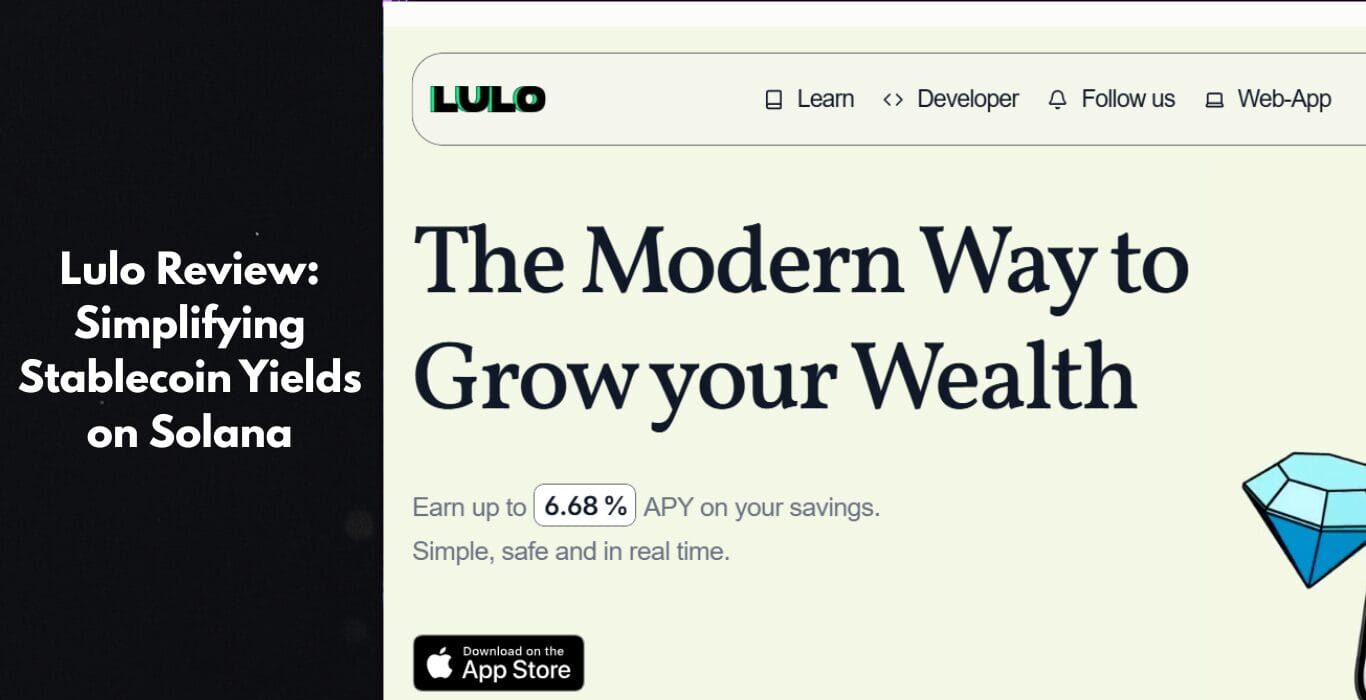

In the fast-paced world of decentralised finance (DeFi), where innovation often comes wrapped in layers of complexity, Lulo stands out with its straightforward tagline: “The Modern Way to Grow your Wealth.” This mobile-first savings app, built on the efficient Solana blockchain, transforms idle stablecoins into high-yield assets without the usual headaches of gas fees, wallet juggling, or impermanent loss. Lulo has hit a major milestone, surpassing $100 million in USDC deposits, signalling robust adoption amid a stablecoin market that’s ballooned to over $160 billion globally. Users can earn up to 7.65% APY on high-yield options through fee-free, real-time compounding—far surpassing traditional bank savings rates, which typically hover near 0.5%. In this article, we delve into Lulo’s DeFi democratisation: routing stablecoins to optimised Solana protocols for seamless yields (up to 7.65% APY), with zero-KYC ease and built-in protections. We’ll assess accessibility, security, performance, post-2024 regs, features, mechanics, and peers—verdict: your passive income bridge against 2-3% inflation.

