President Trump slams Fed Chair Jerome Powell for refusing to chop rates of interest, leaving America’s financial coverage unchanged once more. Consequently, Bitcoin has seen minimal worth motion ever since.

In a latest post shared to Trump Media & Know-how Group-owned social media platform Reality Social, President Donald Trump didn’t maintain again from harshly criticizing Fed Chairman Jerome Powell’s unwavering stance in the direction of rates of interest.

“Too Late—Powell is the WORST. An actual dummy, who’s costing America $Billions!” wrote Trump in his post.

Not solely that, he additionally included a hyperlink to an article printed on the Nationwide Mortgage Information site, which quoted an evaluation from Fannie Mae’s and Freddie Mac’s regulator who referred to as for the Federal Reserve Chairman to give up if he continues to take care of the present rate of interest.

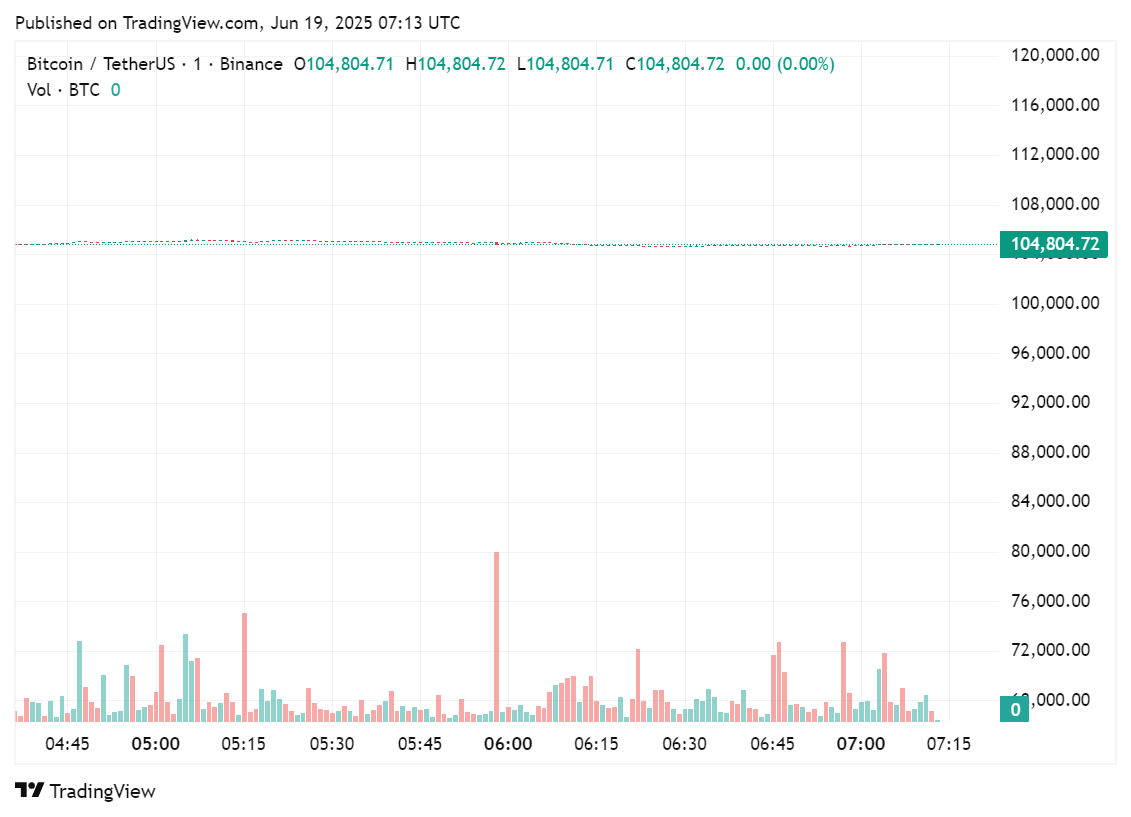

Though the choice to maintain the interest rates regular at a variety of 4.25% to 4.5% vary, it has left Bitcoin (BTC) at a standstill. Ever because it was introduced that the Fed unanimously voted to take care of its present coverage in June, Bitcoin has been caught across the $104,000 floating across the mark, seeing weak good points of solely 0.28% to as little as 0.1%.

It seems that the Fed’s cautionary stance has triggered a pause in Bitcoin’s earlier rally, a lot to the dismay of merchants and the President of the U.S. himself. Prior to now two weeks, the biggest cryptocurrency has seen a slight enhance of 0.3%.

Why has Jerome Powell refused to chop rates of interest?

On June 18, the Federal Reserve got here to a unanimous determination to take care of a “wait-and-see” method to the present financial stance in June.

Based on a CNBC report, Federal Reserve Chair Jerome Powell stated in a press convention that policymakers are “properly positioned to attend” earlier than shifting additional on charges. He additionally stated that the market is starting to see the consequences of Trump’s tariffs on inflation.

“We now have to study extra about tariffs. I don’t know what the precise approach for us to react might be,” stated Jerome Powell, as quoted by CNN Business from the press convention.

“I believe it’s laborious to know with any confidence how we should always react till we see the scale of the consequences,” he continued.

Sustaining rates of interest within the 4.25% to 4.5% is taken into account restrictive by many, contemplating that it led to a fall in investor confidence. Furthermore, Bloomberg reported that the Fed has additionally revised its financial progress forecast, exhibiting a decline for 2025. Decrease GDP projections might counsel much less client spending, weaker funding, or world headwinds.

The inflation forecast for 2025 has been raised to three%, which is above the Fed’s 2% goal. This indicators that inflationary pressures could also be extra persistent than beforehand anticipated.

After the Fed refused to chop rates of interest and foreshadowed a bleaker financial outlook, the U.S. shares took a dive.

Based on a report by Reuters, the Dow Jones Industrial Common fell by 0.10% in comparison with the day before today. In the meantime the S&P noticed a decline of 0.03%. In distinction to the 2 exchanges, the Nasdaq Composite truly rose by 0.13%.

Nevertheless, general inventory costs had been typically increased earlier than the Fed’s announcement.

On the crypto aspect of the market, the general crypto market cap fell by 2.3% previously 24 hours. The present crypto market cap stands at $3.3 trillion, after main tokens like Bitcoin, Ethereum (ETH) and Solana (SOL) noticed declines starting from 1.6% to 0.2%.

Even the general crypto buying and selling quantity suffered a 15% fall following the Fed announcement, from an preliminary $120 billion to $101 billion on June 19.

Moreover, the CBS reported that the central financial institution expects inflation to worsen within the coming months. It additionally foresaw two rate of interest cuts by the top of this yr. This prediction is similar as its earlier projection again in March.

“In the intervening time, we’re properly positioned to attend to study extra in regards to the doubtless course of the economic system earlier than contemplating any changes to our coverage stance,” stated Jerome Powell.

The Fed’s determination goes towards growing pressures from the White Home to decrease curiosity rated by two factors. Simply hours earlier than the announcement, Trump said that “silly” Fed Chair Jerome Powell will doubtless preserve the charges at their present ranges. The remarks had been a part of his ongoing assaults on the Fed.