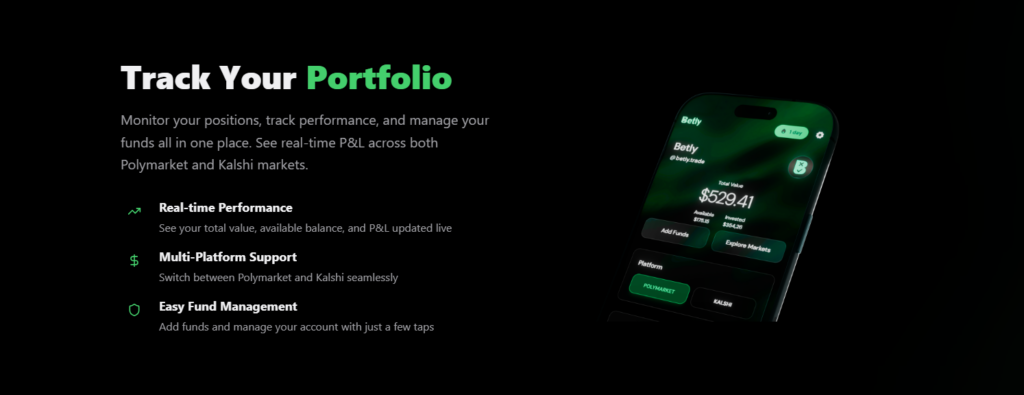

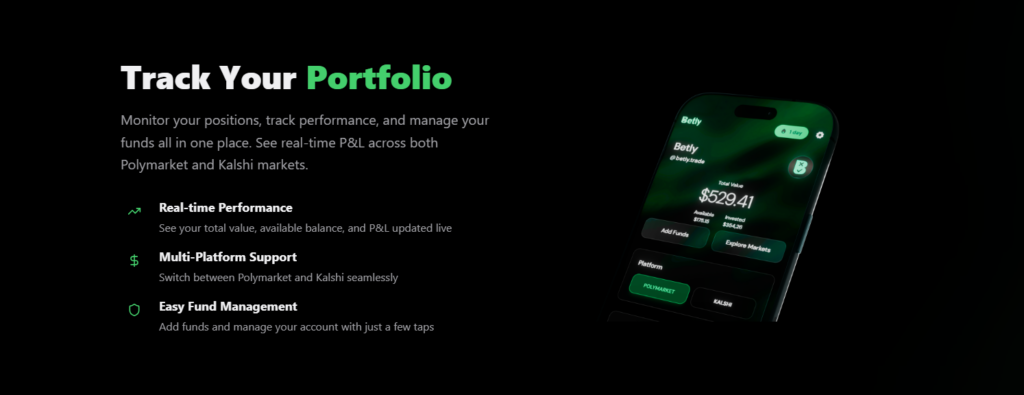

- Real-time portfolio tracking shows open positions, P&L, market resolutions, and total account value across both platforms.

- Live performance metrics update instantly, helping users visualize exposure, balance, and prediction outcomes with clarity.

- Multi-platform switching enables seamless transitions between Polymarket and Kalshi without closing or reopening separate applications.

- Fund management tools allow users to add funds, allocate capital, and manage accounts directly within the app using simple mobile workflows.

- Betly removes traditional barriers—no charts, no order books, no wallet setup—making prediction markets approachable for beginners and convenient for experienced users.

Betly Review: Fees

- Betly itself does not charge additional platform fees. Instead, all costs are derived from the underlying markets (Polymarket or Kalshi) where the actual trades execute.

- Users pay standard prediction market fees such as:

- Polymarket’s trading fee (embedded in its AMM pricing)

- Kalshi’s CFTC-regulated trading and expiry fees

- Because Betly is strictly an interface, not an exchange, it doesn’t impose its own maker/taker fees, spread markups, or hidden charges.

- The cost structure remains transparent: users only incur the fees directly associated with executing trades on the underlying markets.

- There are no additional withdrawal fees from Betly, since funds are held and managed within the integrated platforms’ infrastructures.

