The market’s been choppy, but the world’s largest exchange is stacking Bitcoin for its reserves. Binance just scooped up another $300 million in BTC (4,225 coins) for its SAFU fund, pushing total holdings to 10,455 BTC ($734M at current prices).

This acquisition marks a major step in their plan, announced in late January 2026, to convert $1 billion in stablecoin reserves into Bitcoin within 30 days. The initiative is now 73% complete, with an average purchase price of approximately $70,214 per BTC.

Did they time the bottom buys perfectly?

#Binance SAFU Fund Asset Conversion progress update.

Binance has completed the purchase of 4225 BTC for the SAFU Fund, amounting to 300M USD stablecoins.

Our SAFU BTC address now holds 10,455 BTC:

1BAuq7Vho2CEkVkUxbfU26LhwQjbCmWQkDTXID: https://t.co/ZnE2h3ZN7H

We’re… pic.twitter.com/IUzdLMPdVI

— Binance (@binance) February 9, 2026

EXPLORE: Top 20 Crypto to Buy in 2026

Did Crypto Twitter Bully CZ and Binance Into Buying More Bitcoin?

First, what is SAFU? Established by Binance in 2018, it is a dedicated insurance pool designed to reimburse users if the platform ever suffers a catastrophic hack or major technical failure. It acts as a financial cushion: if something goes wrong, the exchange utilizes this fund rather than touching user deposits.

Recently, Binance decided to overhaul how this fund is composed. Instead of holding the majority in stablecoins, they are actively converting these reserves into Bitcoin.

But why the sudden change in strategy? There are several layers to unpack here.

The first is, of course, a demonstration of full commitment to Bitcoin and the broader crypto ecosystem, especially following the disastrous price action that briefly sent BTC below $60K and wiped nearly $2 trillion from the global market in just a few months.

The second reason is more psychological but equally vital for the standing of Binance and its founder, CZ: the growing FUD directed at the exchange. Following the historic “10/10” market liquidation event, where over $19 billion in leverage was wiped out in hours, numerous accounts accused Binance of insolvency and even blamed it for triggering the crash.

Although the team immediately refuted these accusations, the hostility lingered. As Bitcoin continued to dump, the frustration within the community didn’t vanish; if anything, it intensified.

Nuke the price.

Liquidate thousands.

Scoop cheap coins.

Rinse, repeat.

SAFU.Very nice bull market

pic.twitter.com/oc9dukFk3y

— LeBeR

(@RedPill272) February 9, 2026

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

Binance SAFU Fund Accelerates $1B Bitcoin Reserve Plan, Now 73% Complete

Binance’s SAFU fund has now purchased an additional 4,225 Bitcoin worth approximately $299.6 million, increasing its total holdings to 10,455 BTC. These are the numbers:

- Total Value: ~$734 million at current market prices.

- Progress: The plan to convert $1 billion in stablecoins is approximately 73.4% complete.

- Performance: The average purchase price stands at $70,213.68 per BTC, currently showing an unrealized profit of about $3.41 million.

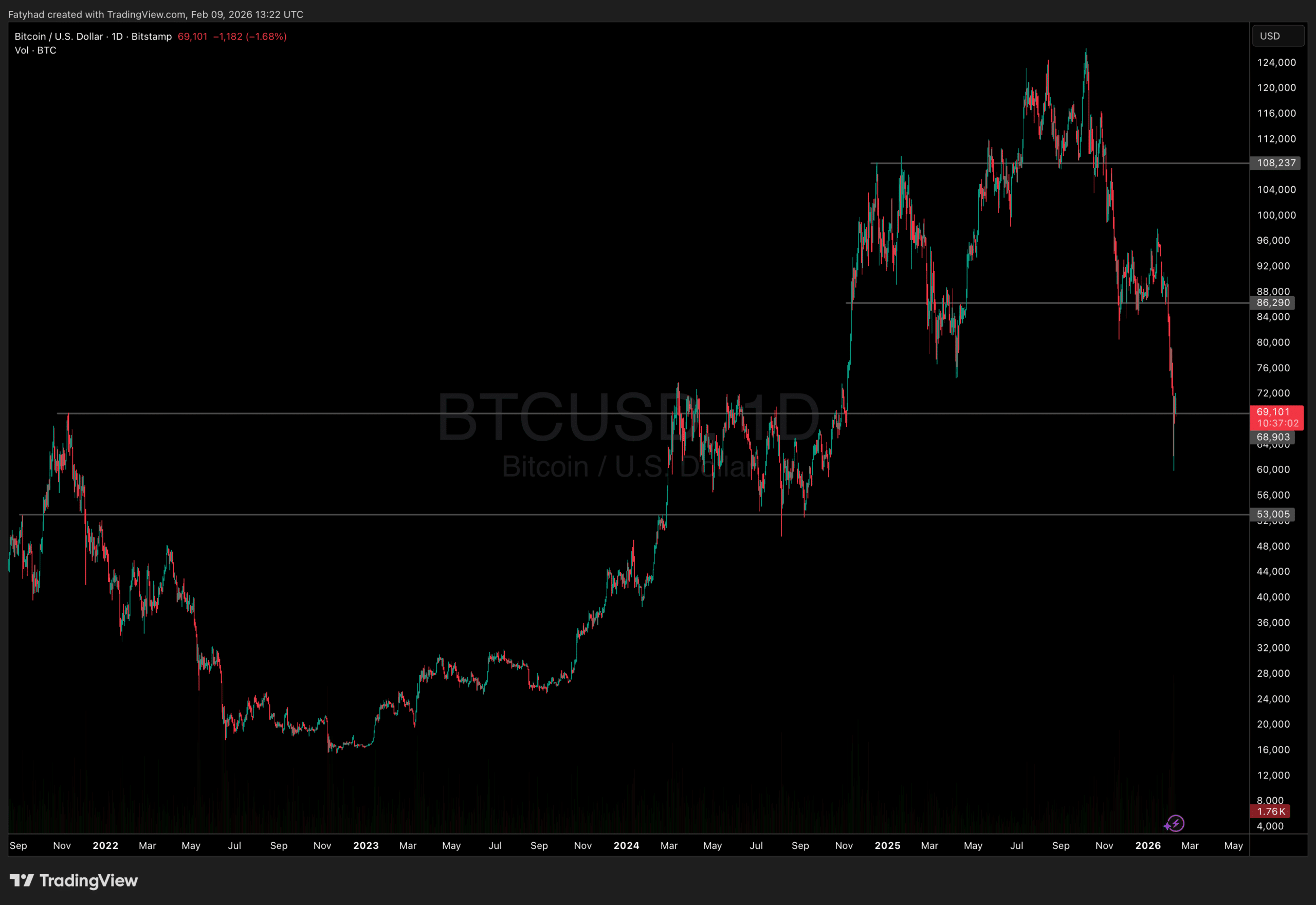

Bitcoin price is holding around $69K, stabilising near a key support zone, but the structure remains bearish unless BTC reclaims the $86K level. Another retest of $60K is possible if this bounce fails.

(Source: TradingView)

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Binance SAFU Fund Buys $300M in Bitcoin: Did They Nail the Bottom? appeared first on 99Bitcoins.