Injective Protocol is trending as the daily active addresses soar 10X from January 2025. INJ crypto prices are flat, but the EVM testnet release may drive the coin above $12.

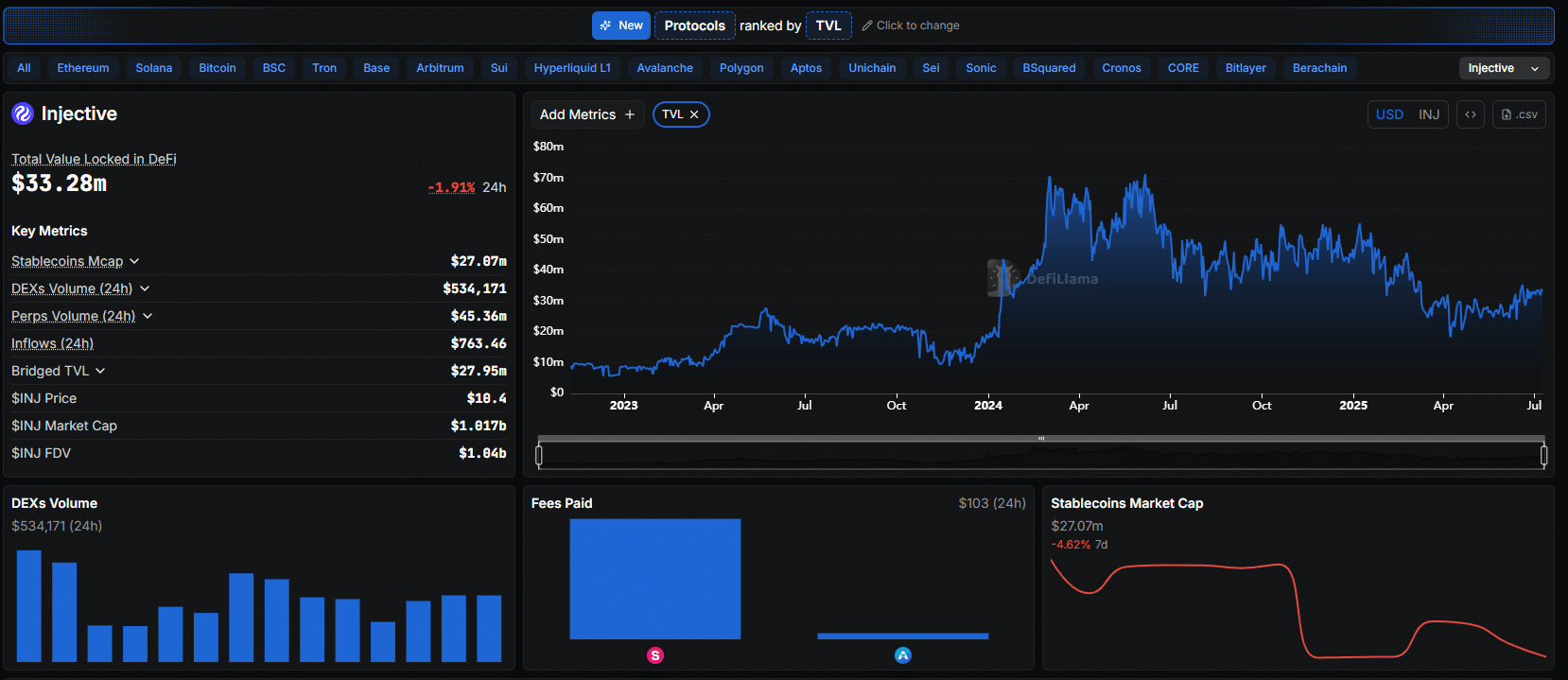

The second quarter of 2025 has been a dynamic period for Injective Protocol, a layer-1 blockchain optimized for decentralized finance (DeFi). Despite the total value locked (TVL) rising from approximately $20 million in April to $33 million by July, the INJ crypto price has yet to see major gains.

(Source)

DISCOVER: Best Meme Coin ICOs to Invest in 2025

Will Injective Crypto Break $12?

The question on investors’ minds is whether Injective’s recent developments, including its Ethereum Virtual Machine (EVM) testnet launch and focus on real-world asset (RWA) tokenization, will propel above $12, breaking above the local resistance level.

Market data indicates that INJ has been trading sideways, confined within a tight $3 range between $9 and $12.

For bulls to take control, there must be a high-volume breakout above the $12 liquidation level. Such a move could drive INJ toward $14, retesting the Q2 2025 highs printed in May.

Despite the lacklustre price gains, on-chain metrics paint a bullish picture.

