Voiding a cheque cancels the payment while keeping a record of the transaction. It changes the amount to $0.00 without deleting the details, ensuring accurate financial records and preventing reconciliation issues. This is useful for correcting errors, lost cheques, or canceled payments.

Here’s how you can void a check in QuickBooks Online and QuickBooks Desktop.

How to void a check in QuickBooks Online

Voiding a check in QuickBooks Online (QBO) changes its amount to $0.00 while keeping the details for record-keeping. It stays in reports but won’t affect reconciliations. If the check was never issued, deleting it might be a better option.

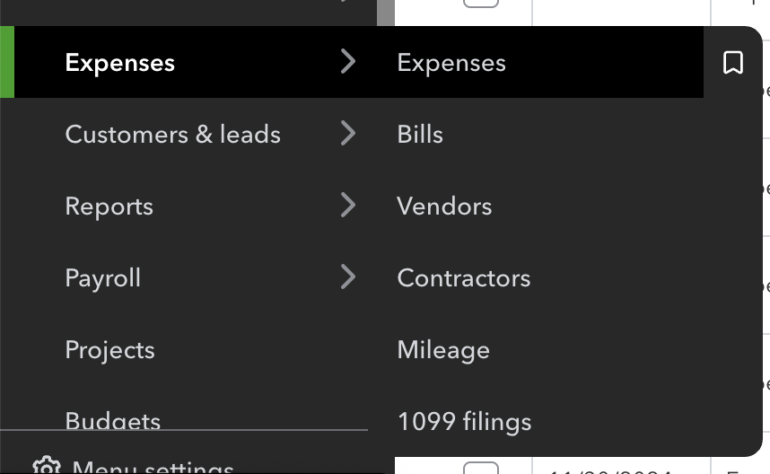

1. In the left menu sidebar, click Expenses. A dropdown menu will appear and select Expenses.

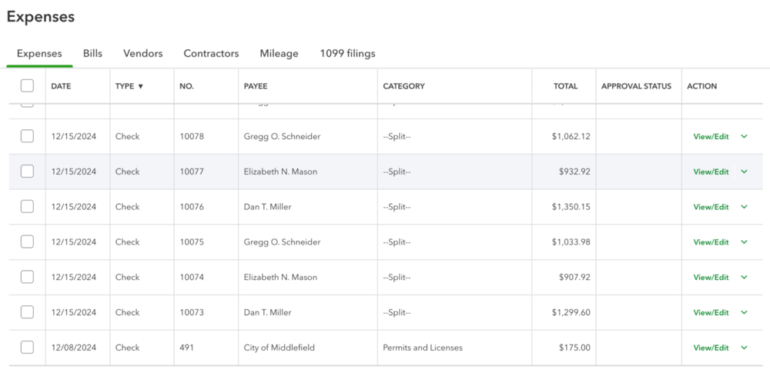

2. You’ll arrive at the Expenses page. Find the check transaction you want to void.

