This past week, Aave V3 on the Ethereum mainnet experienced its highest daily liquidations since early February, coinciding with significant market volatility. According to Galaxy Research, approximately $98.6 million in collateral was liquidated between April 6 and 7, following a similar trend earlier in the year when around $211.2 million was liquidated during the initial […]

This past week, Aave V3 on the Ethereum mainnet experienced its highest daily liquidations since early February, coinciding with significant market volatility. According to Galaxy Research, approximately $98.6 million in collateral was liquidated between April 6 and 7, following a similar trend earlier in the year when around $211.2 million was liquidated during the initial […]

Source link

Chain Articles > Blog > Bitcoin > Ethereum Drives Highest Daily Liquidations on Aave V3 Since February Amid Market Volatility

Ethereum Drives Highest Daily Liquidations on Aave V3 Since February Amid Market Volatility

posted on

You Might Also Like

[LIVE] Ethereum, Solana, BNB Outperforming The Crypto Market: Best Crypto To Buy Now As BTC and XRP Stall

Jack DaviesJuly 26, 2025

It’s the weekend again, and it is the time again to reflect back what the week has brought to the...

Coinbase’s Bitcoin Cache Hits 2.9M—Here’s Who’s Behind the Stack

Jack DaviesJuly 26, 2025

Over the last 83 days, Coinbase Global, Inc. saw a significant influx of bitcoin, taking in around $23 billion worth...

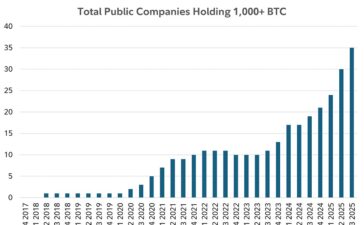

Bitcoin Goes Corporate: 35 Public Companies Now Hold Over 1,000 BTC Each

Jack DaviesJuly 26, 2025

Bitcoin is no longer just an experiment for enthusiasts or retail investors. It has gone corporate. As of mid-2025, more...

GENIUS vs. CLARITY: How Two Crypto Laws Aim to Regulate Digital Assets

Jack DaviesJuly 26, 2025

Disclaimer: This article is for informational purposes only and does not constitute financial advice. BitPinas has no commercial relationship with...