Futures proprietary trading firms are companies that allow traders to trade futures contracts using the firm’s capital rather than their own. These firms typically evaluate traders through structured challenges or performance criteria, after which successful participants gain access to funded accounts. Among others in space, BluSky is a futures trading and proprietary trading platform designed to provide traders with access to global futures markets and professional funding opportunities. Read on this BlueSky to know more about it as a futures proprietary trading firms.

What is BluSky?

BluSky positions itself as a performance-driven proprietary trading firm focused on enabling serious traders to access funded futures accounts (and now stocks) via a structured evaluation process that simulates real market conditions. The platform’s core proposition emphasizes transparent pathways to capital, including tiered evaluation plans with profit goals, trailing drawdown and consistency rules, and attractive profit splits of up to 90% for traders, alongside daily payout availability on qualifying funded accounts Monday through Friday.

BluSky’s official framework highlights no funded activation fee once an evaluation is passed, real-money trading opportunities, and supportive resources such as coaching and an active Discord community, reflecting a broader strategy to foster trader development rather than purely extract fees. The company’s public presentation underscores risk disclosure and realistic trading challenges, aligning its service offering with industry standards for prop trading while differentiating through simplicity of rules and trader-centric features.

Key Features: BluSky

1. No Funded Activation Fee

BluSky highlights that traders do not need to pay any additional activation or onboarding fee after successfully passing the evaluation phase, lowering the total cost of accessing a funded account.

2. Real-Money Trading with Daily Payouts

Funded traders operate with real capital and are eligible for daily profit withdrawals from Monday to Friday, provided account balance requirements are maintained.

3. High Profit Split for Traders

The platform offers up to a 90% profit split in favor of the trader, positioning BluSky as a trader-centric prop firm focused on long-term participant incentives.

4. Multiple Evaluation Account Sizes

BluSky provides a range of evaluation account sizes across futures (and stock programs), allowing traders to choose capital levels aligned with their experience and risk tolerance.

5. Structured Evaluation Rules

Each evaluation plan follows defined rules including a profit target, trailing drawdown limits, and a consistency requirement, designed to assess disciplined and repeatable trading performance.

6. Minimum Trading Day Requirement

Traders must complete a minimum number of trading days (eight) to qualify, ensuring results are not driven by a single high-risk session.

7. No Maximum Time Limit to Pass Evaluation

BluSky does not impose a hard deadline to complete evaluations, enabling traders to progress at a sustainable pace rather than being forced into over-trading.

8. Trailing Drawdown Converts to Static

Once the profit target is reached, the trailing drawdown transitions into a static drawdown on funded accounts, providing clearer risk boundaries during live trading.

9. No Daily Loss Limit on Funded Accounts

Funded accounts do not include a daily loss cap, giving traders flexibility in trade execution while still being governed by overall drawdown rules.

10. Professional Trading Tools Included

Evaluation accounts include access to professional platforms and market data services such as NinjaTrader, Level 2 data, and Rithmic feeds, supporting institutional-style trading conditions.

11. Community and Educational Support

BluSky emphasizes trader development through coaching resources and an active community environment, including access to a Discord server for updates and interaction.

Also, you may read 10 Best Futures Prop Trading Firms

How BluSky works: A step-by-step guide

Step 1: Create Your Account and Choose a Plan

Traders begin by signing up on BluSky.pro and selecting an evaluation plan that matches their desired account size and trading goals.

Step 2: Evaluation Phase – Simulated Live Market Challenge

Once enrolled, the trader enters the evaluation stage, which is a realistic simulation of trading under actual market conditions. The objective in this stage is to demonstrate disciplined performance by meeting specific evaluation criteria such as reaching a profit target while observing risk rules.

- There is a minimum requirement for active trading days (e.g., eight days) with no maximum time limit to complete the evaluation.

- Trailing drawdown rules and consistency requirements apply during this phase to ensure risk discipline.