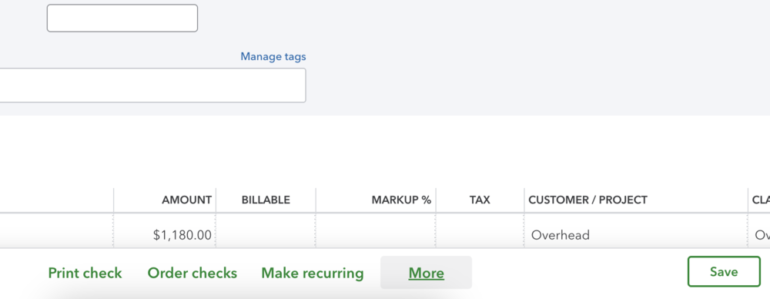

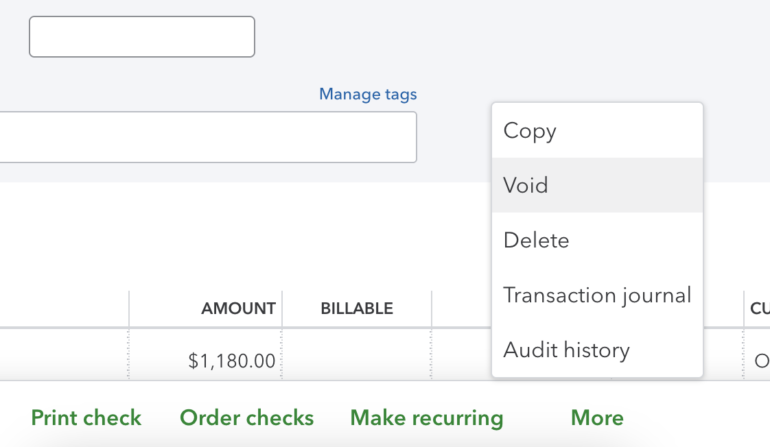

3. Click the transaction to open the record. Once you see the details, click More at the bottom part of the screen.

4. A dropdown menu will appear. Select Void to void the check.

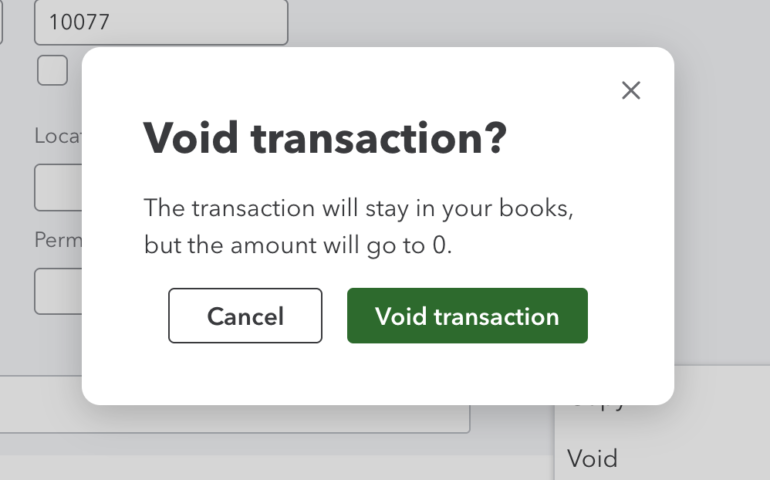

5. A popout box will appear. Click Void transaction to confirm the action.

When you void a check in QuickBooks Online, the amount changes to $0.00, but all transaction details remain intact, creating a clear audit trail while maintaining your financial accuracy. Voided checks still appear in reports like the general ledger with zero-dollar amounts, ensuring past reconciliations stay untouched while preventing outstanding checks from affecting future ones.

If the check was created in error and never issued, deletion might be more appropriate as it completely removes the transaction, whereas voiding preserves a record with a zero balance.

