Japan sits on $14.9 trillion in household financial assets, yet its fixed income market offers some of the lowest returns in the developed world. The 10-year Japanese Government Bond yields just ~1%, and corporate bonds often struggle to clear 2%. For decades, pension funds, insurers, and banks have been locked into low-return allocations simply because there were no compliant, familiar alternatives.

Metaplanet’s Q2 earnings announcement aims straight at this gap. The company unveiled:

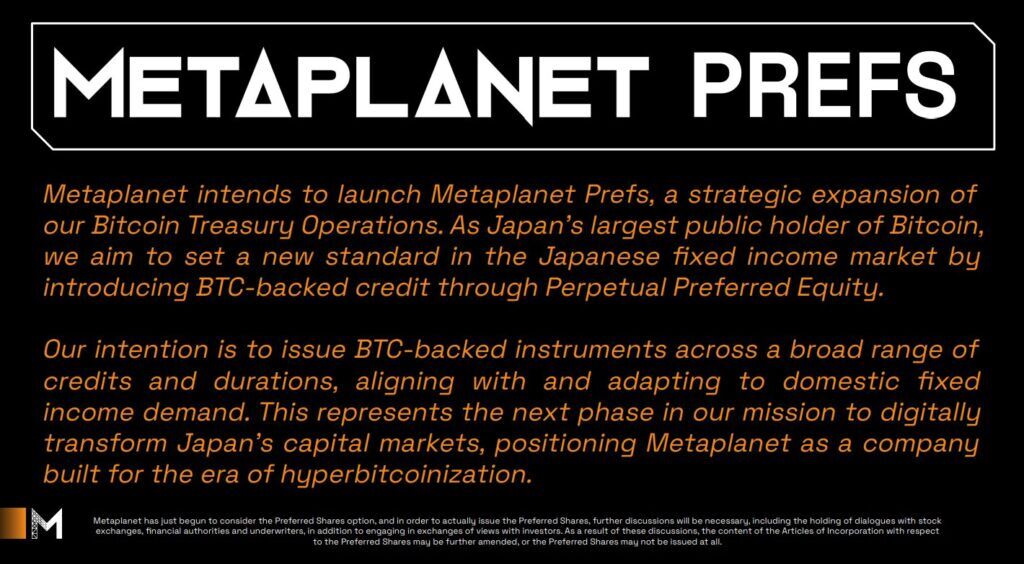

- “Metaplanet Prefs” — a program of Bitcoin-Backed Preferred Shares designed to scale its Bitcoin treasury operations.

- A plan to build a Bitcoin-backed yield curve in Japan’s fixed income market.

In a market where even “high yield” means low single digits, a well-structured Bitcoin-Backed Preferred Share offering 7–12% could command serious attention—and serious capital.

Record Q2 Growth Fuels Bitcoin-Backed Preferred Share Strategy

Metaplanet’s Q2 wasn’t just about announcing a new funding model—it delivered one of the strongest quarters in the company’s history. Both revenue and profitability surged, while assets and net assets multiplied, underscoring the scale at which the company is now operating.

Metaplanet Q2 Earnings Results:

- Revenue: ¥1.239B ($8.4M) +41% QoQ

- Gross Profit: ¥816M ($5.5M) +38% QoQ

- Ordinary Profit: ¥17.4B ($117.8M) vs. -¥6.9B

- Net Income: ¥11.1B ($75.1M) vs. -¥5.0B

- Assets: ¥238.2B ($1.61B) +333% QoQ

- Net Assets: ¥201.0B ($1.36B) +299% QoQ

This surge in financial performance strengthens Metaplanet’s credibility with investors and positions it to roll out Bitcoin-Backed Preferred Shares at scale, using its momentum to capture a share of Japan’s vast but yield-starved fixed income market.