- If a rule is breached, the evaluation account can be reset and retried, with progress continuing as long as subscriptions are renewed.

Step 3: Reach Profit Goals and Compliance With Rules

To successfully pass the evaluation, a trader must achieve the designated profit target and stay within the drawdown and consistency constraints defined for that plan. The evaluation simulates a real trading environment to ensure a genuine test of skill and risk management.

Step 4: Transition to Funded Account (BluLive Stage)

Upon reaching the profit goal while adhering to the rules:

- The trailing drawdown transitions to a static drawdown limit, establishing clear risk boundaries for the funded account.

- The funded account (sometimes referred to as BluLive) is activated with no additional funded activation fee.

- Traders now operate with actual brokerage capital under live market conditions.

Step 5: Funded Trading and Profit Distribution

In the funded account stage:

- Traders can trade with real money provided by BluSky.

- Daily payouts (Monday through Friday) are available once the account remains above its required buffer level.

- Traders retain up to 90% of the profits they generate.

- There are no daily loss limits in the funded stage, although overall drawdown rules still apply.

Step 6: Tools and Support During the Process

- Professional trading tools and data (including platforms such as NinjaTrader with real-time data) are made available.

- Additional support such as coaching and community access (e.g., Discord) is offered to help traders improve and stay connected.

Also, you may read Alpha Futures: An Overview

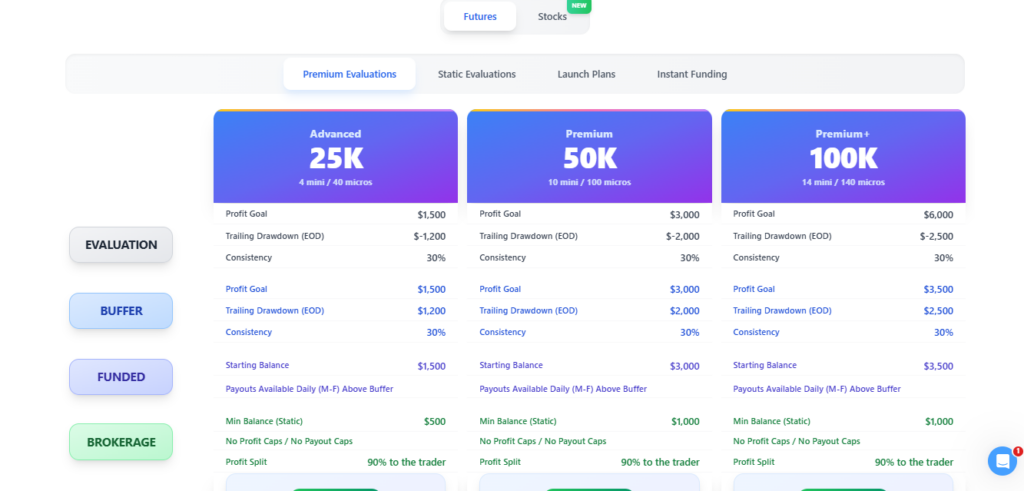

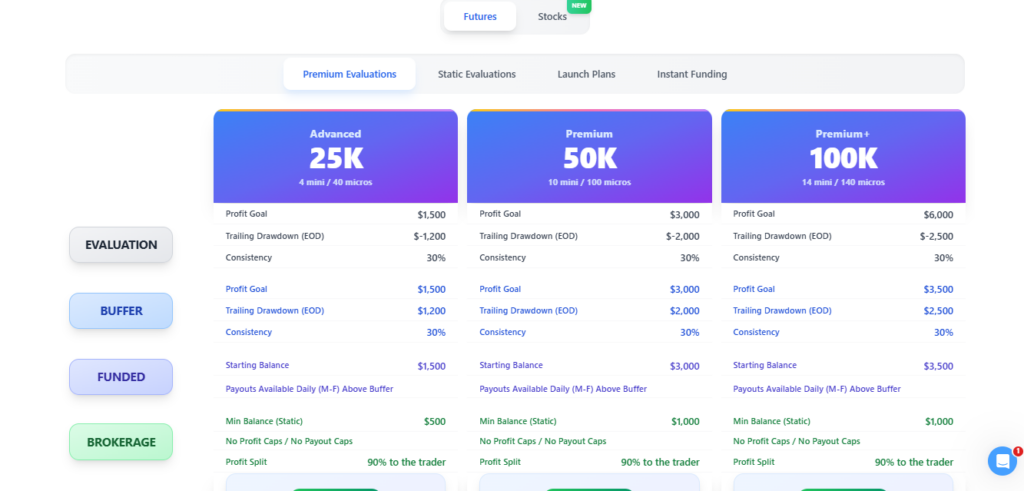

BluSky Challenge Structure Overview

BluSky presents a structured set of evaluation programs designed to assess a trader’s ability to manage risk and generate consistent profits before accessing funded capital. BluSky offers multiple challenge categories—such as Advanced, Static Growth, Launch, Instant, and Stocks—each with defined profit targets, drawdown limits, and consistency rules that scale with account size.

These challenges simulate real market conditions and require traders to balance aggressive performance with disciplined risk management and success unlocks a funded account with daily payout opportunities.

