Key takeaways:

|

Buy now, pay later (BNPL) is one of the most popular payment options in the market. It is easy to set up and seamlessly integrates into any online checkout platform, but is it worth adding to your business?

What is BNPL?

Buy now, pay later is a type of short-term consumer loan that allows customers to pay for their purchases in installments. It works by integrating a BNPL platform into the merchant’s checkout methods. When customers use this payment option, the business receives the entire purchase price upfront minus a considerably higher transaction fee compared to card payments.

Who should use BNPL?

While accessible to all business sizes, BNPL is the most useful to businesses looking to encourage higher average order value. This can be in the form of selling:

- Big ticket items, or

- A combination of low-value items to form big checkout baskets

Not only do large-value sales make more sense to put through installment payments, but they can also effectively cover the cost of transactions, making them more sustainable for the business.

BNPL vs traditional loans

For customers, BNPL loans are short-term, often zero-interest loans. While traditional loans (or traditional consumer financing) can either be short- or long-term, they always come with an interest rate. Additionally, the loanable amount for BNPL is pre-approved based on a soft credit check that does not affect a customer’s credit score; traditional loans require an application and approval process.

| Short-term installments | Either short- or long-term installments |

| Usually zero interest rates | Interest rates on all transactions |

| Customer deals with the BNPL provider | Customer deals with the bank |

| Customer’s loan is based on a transaction purchase | Customer’s loan is based on an approved amount |

Both BNPL and traditional loans are bank-supported. However, with BNPL, the customer deals with the BNPL provider (which in turn works with the bank) while with traditional consumer loans, the customer deals directly with the bank. Traditional loans can either be in the form of a credit card or a personal loan.

Also see: Debits vs credits: What’s the difference?

How does BNPL work?

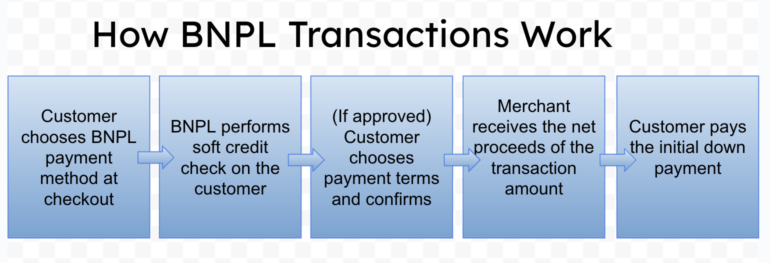

BNPL works like any other payment method on an ecommerce website:

- The customer goes to the checkout page and opts for BNPL as a payment option.

- The BNPL provider conducts a soft credit check (evaluates basic personal information and credit history summary) on the customer.

- If approved, the customer will be prompted to choose a payment term and click on a “buy now” button to confirm the transaction.

- The payment processor sends the proceeds of the transaction amount to the merchant minus the transaction fee.

- The customer pays for the initial downpayment upfront and the BNPL provider collects the installments.

How to add BNPL to your payment methods

There are two major ways to add BNPL as an alternative payment method:

- Use a payment processor with a native BNPL feature: Popular payment providers, such as PayPal and Square, provide their own BNPL program. All you need to do is update your payment methods in the payment settings to sign up for BNPL.

- Integrate a third-party BNPL software: Other payment processors have partnerships with third-party BNPL providers. To add this feature, you will need to choose a BNPL platform from your processor’s list of integrations. Follow the prompts that will let you create a BNPL option and link your merchant account.

Don’t forget to start a test transaction to make sure that the setup is successful. You should be able to see the BNPL provider’s brand under the list of payment methods at checkout.

Pro tip: Aside from those mentioned above, you can support additional installment payment options by working with certain banks and digital wallets that provide their own BNPL programs. These usually come with a mobile banking app that can be used for both online and in-person transactions.

Cost of BNPL transactions

For merchants, the average range of processing rates for BNPL transactions is between 3% and 8%. Most BNPL providers do not charge a monthly fee for using the service but those that do may cost up to $75 a month.

For customers, short-term BNPL transactions are usually interest-free. However, most providers now offer longer payment terms (from 6 months and up) that carry interest rates ranging between 4% and 36%. Late fees start at $7.