Background and Overview

DeFi’s allure lies in its permissionless yields, but entry barriers like smart contract risks and UI friction have long sidelined casual users. Enter Lulo, launched in early 2024 as a Solana-native aggregator that simplifies stablecoin lending. By connecting to battle-tested protocols, it auto-optimises for the best risk-adjusted rates, turning what could be a spreadsheet nightmare into a swipeable app experience. Solana’s proof-of-history consensus—delivering 65,000 TPS at under $0.01 per tx—makes this feasible, outstripping Ethereum’s layer-1 costs even after Dencun.

Lulo’s mission? Bridge TradFi’s familiarity with DeFi’s upside, offering “simple, safe & in one app” yields on assets like USDC and USDT. No leverage tricks or hidden fees; just pure borrow demand from over-collateralised loans fueling APYs. Early traction was fueled by integrations with Kamino and Marginfi, but by October 2025, expansions like Maple Finance—a $4B+ institutional lender since 2021—have broadened its yield sources. This evolution mirrors Solana’s DeFi boom, where TVL hit $5B+ this year, driven by stablecoin liquidity. For users weary of CeFi collapses like FTX, Lulo’s non-custodial model (you hold keys) and audited contracts provide reassurance, positioning it as a “DeFi savings account” for the masses.

Key Features

Lulo’s toolkit is engineered for effortless yield chasing, wrapping sophisticated DeFi in a consumer-grade package that feels more like Venmo than a DEX.

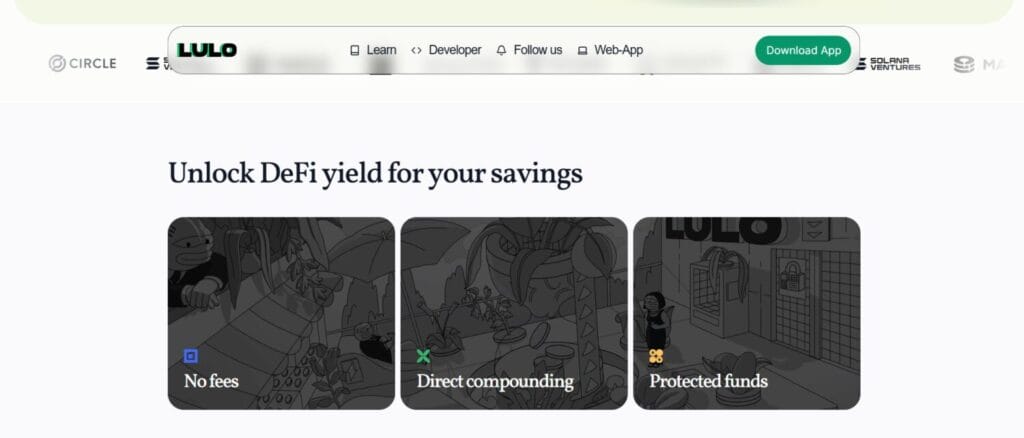

- No-Fee Model: Zero charges for deposits, withdrawals, or management—yields flow straight to you, a rarity in aggregators skimming 0.5-2% spreads. This keeps even micro-deposits viable, fostering inclusivity.

