Google is expanding its push into consumer finance in India with the launch of a UPI-linked credit card, betting on a country of more than 1.4 billion people where fewer than 50 million currently hold a credit card.

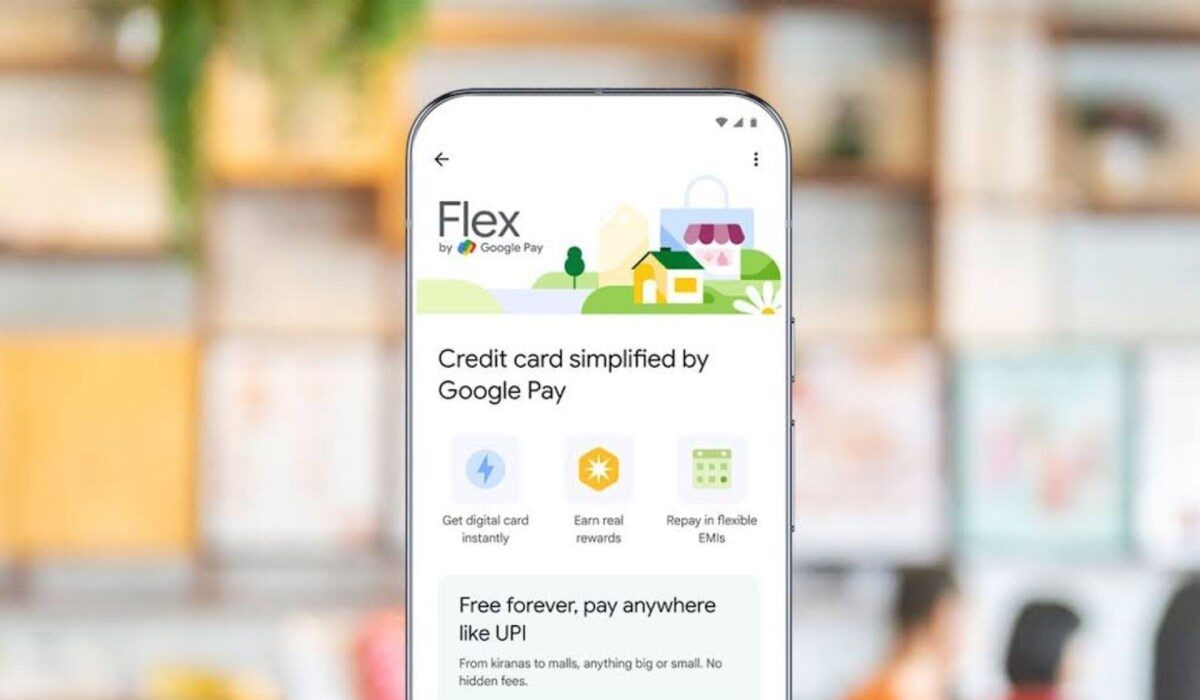

On Wednesday, Google entered India’s growing co-branded credit card market with the launch of Flex by Google Pay, partnering with private lender Axis Bank to expand access to credit in the country’s UPI-driven payments ecosystem.

India’s rapid adoption of digital payments through the government-backed Unified Payments Interface (UPI) has transformed how consumers pay but has not translated into broad access to credit. That gap has created an opportunity for technology companies and banks to embed lending into widely used payments apps, helping explain Google’s move into the space.

Flex by Google Pay is issued digitally through the Google Pay app and can be used both online and at physical merchants, the company said. Built on the Indian government-backed RuPay network, the card includes a rewards programme that credits virtual “Stars” on transactions, with each Star worth ₹1. Users can monitor spending and bills within the app, choose to repay balances in full or convert them into installments, and manage security settings such as blocking the card or resetting a PIN.

The launch builds on Google Pay’s broader effort to expand access to credit in India, where it has already partnered with banks and non-bank lenders to offer personal and gold-backed loans through the app. As one of the country’s most widely used UPI platforms, Google Pay offers Axis Bank access to a large, digitally active user base at a time when lenders are increasingly looking to scale credit distribution through technology platforms rather than physical branches.

While Google has started with Axis Bank, it aims to add more issuer partners soon to expand its co-branded credit card offering in India.

Pricing on the card, including interest and applicable charges, will vary by user and credit profile, with no application fee, Google said, adding that charges linked to repayment choices are shown upfront in the app. Processing fees apply to EMI conversions, and late payment charges will be levied in line with the issuing bank’s policy.

Techcrunch event

San Francisco

|

October 13-15, 2026

India’s credit card market has been expanding rapidly in recent years. The number of outstanding cards has grown at an annual rate of about 14% over the past three years to around 110 million, while transaction volumes and values have risen at close to 30%, per a recent PwC report (PDF). Average annual spending per card has increased from about ₹132,000 (around $1,450) to roughly ₹192,000 (about $2,100), suggesting cards are being used more frequently for routine payments rather than occasional big-ticket purchases.

Despite growth in the number of outstanding cards and credit card spending in India, the expansion has largely been driven by existing users rather than a meaningful increase in the number of cardholders. Google aims to help address that gap by bringing new users into the credit system, particularly those wary of traditional card repayment structures. “It’s the same users getting more and more credit,” said Sharath Bulusu, senior director of product management for Google Pay, adding that flexible repayment options are designed to ease concerns around unpredictable billing for first-time credit users.

“We think we now understand the problem, the space and the user well enough to solve something uniquely for them,” Bulusu told TechCrunch, explaining Google’s timing.

Google’s move comes amid growing competition in India’s co-branded credit card market, where companies including Amazon, as well as Walmart-owned Flipkart and PhonePe, already offer similar products. Consumer internet platforms such as food delivery firms Swiggy and Zomato, along with online travel companies including MakeMyTrip and Yatra, have also entered the space in partnership with banks.

Co-branded credit cards accounted for about 12–15% of India’s total credit cards in the financial year ended 2024 and are projected to capture more than a quarter of the market by volume by 2028, growing at an annual rate of 35–40%, according to a report (PDF) by consultancy firm Redseer.

Alongside the co-branded card launch, Google is also rolling out “Pocket Money,” a feature in the Google Pay app that lets parents give children limited access to digital payments. Built on the recently introduced UPI Circle functionality, the feature lets parents set a monthly spending cap of up to ₹15,000 or approve individual transactions initiated by the child.

Parents receive notifications for each transaction and can view spending history or pause access to the feature through their own Google Pay app, the company said. The move could also help Google broaden Google Pay’s usage and addressable market in India, where it competes closely with Walmart-backed PhonePe among the country’s leading UPI platforms.

Google’s Pocket Money feature follows earlier efforts by Indian fintechs such as FamPay and Junio, which sought to enable children’s digital spending through prepaid cards. However, unlike prepaid instruments, Google uses the UPI Circle framework to let parents retain control of funds until the moment a transaction is made, rather than loading money in advance.

“With UPI Circle, the money stays in the parent’s account until it is spent,” Bulusu said, adding that the approach makes it easier for families already comfortable using Google Pay to introduce children to digital payments. He said the feature reflects a broader bet on familiar payments apps as a way to build financial confidence among younger users as digital payments become more pervasive.

Google is also upgrading the experience for small businesses on Google Pay, allowing customers to rate merchants directly after a transaction, with those reviews syncing to the merchant’s Google Maps listing. The company is also rolling out an AI-powered advertising feature within the Google Pay for Business app that assists merchants in creating and launching ads.

More than 530 million unique users have made at least one payment through Google Pay, while over 23 million small merchants have been onboarded to the platform over the years, Bulusu said. That reach, he added, gives the company confidence it can introduce new financial products to users already comfortable transacting digitally.