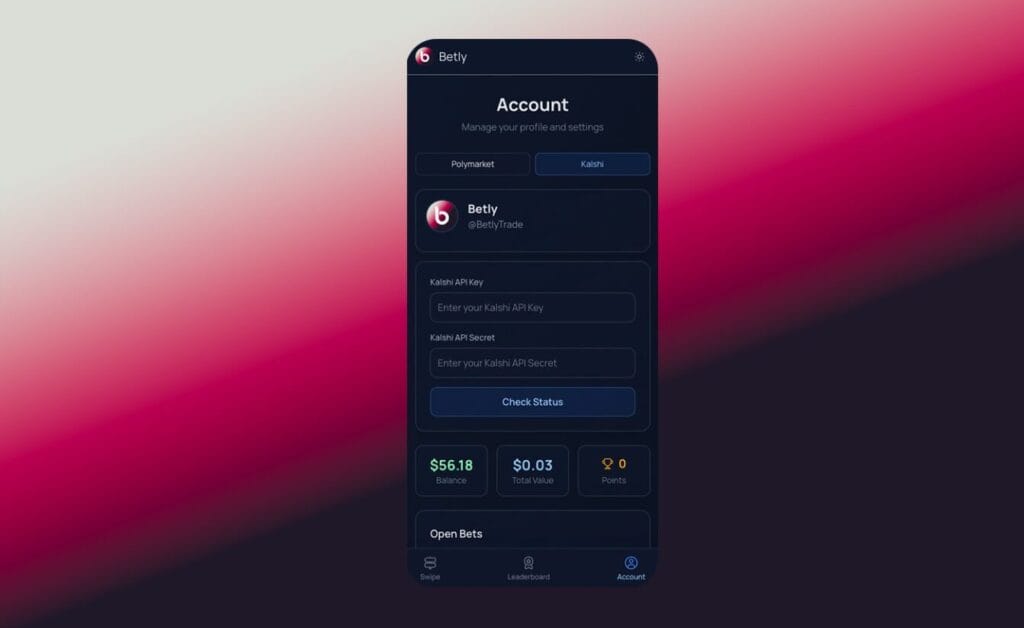

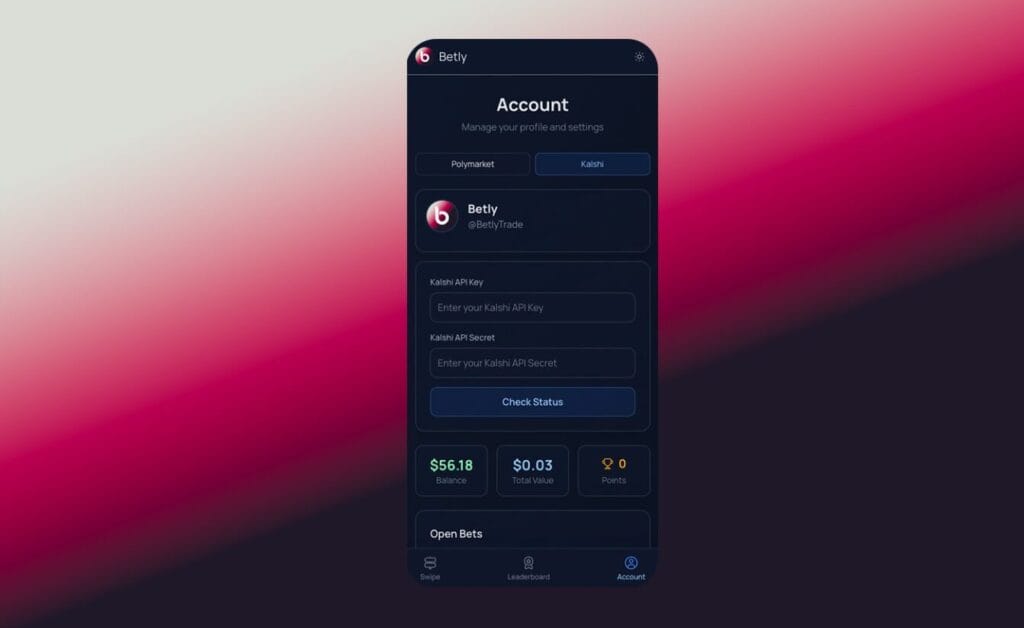

Betly Review: Mobile App

- Betly is designed as a mobile-first platform, optimized for smartphones and built for fast, intuitive interaction through swiping motions and real-time feedback loops.

