Strategy, the corporate bitcoin treasury firm formerly known as Microstrategy, revealed plans for a $21 billion at-the-market (ATM) common stock offering to acquire additional bitcoin ( BTC), even as it reported a first-quarter net loss of $4.2 billion, or $16.49 per diluted share. Strategy Wants More Bitcoin The company’s net loss included a $5.9 billion […]

Strategy, the corporate bitcoin treasury firm formerly known as Microstrategy, revealed plans for a $21 billion at-the-market (ATM) common stock offering to acquire additional bitcoin ( BTC), even as it reported a first-quarter net loss of $4.2 billion, or $16.49 per diluted share. Strategy Wants More Bitcoin The company’s net loss included a $5.9 billion […]

Source link

Chain Articles > Blog > Bitcoin > Strategy Unveils $21B Stock Offering to Amplify Bitcoin Holdings Amid Q1 Loss

Strategy Unveils $21B Stock Offering to Amplify Bitcoin Holdings Amid Q1 Loss

posted on

You Might Also Like

Bitget Teams Up with MotoGP for 2025 Grand Prix Events in Europe and Southeast Asia

Jack DaviesJuly 9, 2025

Disclaimer: This article is for informational purposes only and does not constitute financial advice. BitPinas has no commercial relationship with...

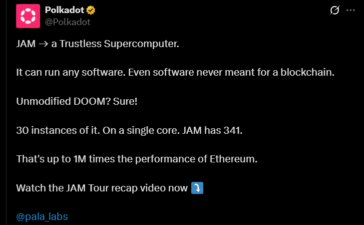

Polkadot Crypto Breaks Out of Two-Year Downtrend as Momentum Builds

Jack DaviesJuly 9, 2025

After years stuck in reverse, the Polkadot crypto price just slammed the gearshift. DOT ▲4.26% has broken free from a...

Sequans Closes $384 Million Investment To Launch Bitcoin Treasury Initiative

Jack DaviesJuly 9, 2025

Sequans Communications, a fabless semiconductor company focusing on 5G/4G IoT semiconductor technology, has officially closed a $384 million strategic investment...

Sequans Communications Raises $384 Million to Purchase Bitcoin

Jack DaviesJuly 9, 2025

Sequans Communications (NYSE: SQNS), a French semiconductor company, announced on Tuesday that it has successfully closed a $384 million private...