How to void a check in QuickBooks Desktop

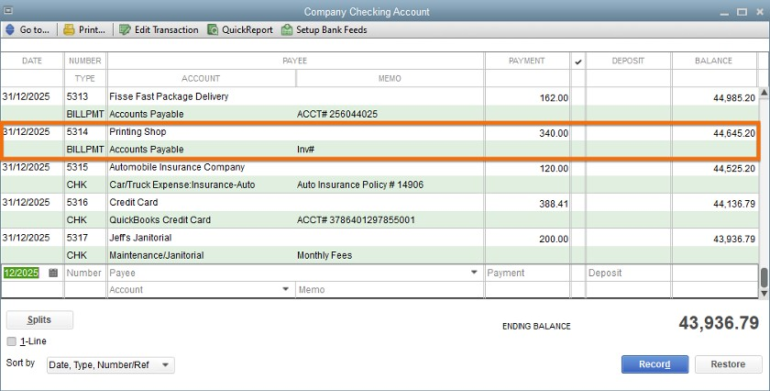

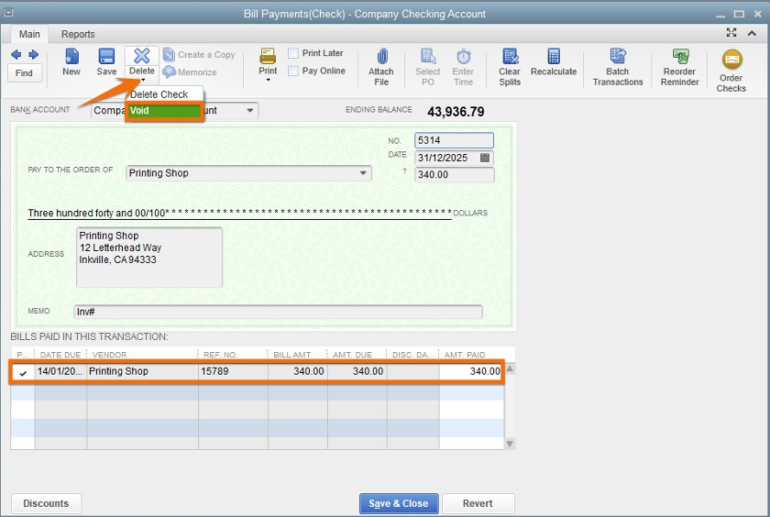

To void a check in QuickBooks Desktop, locate it in the Check Register under the appropriate bank account. Voiding sets the check’s balance to $0.00 while keeping a record of the transaction. Once confirmed, the check remains in the system but won’t impact future balances or reports.

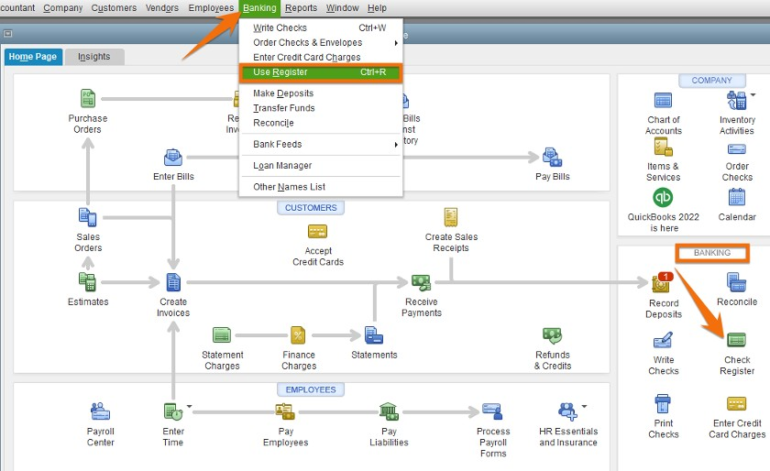

1. Go to the Check Register and select the bank account where you want to void a check.

2. Select the check you want to void.

3. Click Void to zero out its balance then click Save & Close.

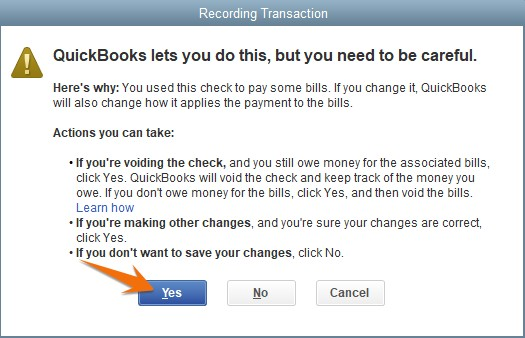

4. Confirm your action by clicking Yes.

Why you need to void a check in QuickBooks

Voiding a check is a safer and cleaner way to handle mistakes and errors. It zeroes out the balance but still keeps a record of the transaction for auditing purposes. Here are some reasons when you need to void a check:

1. There are incorrect details

If a check was written with the wrong payee name, amount, or date, voiding it ensures the incorrect transaction is adjusted while keeping a record of the issue. Instead of deleting the check, which removes all history, voiding it keeps the details intact while ensuring it won’t affect future reports or bank reconciliations.

2. Check is lost or stolen

If a check has been lost in the mail or stolen, you’ll likely need to issue a replacement. Voiding the original check prevents it from being cashed while maintaining a record in QuickBooks. This helps avoid duplicate payments and ensures the lost check no longer impacts outstanding balances.

3. It is a duplicate entry

Sometimes, a check may be entered twice by mistake. If the duplicate entry hasn’t cleared the bank, voiding it removes the incorrect record without disrupting your books. This prevents discrepancies in your bank reconciliation and financial reports.

FAQs on how to void a check in QuickBooks

Can I recover a voided check in QuickBooks?

No, you can’t reverse a voided check in QuickBooks once it’s been voided. However, the transaction details remain in your records with a $0.00 amount. If you need to restore it, you’ll have to create a new check with the original details.

Does voiding a check affect my bank balance?

No, voiding a check does not change your bank balance. If the check was already cleared in a past reconciliation, its impact on the bank account remains. However, if the check was still outstanding, voiding it removes it from your list of pending transactions, preventing future discrepancies.