Note: Any successful chargeback claim on BNPL transactions is shouldered by the BNPL provider, not the merchant.

Also see: 5 Online payment methods for small business

BNPL pros and cons for small business

| BNPL pros | BNPL cons |

|---|---|

| Attract more customers | Expensive transaction fees |

| Increase average order value | Increased purchase returns |

| Full upfront payment | Potential for more regulations around BNPL |

| Free from risk of chargebacks and default repayments |

In general, adding BNPL provides businesses with more benefits than disadvantages. For one, BNPL is a great marketing angle to attract more customers. The installment payment plan also encourages customers to make larger purchases, thereby increasing the average order value.

BNPL also helps businesses keep a healthy cash flow because it receives the full amount of the customer’s purchase upfront. It also helps maintain a healthy chargeback ratio since the BNPL provider assumes the risk of chargebacks.

The major downside of using BNPL for merchants is exorbitant transaction fees. This is primarily because the provider assumes most of the risk, such as chargebacks and default payments, associated with financing.

That said, the installment plan can encourage a “try before you buy” behavior from consumers that can potentially increase product returns. And as the market continually grows, more regulations will likely be enacted in the future to protect customers from widely varied payment terms and expensive interest rates—something that may impact customer behavior and sales revenue.

Regulations governing BNPL

At the moment, there are no existing BNPL regulations implemented on a global scale, although there are different levels of oversight in countries that allow this payment service.

In Singapore, the Singapore FinTech Association (SFA) published a BNPL code of conduct in November 2022. It caps credit check-free loans at SGD 2,000. Just last year, Australia expanded its National Consumer Credit Act to address BNPL transactions.

The UK also introduced a similar consumer protection bill late last year that would require new disclosure requirements and creditworthiness assessments in BNPL transactions. In the US, the Consumer Financial Protection Bureau (CFPB) classified BNPLs as credit providers, similar to credit cards. This means any transaction will give consumers the right to request returns and refunds and file chargeback claims.

Top BNPL payment providers

For BNPL payments to work, customers and merchants have to use the same provider. So, if you decide to add a BNPL checkout option to your payment methods, it’s important to know which platform is most popular with your target customers. This means businesses should take both merchant transaction fees and customer payment terms into consideration.

Below are four of the most popular BNPL providers in the market today:

| Merchant fees | Customer payment terms | Customer late fees | |

|---|---|---|---|

| Klarna | 5.99% + 30 cents | Pay in 4, pay in 30 days, 6-36 months financing | From $7 |

| Affirm | 5.99% + 30 cents | Pay in 4, 6-48 months financing | None |

| PayPal | 4.99% + 49 cents | Pay in 4, 6-24 months financing | None |

| AfterPay | 4-6% + 30 cents | Pay in 4, 6-12 months financing | From $8 |

Latest BNPL trends

While buy now, pay later grew in popularity during the COVID-19 pandemic to make ends meet, many consumers continue to choose BNPL’s short-term consumer financing program today as a means to improve cash flow.

The latest research from The Business Research Company estimates that the global BNPL market size reached US $231.5 billion in 2024 and will continue its exponential rise at a compound annual growth rate (CAGR) of 48.4% in 2025.

Young adults are the most likely users of BNPL. That said, Brite’s Instant Economy Payment Insights report for 2024 finds BNPL as the second least popular instant payment method across the EU and UK, with less than 25% of adults ever using the service.

In 2025, BNPL is expected to reach more industries, transcending from retail into travel, education, and healthcare. Global banks, such as JPMorgan Chase, will compete with third-party BNPL providers in providing consumer financing services.

2025 will also be a pivotal year in consumer protection as more government bodies around the world aim to establish better transparency, safe lending, and stricter assessment guidelines specifically for BNPL transactions.

BNPL frequently asked questions

Is BNPL the same as a credit card?

In some ways, credit cards are similar to BNPL. Both are consumer financing options that can be used for low-value transactions with fast transaction approval. That said, credit cards are pre-approved with considerably lower fees for both customers and merchants.

Does BNPL affect your credit score?

Partially, yes. Soft credit checks during checkout do not affect a customer’s credit score but default or missed payments do.

Is BNPL safe for online shopping?

Yes, BNPL payments receive the same fraud monitoring and protection features when integrated with a merchant processor’s payment gateway.