BlackRock is all set to launch its iShares

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

.cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) {

stroke: #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-trend.positive {

color: #008868 !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive {

border: 1px solid #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.positive::before {

border-bottom: 4px solid #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) {

stroke: #A90C0C !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative {

border: 1px solid #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.negative {

color: #A90C0C !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-trend.negative::before {

border-top: 4px solid #A90C0C !important;

}

3.39%

Bitcoin

BTC

Price

$101,616.05

3.39% /24h

Volume in 24h

$109.95B

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

ETF in Australia on the ASX (Australian stock exchange) by mid-November 2025.

By joining Australia’s fast-growing crypto scene, BlackRock has decided to test its might against other major players such as Global X 21Shares Bitcoin ETF (EBTC), VanEck Bitcoin ETF (VBTC), Monochrome Bitcoin ETF (IBTC), and DigitalX Bitcoin ETF (BTXX), which already have their operations ongoing in full swing, a publication reported on 4 November 2025.

Director of Institutional Client Business at BlackRock Australia, Tamara Stats, said the product responds to “growing institutional interest” in Bitcoin as a potential portfolio diversifier.

Steve Ead, Head of Global Product Solutions, added that local availability of IBIT reflects BlackRock’s focus on “broadening access and democratizing investment opportunities for more Australians.”

Additionally, the ETF launching in Australia will be linked to BlackRock’s existing US-linked BTC Trust and will charge a 0.39% management fee. For Australian investors, it offers a simple and regulated pathway to invest in BTC without needing to buy the crypto directly.

JUST IN:

BlackRock to launch #Bitcoin ETF in Australia. pic.twitter.com/akTtrSnbdy

— Bitcoin Magazine (@BitcoinMagazine) November 4, 2025

EXPLORE: Top 20 Crypto to Buy in 2025

Can BlackRock’s BTC ETF Shake Up The Australian Crypto Scene?

EBTC, VBTC, IBTC, and BTXX already manage between A$150 million and A$300 million each, with VanEck leading in trading volumes and Monochrome standing out for being the first to directly hold BTC. It now holds over 1,000 BTC worth A$188 million as of October.

(Source: Stockspot)

Meanwhile, industry insiders expect BlackRock’s IBIT to intensify the competition and boost market liquidity. The launch comes in as Australian regulators work across the board to bring crypto products into the mainstream financial system.

Also, the move follows BlackRock’s similar expansion in the UK, where its Coinbase-backed BTC ETP (Exchange Traded Product) debuted on the London Stock Exchange (LSE), reopening retail access after a regulatory ban that lasted years.

EXPLORE: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

Australia Tightens Crypto Rules As BlackRock’s iShares Makes Landfall

Australian Securities and Investment Commission (ASIC) is now tightening its rules around digital assets. Last week, it unveiled a set of new guidelines, according to which most crypto-related products, including stablecoins, wrapped tokens, tokenized securities, and even digital wallets from now on, will be classified as financial products.

Basically, any company that operates in Australia and offers these services must get a specialized license called an AFSL (Australian Financial Services Licence) by 30 June 2026.

Although BTC itself isn’t classified as a financial product, associated services that let traders invest in BTC, like ETFs, might fall under this rule going forward. To give the companies affected by this change some time to reorganize, the ASIC won’t take enforcement actions till June next year.

(Source: BlackRock)

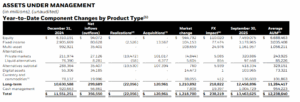

At the global stage, BlackRock’s iShares platform continues to dominate. In the last quarter alone, it pulled in $205 billion in new investments, with $17 billion coming from its digital asset ETFs.

So far this year, crypto-related inflows have hit $34 billion. This pushes total assets under management (AUM) to nearly $104 billion.

At the same time, iShares Bitcoin Trust, launched less than two years ago, has become BlackRock’s most profitable ETF. It generated $245 million in annual fees and is outperforming some of its legacy funds.

I wrote last wk that $IBIT could hit $100b this summer, but hell, could be this month. Thx to recent flows + overnight rally it's already at $88b. At only 1.5yrs old is now 20th biggest in US, 7th biggest for BlackRock (and their #1 most profitable ETF). Un-freaking-believable. pic.twitter.com/r5FLwKSE7j

— Eric Balchunas (@EricBalchunas) July 14, 2025

EXPLORE: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

Key Takeaways

- BlackRock Australia BTC ETF launches mid-November, challenging top players in a booming market.

- ASIC reclassified crypto as financial products, requiring mandatory licenses by June 2026.

- iShares Bitcoin Trust becomes BlackRock’s most profitable ETF, generating $245M in annual fees

The post BlackRock Eyes BTC Spot ETF Market In Australia: Can It Hold Its Own Against Competition? appeared first on 99Bitcoins.