BTC-Backed Preferred Equity: How ‘Metaplanet Prefs’ Will Work

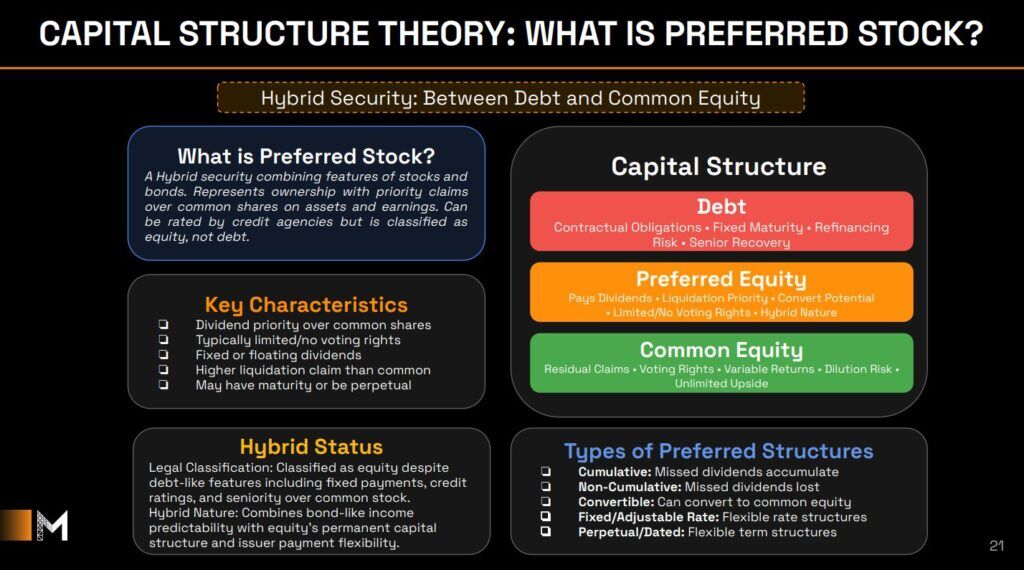

Preferred equity sits between debt and common stock in a company’s capital structure. It offers dividend priority, higher liquidation claims, and predictable payouts—often without voting dilution.

Metaplanet’s Bitcoin-Backed Preferred Shares are designed to:

- Deliver materially higher yields than JGBs while retaining a familiar format for Japanese institutions.

- Avoid refinancing risk tied to debt maturities.

- Diversify funding sources for BTC accumulation beyond common equity issuance.