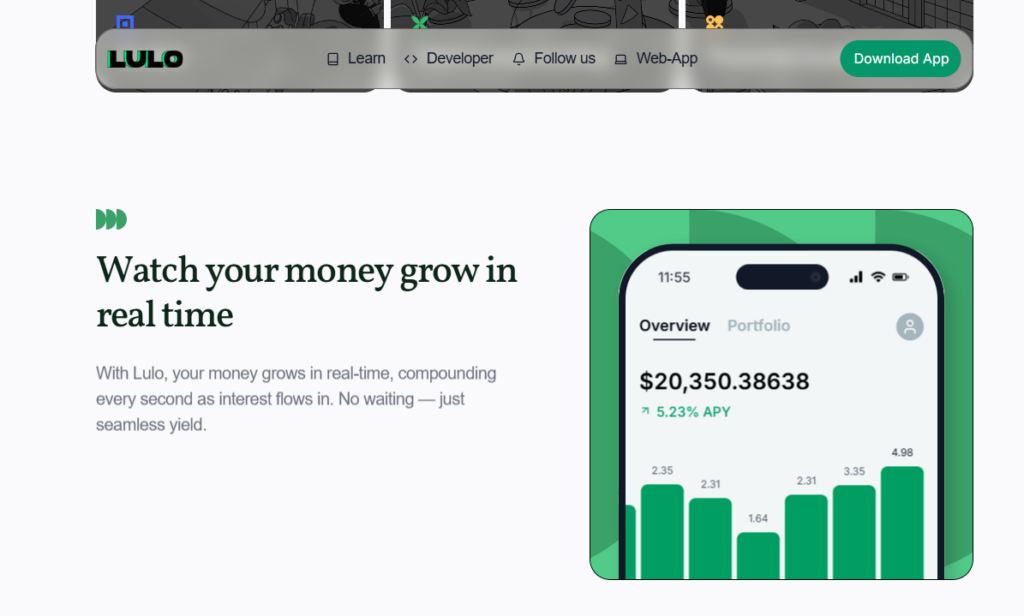

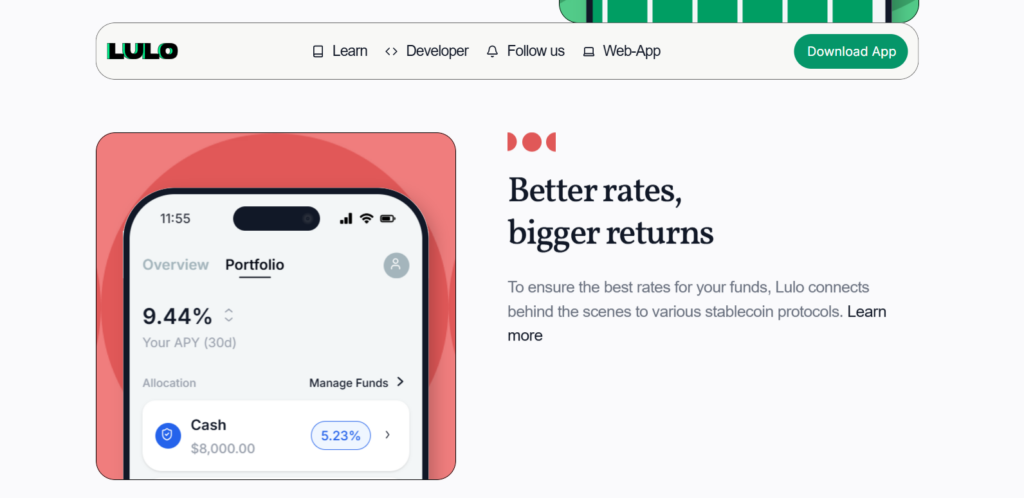

- Real-Time Compounding: Interest accrues and is reinvested every second via Solana’s blocks, with the dashboard updating live. For a $20K portfolio split evenly, expect visible growth: a 30-day projection at 9.44% APY could add $500+, tracked via intuitive daily/monthly/yearly charts showing fluctuations like 1.64% to 4.98%.

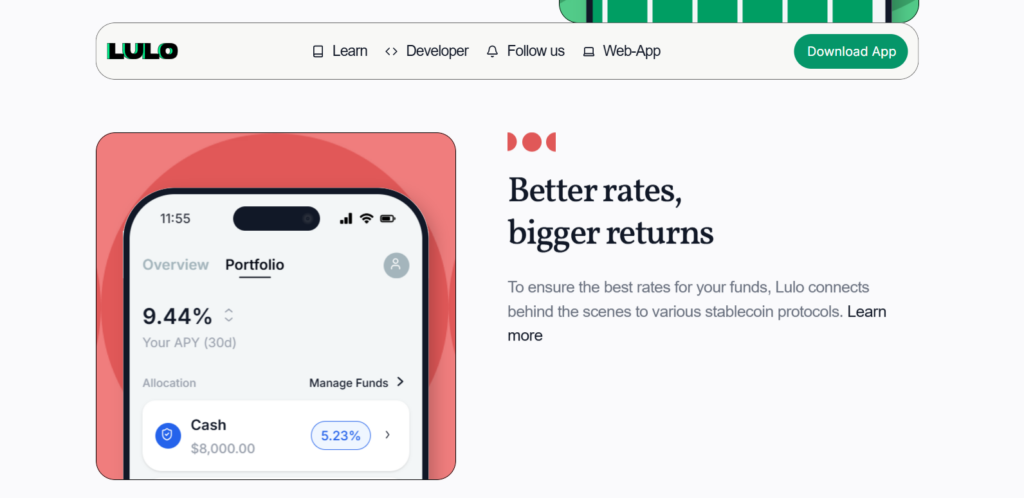

- Flexible Allocations: Toggle between “Cash” (conservative 5.23% APY with full protection) and “High Yield” (aggressive 7.65% APY for maximisers). Split ratios on the fly—e.g., 60/40—and adjust without friction, ideal for risk tuning.