BluSky Supported Platforms: Volumetrica, VolSys / DeepChart, VolBook / DeepDOM, NinjaTrader (Evaluation, BluLive & Sim Funded only), R|Trader Pro, MotiveWave, Quantower, Jigsaw, ATAS, Sierra Chart, Bookmap, and most other Rithmic-supported platforms (Brokerage partner: Sweet Futures); plus NinjaTrader Prop, Tradovate Prop, TradingView, Jigsaw, and Bookmap (Brokerage partner: Tradovate).

Futures Challenge Overview

| Program | Size | Contracts | Eval Goal | Drawdown | Funded Start | Price |

|---|---|---|---|---|---|---|

| Advanced | 25K | 4M / 40µ | $1.5K | Trailing -$1.2K | $1.5K | $105 |

| 50K | 10M / 100µ | $3K | Trailing -$2K | $3K | $112 | |

| 100K | 14M / 140µ | $6K | Trailing -$2.5K | $3.5K | $147 | |

| Static Growth | 150K | 1M / 10µ | $3K | Static -$1K | $2K | $119 |

| 200K | 2M / 20µ | $6K | Static -$2K | $3K | $154 | |

| 300K | 5M / 50µ | $20K | Static -$5K | $3.5K | $224 | |

| Launch | 50K | 5M / 50µ | $3K | Trailing -$2K | $3K | $59 + $99 |

| 100K | 10M / 100µ | $6K | Trailing -$2.5K | $3.5K | $69 + $149 | |

| 200K | 2M / 20µ | $6K | Static -$2K | $3K | $79 + $149 | |

| Instant | 50K | 5M / 50µ | — | Trailing -$2K | $50K | $599 |

| 3.5K | 5M / 50µ | — | — | $3.5K | $749 |

Applies to All Futures plan

- Profits most plans: 90% to the trader

- Profits Instant plans: 80%, or 50% → 80% after 30 trading days

- Payouts: Available daily (Mon–Fri) once above buffer

- Consistency Rule Advanced & Static Growth: 30% (300K Static: 21%)

- Consistency Rule Launch: 50% during evaluation, 30% after launch Instant: 21%

- Drawdown Rule Logic Advanced & Launch: Trailing (EOD)

- Drawdown Rule Static Growth & Static Launch: Fixed/static

Also, you may read My Funded Futures: Review

Stocks Challenge Overview

| Account | Eval Target | Drawdown | Daily Loss | Days | Min Payout | Price |

|---|---|---|---|---|---|---|

| 2K | $200 | $200 (EOD) | $100 | 60 | $250 | $199 / mo |

| 4K | $400 | $400 (EOD) | $250 | 60 | $250 | $399 / mo |

| 7K | $700 | $700 (EOD) | $350 | 60 | $250 | $799 / mo |

Applies to All Stock Plans

- Market: Stocks only

- Consistency rule: 30%

- Resets: $99

- Launch fee: $99

BluSky: Security & Safety.