- The app offers instant onboarding using an X (Twitter) login, enabling new users to sign in without wallets, crypto steps, or identity friction.

- The mobile app consolidates portfolio tracking, live market monitoring, and fund management into a single dashboard that updates in real time.

- Multi-platform trading is integrated seamlessly, allowing users to toggle between Polymarket and Kalshi markets without navigating multiple applications.

- Betly uses tactile interaction cues (swipe animations, confirmations, notifications) that enhance user flow and maintain engagement throughout the prediction experience.

- The design caters specifically to casual and intermediate users, offering simplicity without overwhelming them with advanced trading jargon or dense interfaces.

Security

- Betly does not custody user funds; instead, it routes all transactions directly to Polymarket and Kalshi, meaning users inherit the security, compliance, and infrastructure standards of these established platforms.

- Polymarket provides blockchain-based settlement and cryptographically verifiable positions, while Kalshi is regulated by the Commodities Futures Trading Commission (CFTC), ensuring strict compliance for U.S. event trading.

- Because Betly functions as an interface layer, no private keys, seeds, or wallet custody risks occur at the Betly level.

- Users maintain control of assets stored on the underlying prediction markets and benefit from their established financial safeguards, risk controls, and resolution frameworks.

- Betly’s login via X (Twitter) avoids typical account creation vulnerabilities such as email phishing or seed phrase mismanagement.

- The platform uses standard authentication protocols and secure routing practices to ensure safe transmission of trade instructions between the user and the underlying markets.

- Since Betly doesn’t intermediate fund flow, its overall risk surface remains minimal while allowing users to benefit from both decentralized and regulated market security models.

UI and UX

- Betly is designed to be intuitive by design, intentionally stripping away complex visual elements found in prediction markets—no charts, no order books, no confusing liquidity information.

- The core gesture—swiping—is familiar to nearly all mobile users, mirroring swipe patterns from popular social apps, making it highly accessible for newcomers.

- Clean typography, minimalistic layouts, and a dark-themed aesthetic create a modern and premium visual feel aligned with financial applications.

- Interactions are simplified through large card interfaces that display questions and outcome probabilities visually rather than through numerical price grids.

- The app relies on lightweight visual indicators, clear probability displays, and consistent animation cues to ensure users always understand what action they are taking.

- UX decisions prioritize speed, clarity, and discoverability, ensuring users can place predictions within seconds while maintaining situational awareness of their portfolio and P&L.

Betly Review: Affiliate / Referrals and Rewards

- Betly does not currently operate a multi-layered affiliate system like typical trading platforms, but it offers simplified referral functionality to encourage organic user growth.

- Users can share the platform with friends, allowing newcomers to join prediction markets easily through their mobile device and X account.

- Betly’s product design philosophy is built on simplicity, so any reward or referral program is expected to follow the same minimalistic approach—easy to understand and frictionless to use.

Betly introduces a refreshing and approachable alternative to traditional prediction market interfaces by transforming event trading into a simple swipe gesture rather than a technical trading process. By connecting directly to Polymarket and Kalshi, it provides access to institutional-grade prediction markets while maintaining a user experience tailored for mainstream audiences rather than advanced traders. With secure routing, non-custodial infrastructure, and support from two of the most credible event markets in the industry, Betly balances ease of use with market integrity and financial safety.As prediction markets continue to grow globally, Betly positions itself as the simplest, most user-friendly gateway into real-money event forecasting, making it ideal for newcomers, casual users, and anyone who wants to trade opinions with minimal complexity.

Does Betly support international users?

Yes. Most users outside the U.S. can access Polymarket markets through Betly, though Kalshi access depends on regional regulatory restrictions.

Can I withdraw directly from Betly?

Are there trading limits on Betly?

Trading limits depend on underlying platforms. Kalshi enforces regulatory caps, while Polymarket limits are based on market liquidity and price impact.