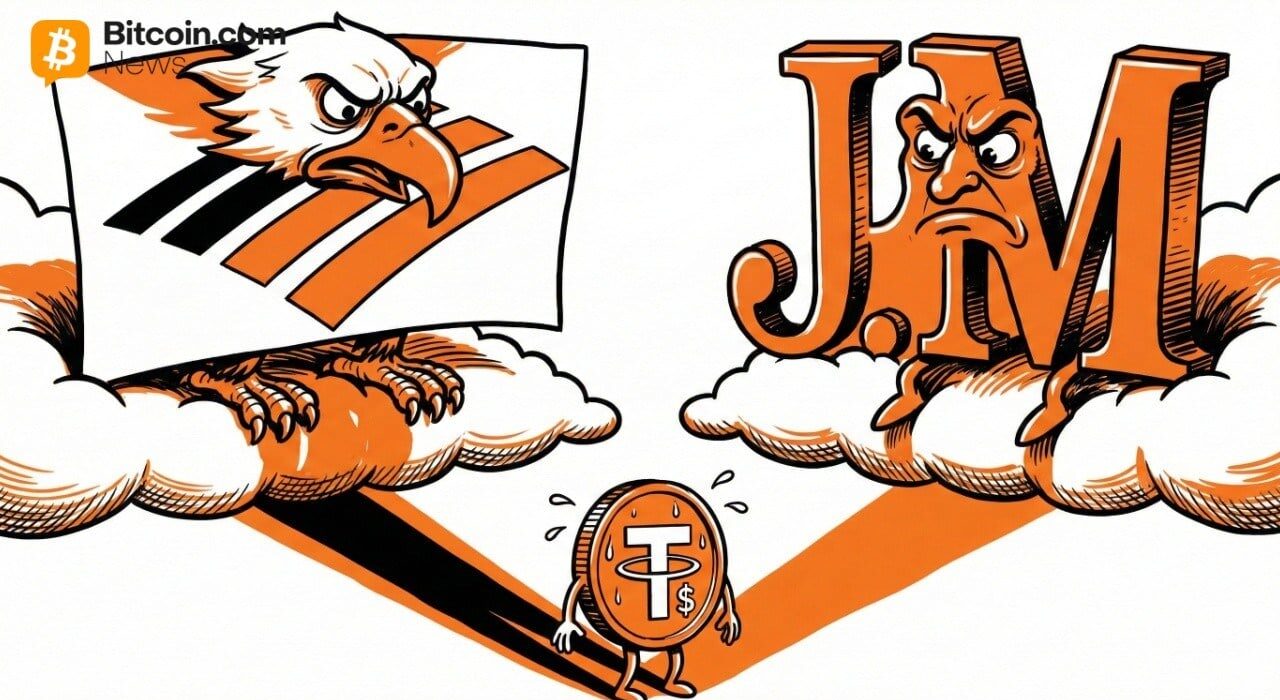

A recent New York Times piece misleadingly suggests that stablecoins facilitate money laundering by criminal actors. However, the article reveals that crypto-to-cash conversion services and inadequate compliance measures by financial companies are the primary mechanisms enabling such activities. Stablecoins are Not Aiding Money Launderers, Weak Compliance Is The Facts A recent article published by The […]

A recent New York Times piece misleadingly suggests that stablecoins facilitate money laundering by criminal actors. However, the article reveals that crypto-to-cash conversion services and inadequate compliance measures by financial companies are the primary mechanisms enabling such activities. Stablecoins are Not Aiding Money Launderers, Weak Compliance Is The Facts A recent article published by The […]

Source link

Chain Articles > Blog > Bitcoin > No, Stablecoins Don’t Aid Criminals in Laundering Money Directly – but Banks Want You to Think So

No, Stablecoins Don’t Aid Criminals in Laundering Money Directly – but Banks Want You to Think So

posted on

You Might Also Like

Swiss UBS Plans Bitcoin Trading For Select Wealth Clients

Jack DaviesJanuary 24, 2026

UBS Group AG is preparing to offer bitcoin trading to a select group of private banking clients in Switzerland. According...

UBS Plans Bitcoin and Ether Trading for Private Clients as Institutional Demand Accelerates: Report

Jack DaviesJanuary 24, 2026

UBS is quietly opening the door to cryptocurrency trading for wealthy clients, signaling a cautious but meaningful shift as global...

Thailand | South Korea | Vietnam Crypto News Catch Up: Jan. 18 – 24, 2026

Jack DaviesJanuary 24, 2026

Disclaimer: This article is for informational purposes only and does not constitute financial advice. BitPinas has no commercial relationship with...

Coinbase Adds Sentient Crypto Futures—Here’s What That Means for You

Jack DaviesJanuary 24, 2026

Coinbase announced it will list a perpetual-style futures contract for Sentient (SENT) on its regulated trading platform. SENT saw a...