- Data Privacy: BluSky collects personal information only to operate and improve its services, such as account management, communication, and platform functionality.

- Controlled Data Sharing: User data may be shared with third-party service providers solely as required to deliver services, not for unrelated disclosure.

- Risk Transparency: The platform clearly states that futures and stock trading involve substantial risk, including potential losses, and that past performance does not guarantee future results.

- No Brokerage or Financial Advice: BluSky explicitly notes that it is not a broker-dealer and does not provide investment or trading advice.

- User Responsibility: Traders are responsible for safeguarding their account credentials and complying with all platform rules and terms.

- Clear Disclosures: Risk disclosures, privacy policy, and terms of service are publicly accessible, outlining liabilities, simulated trading limitations, and user obligations.

- Support Access: Official support channels are available for account, safety, and platform-related concerns.

Also, you may read 5 Best Risk Management Books

Partnership and Affiliate Programs

- Open Affiliate Program: BluSky offers an affiliate program that allows users to register and earn rewards by referring others. Affiliates can sign up to participate and receive a custom referral link and dashboard for tracking their performance.

- Commission Structure: The standard commission rate for affiliates is 10% on referrals generated through their unique link, with specific terms and rates provided upon enrollment.

- Affiliate Access: After signing up, affiliates receive access to their referral links and tools via the affiliate dashboard to track clicks, conversions, and earnings.

- Eligibility: Any participant meeting BluSky’s affiliate terms can join, with no publicly stated restrictions beyond agreeing to the program’s terms and conditions.

Support and Community Ecosystem

- Daily Payouts with No Maximum Restriction

BluSky allows traders to take payouts as often as they like, as long as the minimum balance is maintained. ACH payout requests submitted before 11:00 AM EST are processed the same day, with daily brokerage payments supported. - Free Discord Community

BluSky offers a free Discord chatroom where traders can connect, share experiences, and interact with other BluSky-funded traders, helping reduce the isolation often associated with trading. - Free Coaching Access

Traders gain access to free coaching sessions, featuring real-time trading insights and guidance from experienced industry professionals, aimed at improving consistency and long-term performance. - Same-Day Funded Account Activation

After successfully passing an evaluation, BluSky automatically activates the BluLive funded account the same evening, allowing traders to transition quickly into live trading. - Accessible Support Resources

BluSky provides official FAQs and support resources to help traders understand rules, payouts, platforms, and account management throughout the evaluation and funded stages.

Also, you may read Take Profit Trader: Is it Reliable?

Conclusion

BluSky presents a clear and structured pathway for traders to access funded trading capital through a realistic evaluation model that simulates actual market conditions and emphasizes disciplined performance. Once funded, traders benefit from daily payout eligibility with no maximum restriction, supportive resources including a free Discord community and coaching, and a quick same-day transition to live accounts after passing evaluations.

The firm’s transparent rules, accessible plan tiers, and trader-centric features make it best suited for disciplined futures and stocks traders who are willing to demonstrate consistency and risk management in a real-market environment and who seek a straightforward, predictable route to funded trading without hidden conditions or unnecessary complexity.

Can I trade news events?

Yes, trading news events is allowed, though it carries the trader’s own risk and will not cause automatic failure if rules are otherwise followed.

Who is the founder/leader of BluSky?

BluSky is led by Richard Amann Jr., Chief Executive Officer of BluSky Trading Company, a proprietary trading firm.

Are there limits on evaluation time?

Most BluSky evaluations can be completed without an upper time limit, letting traders work at their own pace to meet the goals.