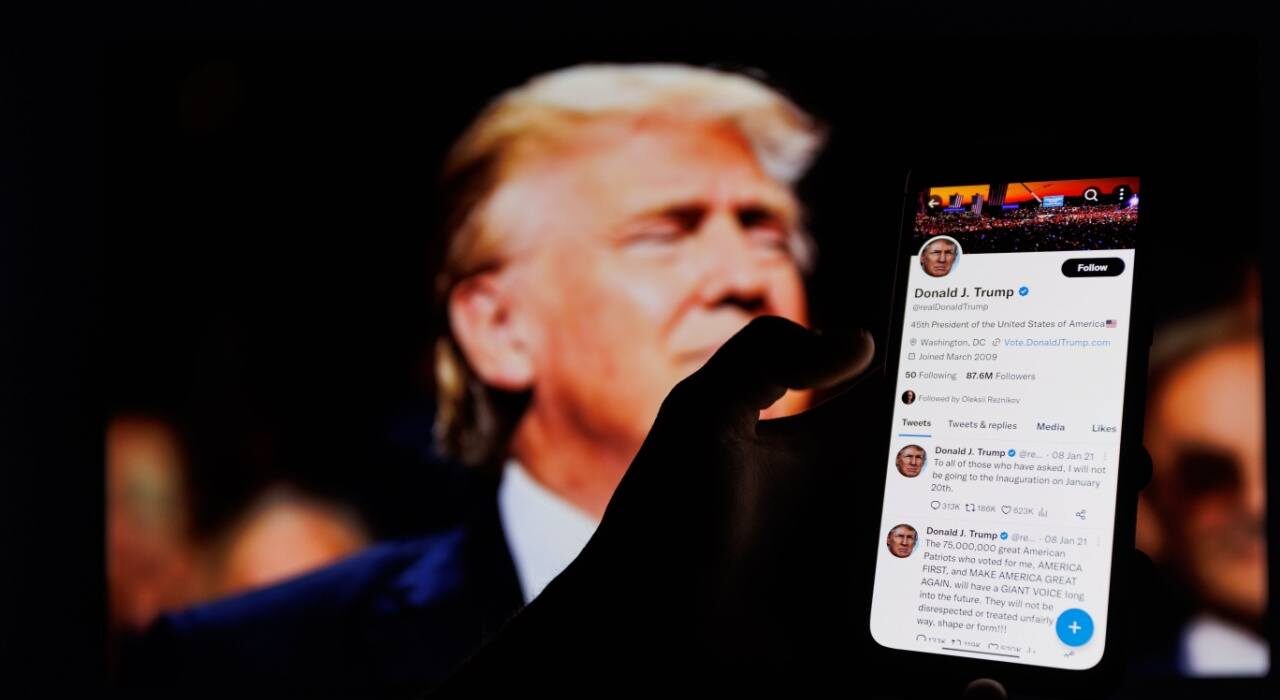

A JPMorgan study reveals that Trump’s social media influence on financial markets has decreased, with only 10% of his economic-related posts triggering currency movements. However, tariff-related tweets continue to impact global markets, raising questions about potential spillover effects into crypto. Trump’s Tariff Tweets Still Move Currencies and Crypto Could Be Next Donald Trump’s social media […]

A JPMorgan study reveals that Trump’s social media influence on financial markets has decreased, with only 10% of his economic-related posts triggering currency movements. However, tariff-related tweets continue to impact global markets, raising questions about potential spillover effects into crypto. Trump’s Tariff Tweets Still Move Currencies and Crypto Could Be Next Donald Trump’s social media […]

Source link

Chain Articles > Blog > Bitcoin > JPMorgan: Trump’s Market Influence Diminishes, but Tariff Tweets Still Rattle Markets

JPMorgan: Trump’s Market Influence Diminishes, but Tariff Tweets Still Rattle Markets

posted on

You Might Also Like

BlackRock’s iShares Launches First Bitcoin ETP on SIX Swiss Exchange

Jack DaviesAugust 17, 2025

BlackRock, the world’s largest asset manager, has launched its first Bitcoin exchange-traded product (ETP) on the SIX Swiss Exchange, under...

BTC’s Post-High Bull Trap, $12B BlackRock Bet Rattles ETH Supply: Best Crypto To Buy Now?

Jack DaviesAugust 17, 2025

BTC experienced significant volatility after setting a new all-time high. The price quickly reversed, signalling a possible bull trap, leading...

India’s First Bitcoin Think Tank Launches On Independence Day. Its Mission? Financial Sovereignty

Jack DaviesAugust 17, 2025

On India’s Independence Day, August 15, 2025, at 12:00 a.m. local time, the Bitcoin Policy Institute of India (BPI India)...

Gemini Exchange Files S-1 for Proposed Nasdaq IPO Under Ticker ‘GEMI’

Jack DaviesAugust 17, 2025

Gemini Space Station, Inc. (Gemini Exchange) filed a registration statement on Form S-1 with the U.S. Securities and Exchange Commission...