The Precedent: Strategy’s Multi-Class Stack

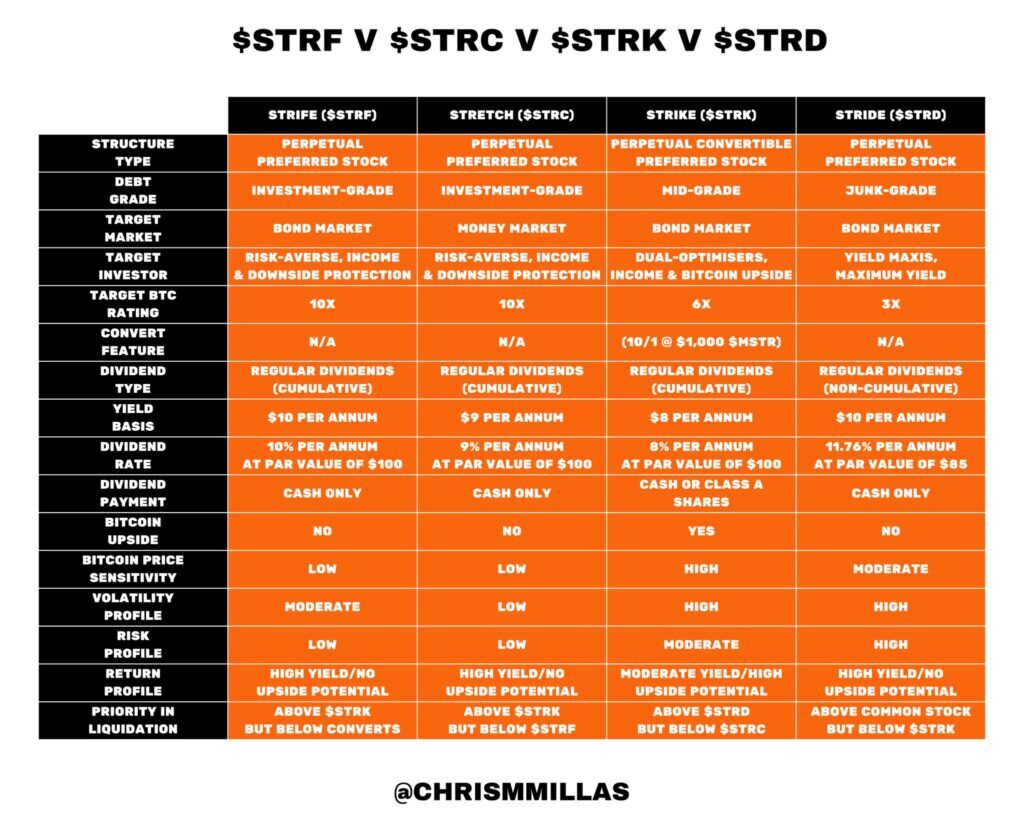

Strategy (formerly MicroStrategy) has already shown what’s possible. The company built a stack of Bitcoin-backed preferred equity classes, each aimed at a different part of the yield curve and a specific investor profile:

- Low-volatility, income-focused classes for conservative buyers.

- Convertible preferreds combining fixed income with BTC upside.

- Higher-yield classes targeting risk-tolerant investors.

By matching each issuance to market demand, Strategy has raised billions and grown its Bitcoin holdings to more than 500,000 BTC—without relying solely on common equity dilution.

Metaplanet is taking the same multi-class concept into a market where preferred share issuance is rare, the investor base is yield-hungry, and Bitcoin-Backed Preferred Shares could see rapid adoption.

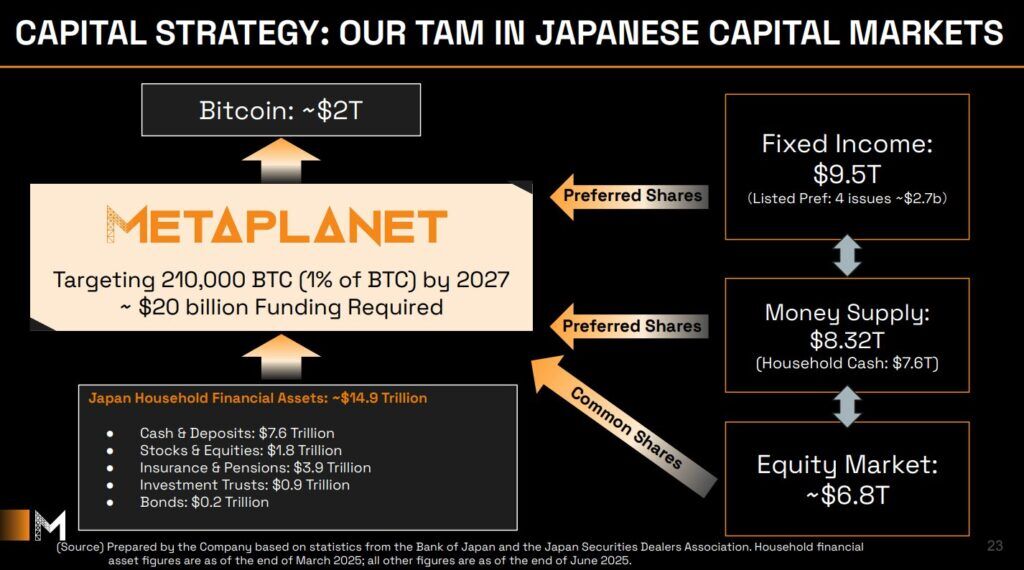

Japan’s Capital Market: A $14.9 Trillion Opportunity

Japan’s fixed income market has faced decades of near-zero yields, leaving trillions in capital with few compliant, income-producing options. This scarcity makes it uniquely primed for higher-yield instruments like Bitcoin-Backed Preferred Shares.

Japan’s household financial assets break down as follows:

- $9.5 trillion in fixed income

- $6.8 trillion in equities

- $7.6 trillion in cash and deposits

The listed preferred share market is just $2.7 billion—less than 0.02% of total financial assets. Yet demand for stable, income-oriented products is immense.

Here’s the gap: a Bitcoin-Backed Preferred Share yielding 8% offers 8x the return of a 10-year JGB and 4x the return of most high-grade corporate bonds. In a regulatory-compliant, familiar structure, that spread could attract both domestic institutions and retail allocators looking for yield without leaving the fixed income universe.