- Referral Rewards: Share a code for perpetual cuts of friends’ yields; as deposits grow (hello, $100M milestone), so do bonuses. This viral loop has sparked community buzz, with X users raving about “recurring passive kicks.”

- Boosted Yields Option: Opt-in to provide coverage for others and pocket 1-2% extra APY—a symbiotic twist on mutual insurance, rewarding liquidity providers.

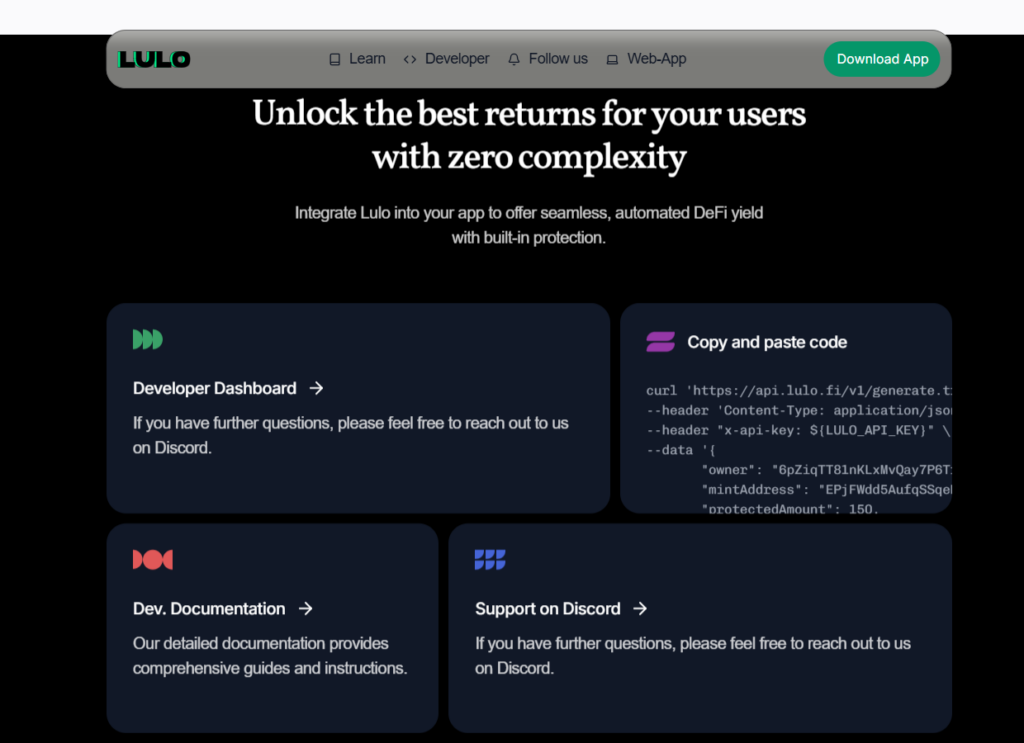

- Notifications and Integrations: Push alerts for APY spikes or milestones keep you looped; devs can embed Lulo’s engine into wallets or apps for automated, protected yields—unlocking “zero complexity” DeFi for third-parties.

These aren’t gimmicks; they’re Solana-composable building blocks, audited for MEV resistance, making Lulo a set-it-and-forget-it staple.

How It Works

The working of Lulo is frictionless. Just download the iOS app from the App Store, link a Solana wallet (Phantom is recommended), fund it with USDC/USDT, and approximately 0.005 SOL (~$1), then click “Deposit.” No emails, no selfies—just allocate to Cash or High Yield via sliders, and funds route instantly to diversified protocols like Kamino, Drift, Marginfi, Save, and now Maple.

Under the hood, Lulo’s smart contracts—open-source and audited—deposit into over-collateralised pools (150%+ ratios) where borrowers pay interest for leverage. An optimisation engine scans utilisation rates, chasing peaks while dodging illiquid traps; yields from real lending demand (e.g., traders borrowing for perps) compound sub-second, no manual claims needed. The dashboard’s Overview tab snapshots your $20,350 balance at 5.23% APY, while Portfolio drills into allocations—$8K Cash growing steadily, $8K High Yield juiced higher.

