Coinbase is not your ordinary crypto exchange. Even when most of today’s Ethereum killers were concepts, the ramp helped traders and investors bet big money on 1000X coins. In 2025, Coinbase is not an exchange but a thriving ecosystem powering some of the industry’s core infrastructure.

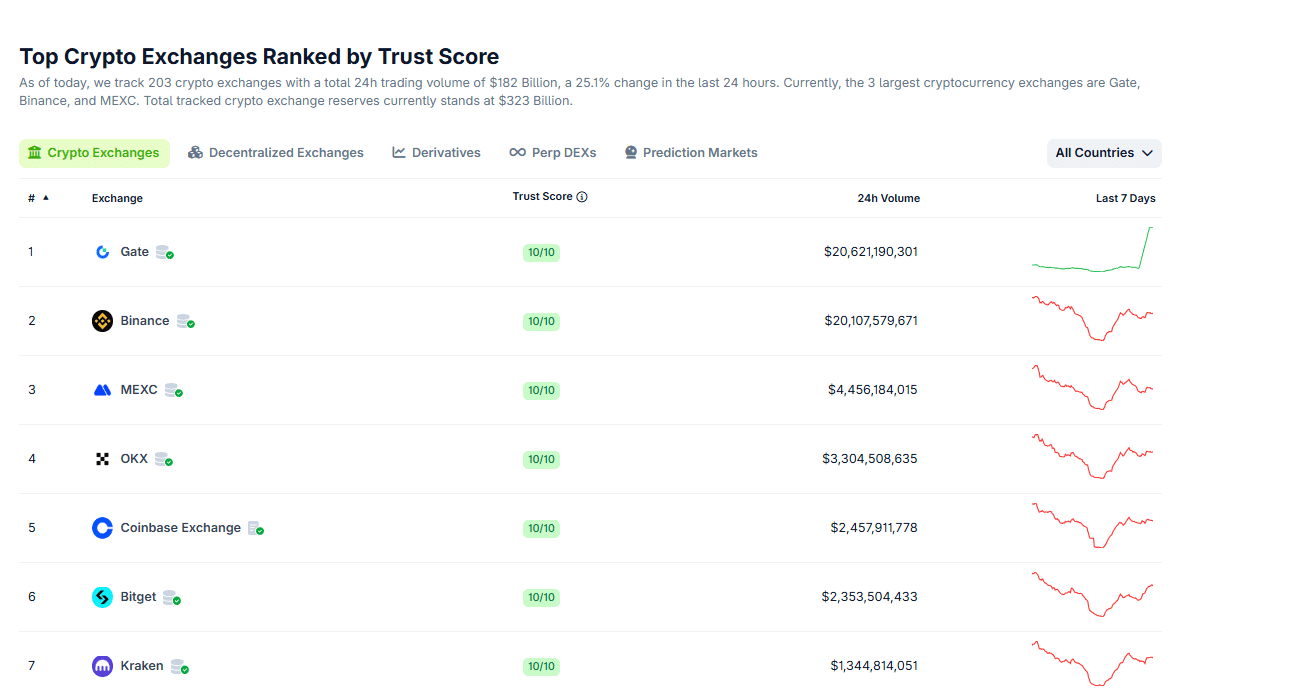

Their leaning on compliance might have pushed it down the market rankings, allowing Binance to shine. Even still, Coinbase is a crypto powerhouse. As of late October 25, Coinbase generated over $2.4 billion in 24-hour trading volume, which is roughly 10X less than what Binance and Gate processed within that window.

(Source: Coingecko)

While trading volume is a metric that most analysts use, they should be wary of wash trading and other manipulation tactics used to pump exchange activity in exchanges outside the United States and the EU. Coinbase’s very pro-regulation stance helps clean it from wash trading, a vice that prevented the SEC from approving spot Bitcoin and Ethereum ETFs for years.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

Coinbase Q3 2025 Earnings: What to Expect?

As crypto grew, so did Coinbase, and the demand for more services and offerings equally exploded. The exchange buckled under the pressure, expanding the number of coins to include some of the top Solana meme coins.

Check your phone – the wait is over.

Explore millions of assets, moments after they launch, right from the Coinbase app.

DEX trading is live for all U.S. users (ex. NY).

Coming soon: more assets, more networks, more countries. pic.twitter.com/XryNvDXkdL

— Coinbase

(@coinbase) October 8, 2025

Coinbase also went public, and COIN is now trading on NASDAQ with a market cap of over $91Bn.

After GOOGL, Meta, and Microsoft released their Q3 2025 earnings reports yesterday, on October 28, the investment community is eager to see whether Coinbase will beat analysts’ expectations tomorrow, on October 30.

In a press release earlier this month, on October 10, when some of the best cryptos to buy suddenly plunged, Coinbase Global said it would publish its Q3 2025 shareholder letter, which includes financial results, tomorrow, October 30, after market close.

Overall, analysts are cautiously optimistic but still expect a strong year-on-year rebound from a lackluster Q2 2025. The consensus is that revenue could grow to over $1.76Bn, up +44% YoY. Meanwhile, net income could balloon to over $400M, a +150% YoY change.

Drivers could include rising crypto prices, which also impact trading revenue generated from, among others, subscriptions and institutional offerings, including staking and custody. Investors should also watch the number of monthly transacting users (MTUs), which may grow to over 8.5M, and revenue from Circle, the USDC issuer.

DISCOVER: Best New Cryptocurrencies to Invest in 2025

What Happened In Q2 2025? Is Coinbase Heavily Reliant on Circle For Revenue?

In Q2 2025, Coinbase’s MTUs missed estimates by +10%. Therefore, an expansion in Q3 2025 could signal a revival in retail trading activity. At the same time, as one analyst notes, a big chunk of Coinbase’s revenue came from Circle. This isn’t good.

The analyst observes that a big chunk of Coinbase’s $1.5Bn revenue came from its strategic investments.

Although Coinbase’s “investments” were completely hidden from Q2 2025 earnings, it was revealed that Coinbase only made one investment in Circle, which matured in Q2 2025.

He added that if the total revenue from Circle is deducted (at $1.47Bn, which remains paper gains until the exchange sells), Coinbase’s income will fall drastically, leaving them with an operating income of $30M.

Some VERY INTERESTING numbers from @Coinbase's latest quarterly earnings.

Mind you this company is worth $90 BILLION DOLLARS.

Company had $2.5B in revenue and $1.5B in operating expenses. Leaving us with an net income of $1B.

Impressive right? Not when you dig deeper. pic.twitter.com/cuxwhsz2r3

— Derivatives Monke (@Derivatives_Ape) October 28, 2025

Circle, it should be noted, went public in June 2025, and shares surged post-IPO, effectively inflating the value of Coinbase’s holdings, since they own a minority stake in the USDC issuer.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

Coinbase Q3 2025 Earnings Report: What to Expect?

- Coinbase is a mega exchange with millions of users

- The Q2 2025 report was underwhelming

- Coinbase has a minority stake in Circle

- Will Coinbase beat expectations in Q3 2025?

The post Coinbase COIN Earnings Report: What To Expect? Will Circle Save COIN? appeared first on 99Bitcoins.