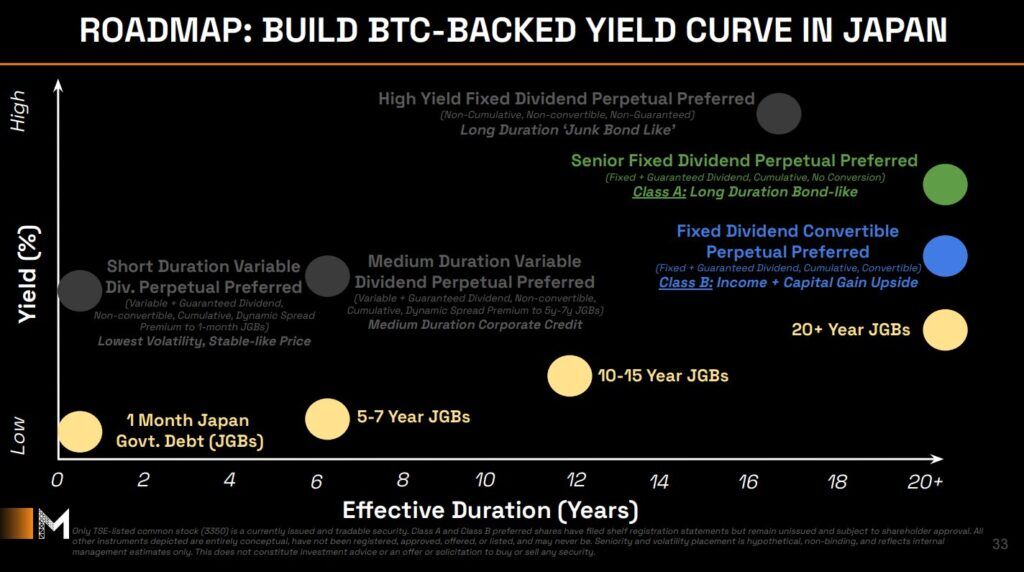

Engineering a Bitcoin-Backed Yield Curve

Metaplanet plans to issue multiple classes of Bitcoin-Backed Preferred Shares, each built for a different investor segment:

- Short Duration Variable Dividend Perpetuals pegged to short-term JGB spreads for conservative buyers.

- Medium Duration Variable Dividend Perpetuals as a mid-range corporate credit alternative.

- Senior Fixed Dividend Perpetuals (Class A) for stability-focused, long-duration portfolios.

- Fixed Dividend Convertibles (Class B) combining predictable income with BTC upside potential.

- High Yield Fixed Dividend Perpetuals for investors willing to take on more risk in exchange for higher returns.

This isn’t just a product lineup—it’s the construction of an investable BTC-backed yield curve. Strategy built one in the U.S.; Metaplanet is doing the same in Japan, but with the added tailwind of a market desperate for yield.

Implications for Corporate Bitcoin Strategy

Metaplanet’s approach offers three clear takeaways for corporate strategists:

- Capital Efficiency: Bitcoin-Backed Preferred Shares channel yield-seeking capital into the treasury without over-relying on common equity. They provide permanent capital without the same maturity constraints as debt.

- Market Fit Matters: Strategy succeeded in the U.S. with convertible debt and equity raises because those markets are deep and liquid. Japan’s capital structure norms are different, and Metaplanet is adapting the playbook to local investor behavior—a critical step for adoption.

- Legitimization of Bitcoin as Collateral: Every issuance of Bitcoin-Backed Preferred Shares that finds a home in a regulated, yield-hungry portfolio chips away at the perception of Bitcoin as speculative-only. Once normalized in one major economy, replication in others becomes easier.

The Bigger Picture: Bitcoin’s Fixed Income Era

Metaplanet’s Q2 announcements can serve as a blueprint for how Bitcoin can be integrated into national capital markets.

By pairing a proven capital structure model with one of the most yield-constrained environments in the world, Metaplanet is positioning Bitcoin as a legitimate, income-generating collateral base for a sovereign-scale fixed income market.

If they succeed, Japan’s first Bitcoin-Backed Preferred Share program won’t be the last. It could mark the beginning of Bitcoin’s fixed income era—and a case study in how corporate Bitcoin strategies evolve to fit the markets they enter.

Disclaimer: This content was written on behalf of Bitcoin For Corporations. This article is intended solely for informational purposes and should not be interpreted as an invitation or solicitation to acquire, purchase or subscribe for securities.