Withdrawals? Tap out anytime, funds hit your wallet fee-free in seconds, thanks to Solana’s liquidity. Referrals auto-apply: invite via link, earn as cohorts deposit. For power users, “what-if” simulators preview tweaks, like shifting 20% to High Yield for +$200 yearly. It’s non-custodial purity: Lulo executes, you control—backed by real-time charts logging daily yields (e.g., 2.43% on Oct 1). In Web3 terms, this is yield farming sans the farm.

Security: Lulo Protect

DeFi’s $3B+ hack tally since 2016 looms large, but Lulo Protect flips the narrative with default, premium-free coverage— a peer-to-peer mutual shield against exploits, failures, or black swans. For Cash balances (e.g., your $10.5K safeguarded pot), it’s automatic: if a protocol like Maple glitches, the communal pool reimburses proportionally, settled via oracles in minutes, no claims bureaucracy.

Mechanics shine in symbiosis—Boosted users (those providing the backstop) earn that 1-2% APY premium, scaling coverage organically as TVL grows. It targets smart contract vulnerabilities, not market dips (depegs excluded), drawing from audited bases like Nexus but automated for speed. “Your Cash balance is safeguarded by Lulo’s built-in coverage,” the app assures, echoing FAQs on making DeFi safer. Real-time monitoring flags pool health, with over-collateralization (liquidations at 80%) as a first line.

Yields and Performance

Lulo’s yields tap authentic demand: stables lent to margin traders, perps speculators, and now institutions via Maple, diversified for stability. Current snapshots? Cash at 5.23% APY for protected preservation; High Yield at 7.65% for growth chasers; blended portfolios hitting 9.44% over 30 days. Historical dailies vary—1.64% lows to 4.98% highs—but compound relentlessly: $10K at 7% nets ~$835 yearly, exponential via seconds.

Performance holds firm amid 2025’s chop: down from 2024 peaks (15-18% in bull froth), but resilient at 5-9%, outbeating CeFi like Nexo (4-6%) sans custody risks. Optimisation hedges via protocol rotation—e.g., Maple’s $4B deposits add institutional ballast. Factors like utilisation (70-90% sweet spot) and Solana upgrades (post-Firedancer) ensure uptime. For inflation-beaters, it’s gold: offsets 2.5% USD erosion while diversifying from fiat rugs.

User Experience and Community

Lulo’s iOS app is a UX masterclass: minimalist dashboard with Overview for at-a-glance ($20K total, 5.23% APY), Portfolio for splits, Funds for tx history—swipeable like Apple Wallet, sans crypto jargon. Real-time charts and notifications (toggle for APY alerts) make monitoring addictive, not arduous. Android? Still pending, a gripe in X threads, but iOS polish (4.8/5 stars) shines.

Community thrives referral-fueled: @uselulo’s feed buzzes with yield drops (Maple integration lit up 5K+ views), users sharing “syrup’d” wins. FAQs demystify (“What are stablecoins?”), while integrations tease wallet embeds. Sentiment? Bullish—posts hail $100M as “simple yield, done right,” with devs eyeing API hooks.

Pros and Cons

Pros

- Fee-Free Operations: No charges on deposits, withdrawals, or management fees ensure users capture 100% of yields, making it highly accessible for small savers without erosion from hidden costs.

- Real-Time Compounding: Yields accrue and reinvest every second on Solana’s fast network, providing exponential growth visible instantly—e.g., turning a $10K deposit into $10,765 annually at 7.65% APY.

- Innovative Lulo Protect: Built-in, premium-free coverage against protocol hacks or failures offers peace of mind, a rare DeFi feature that shields balances like traditional FDIC without centralisation.

- User-Friendly Mobile Interface: The iOS app’s intuitive dashboard and seamless wallet integration (e.g., Phantom) abstracts DeFi complexities, ideal for beginners seeking bank-like simplicity.

- Referral and Boosted Rewards: Earn recurring bonuses from friends’ deposits plus 1-2% extra APY by providing coverage, fostering a viral, community-driven ecosystem that amplifies passive income.