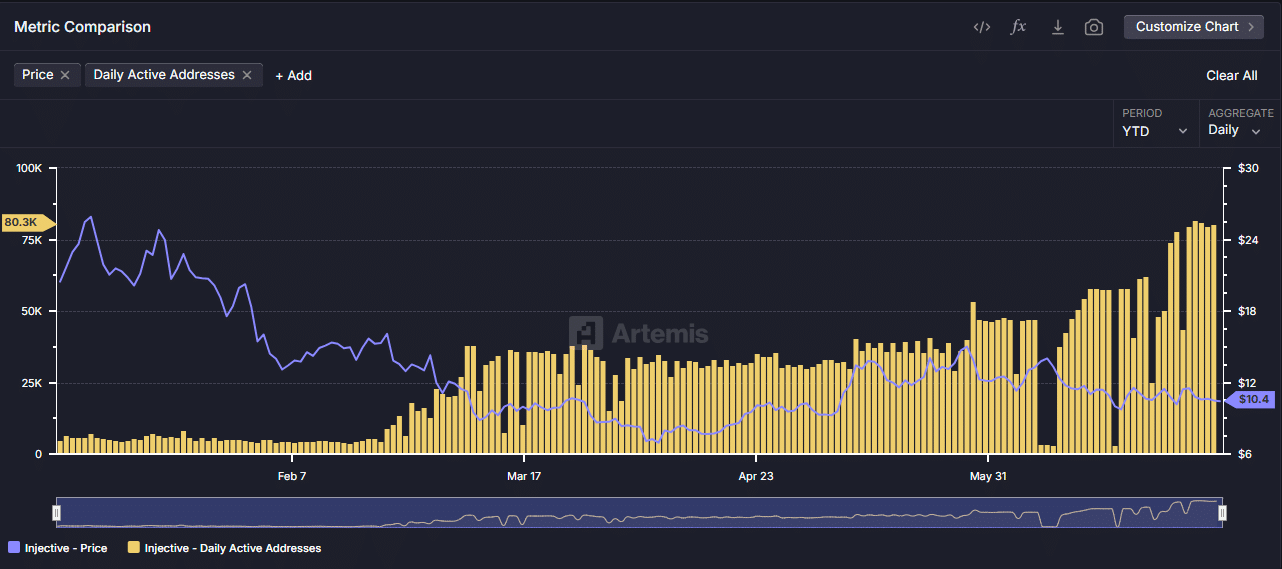

According to Artemis, daily active addresses on the Injective network have skyrocketed nearly 10X over the past six months, climbing from 5,000 to over 81,000 by early July 2025.

(Source)

This surge in activity suggests growing user engagement, even as INJ prices remain subdued. INJ crypto prices fell from $25, as printed in early January 2025, to a low of $6 in April.

Injective EVM Testnet Released

The spike in network activity aligns with Injective’s technological advancements.

Unlike Ethereum, it can process 20,000 transactions per second, offering near-zero fees and instant transaction finality.

This high-performance infrastructure, combined with interoperability across Ethereum, Cosmos, and non-EVM chains like Solana, positions Injective as a compelling DeFi platform.

The recent launch of the Injective EVM testnet on July 2, 2025, marks a major milestone.

This testnet introduces the first layer-1 blockchain with native EVM integration, enabling Ethereum-compatible smart contracts to operate seamlessly without external bridges.

The MultiVM Token Standard (MTS) further enhances this by allowing tokens to function across various Ethereum-compatible environments, boosting code composability and user experience.

Focus on RWA Tokenization

The upgrade will be key as Injective seeks to gain market share in the fast-growing tokenization sector, cementing its position among the best cryptos to buy.

Thus far, Helix, the top DeFi dapp on Injective, supports the trading of over 25 tokenized securities, including stocks like Apple and Tesla, and commodities such as gold and silver.

Moreover, strategic partnerships with industry giants like BlackRock, through the integration of the BUIDL index and collaborations with Aethir and Google Cloud, underscore their ambition to dominate the tokenization sector.

$INJ – Trade Idea

Just entered a new long position.

I believe $INJ completed its first impulsive move from the $9 low to the $12 high and has now finished the correction.

The recent breakout above $12 confirms this as wave (1) in a new bullish impulse.

The current level… pic.twitter.com/buigndr6pq

— Crypto Wave Vision (@CryptoWaveV) July 8, 2025

On X, one trader thinks the INJ bulls run is getting started. In his analysis, the trader thinks the coin may 2X to $23 in the coming weeks, outpacing some of the best Solana meme coins.

DISCOVER: Best New Cryptocurrencies to Invest in 2025 – Top New Crypto Coins

Injective Protocol Trending After EVM Testnet Launch, INJ Crypto To $12?

- Injective Protocol is trending as DAUs rise by 10X from January 2025

- Developers release the EVM testnet

- Injective focusing on RWA tokenization

- Will INJ crypto break $12?

The post Injective Crypto Gains Momentum: Will EVM Testnet Launch and RWA Tokenization Push INJ Price Above $12? appeared first on 99Bitcoins.