Cons

- iOS-Only Availability: Limited to Apple devices, excludes Android users, potentially capping broader adoption until a 2026 rollout—frustrating for the 70%+ global Android market.

- Yield Fluctuations: APYs (5-9%) vary with lending demand and market conditions, lacking the fixed rates of CeFi, which can disappoint conservative savers during low-borrow periods.

- Limited Stablecoin Variety: Primarily supports USDC and USDT, restricting diversification compared to multi-asset platforms like Aave, exposing users to peg risks in fewer options.

- Protocol Transparency Gaps: While diversified across Kamino, Marginfi, etc., exact allocation weights aren’t always visible, raising minor trust concerns for advanced users auditing exposure.

- No Native Governance Token: Absence of a utility token limits community voting or staking incentives, hindering long-term DAO evolution in a token-centric DeFi landscape.

Comparisons

| Platform | Network | APY Range | Key Advantage | Main Drawback | Summary |

|---|---|---|---|---|---|

| Lulo | Solana | 5–8% | Automated diversification, Protect feature | Newer platform, limited track record | Non-custodial, automated “savings account” for Solana users |

| Marginfi | Solana | 5–8% | Established lender, transparent yields | Manual routing, no Protect feature | Reliable returns but lacks automation |

| Aave | Ethereum | 4–7% | DeFi pioneer, deep liquidity | High gas fees, slower UX | Trusted, but Solana options are cheaper and faster |

| Ethena | Ethereum | 10%+ | Synthetic yields, high APY | Depeg and systemic risk | Attractive returns, but risky for stablecoin holders |

| Tulip | Solana | 4–6% | Native yield aggregator | Higher fees, less safety | Decent yields, but Lulo’s protection system is stronger |

Conclusion

Lulo encapsulates DeFi’s maturation: secure, scalable yields without the sorcery. From $15M AUM in late 2024 to $100M+ today, its trajectory—bolstered by Maple and Solana’s rails—promises Android rollout and multi-chain whispers by 2026, potentially tokenising Protect for governance. For stablecoin holders battling inflation, it’s a no-brainer: deposit USDC, allocate wisely, and watch 5-9% compound in real-time, protected and fee-free. In a Web3 where accessibility unlocks sovereignty, Lulo scores 8.7/10—polished for newbies, potent for pros. Download, deposit, diversify: your savings deserve better than 0.01%. As X echoes, “Save different”—Lulo makes it real.

Frequently Asked Questions (FAQs)

What is Lulo and how does it differ from traditional savings accounts?

Lulo is a mobile DeFi savings app on Solana that lets users earn yields on stablecoins like USDC through lending protocols, with APYs up to 7.65% via real-time compounding. Unlike traditional banks offering ~0.5% APY, Lulo is non-custodial (you control keys), fee-free, and decentralised—no KYC, just wallet connect for instant, higher returns beating inflation.

Is Lulo safe? What protections are in place?

Yes, Lulo prioritises security with Lulo Protect: premium-free coverage against protocol hacks or failures, backed by a peer-to-peer mutual pool. Funds route to audited, over-collateralised protocols like Kamino and Marginfi. While DeFi risks exist (e.g., smart contract bugs), non-custodial design and real-time monitoring minimise them—far safer than unsecured yield farms.

How do I get started with Lulo?

Download the iOS app from the App Store, connect a Solana wallet (e.g., Phantom), fund with USDC/USDT and ~0.005 SOL for gas. Deposit via sliders to Cash (protected 5.23% APY) or High Yield (7.65% APY). Withdrawals are instant and fee-free—no minimums beyond gas, onboarding in under 2 minutes.

What yields can I expect, and do they fluctuate?

Yields range 5-9% APY based on lending demand: Cash at ~5.23% (stable), High Yield at ~7.65% (optimised). They compound every second but vary with market borrowing rates—e.g., higher in bull markets. Historical data shows resilience, outpacing CeFi like Nexo without custody risks; check the dashboard for live projections.

Can I use Lulo on Android, and are there fees?

Currently iOS-only (Android launch eyed for 2026), but Solana’s speed makes it seamless on mobile. Zero fees for deposits, withdrawals, or management—yields are pure, no spreads. Referrals add bonuses, but watch Solana gas (~$0.01/tx); it’s designed for cost-free passive growth.