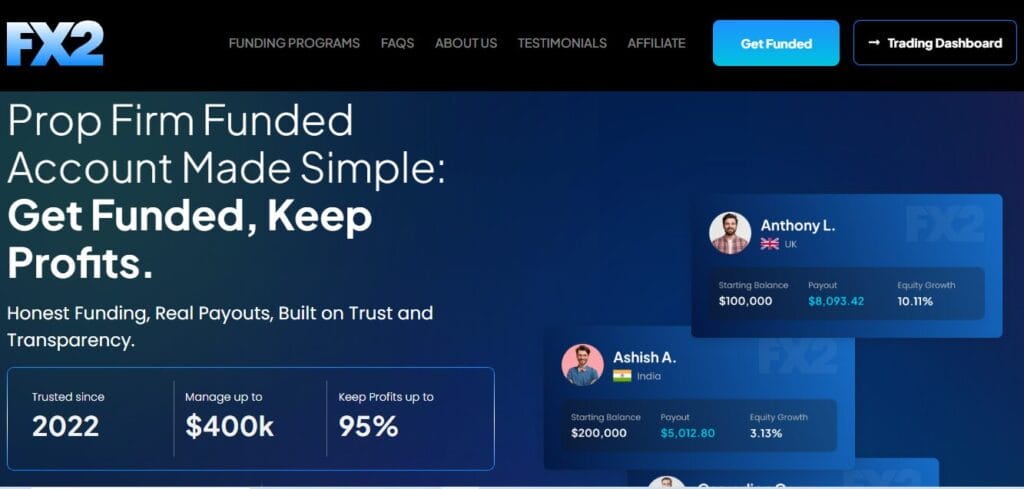

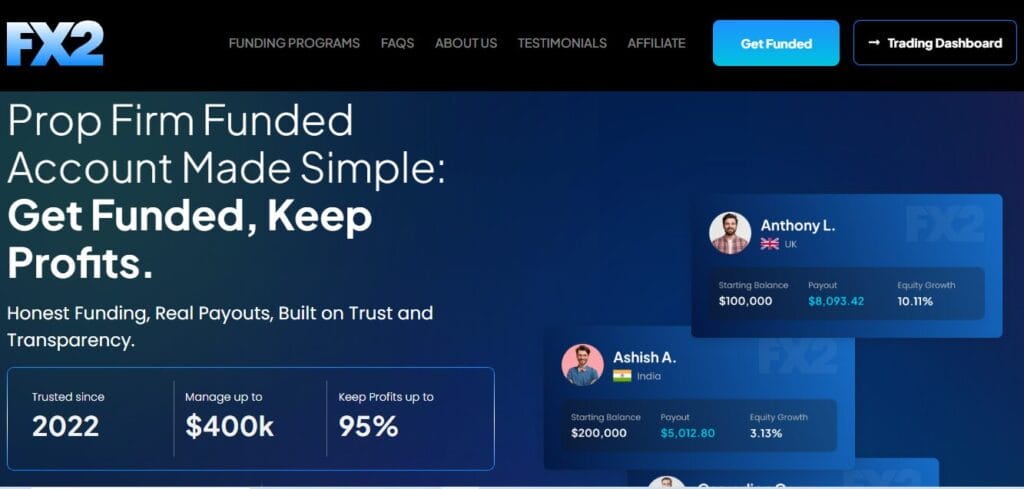

The world of proprietary (prop) trading continues to evolve as traders seek flexible ways to access capital without risking their personal funds. Among the many firms in the space, FX2 Funding also acts as a prop trading firm as it provides simulated capital to skilled traders lacking personal funds to leverage their abilities. Read on this FX2 Funding Review to learn more about the firm as a proprietary trading firm.

What is FX2 Funding?

Founded in November 2022 by David Dombrowsky, Jacob Scott, and Yoel Bender, the firm operates across 150+ countries with a mission centered on transparency and trader support.

FX2 Funding serves as an intermediary, connecting undercapitalized traders with trading capital. FX2 Funding, LTD is registered in Saint Lucia, and its services are available in various global jurisdictions. As of now, the firm boasts a community of 7,000+ active members, aiming to cater to different trading styles, from scalping to swing trading.

FX2 Funding: Key Features

- FX2 Funding offers account sizes ranging from $10,000 to $200,000, which are split into five tiers. The Profit Split Structure is progressive: First payout: 75/25 (trader/firm), Second payout: 80/20, Third payout and onwards: 85/15.

- Traders can choose to upgrade their split to 95/5 at checkout. The account scaling mechanism allows traders to increase their account size by 10% for every 10% profit and withdrawal, with a maximum scaling cap of $1,000,000. No re-evaluation is required to scale up.

- Trading Platforms and Leverage– FX2 Funding supports multiple trading platforms, including cTrader (proprietary label with direct liquidity), DXTrade with GooeyTrade white-label and MatchTrade.

- Leverage available by program type is as follows for evaluation programs (1-Step, 1-Step Pro, 2-Step) Forex: 1:100, Metals: 1:30, Indices: 1:25, Energies: 1:10 and Crypto: 1:2.

- Instant Funding: Forex & Metals: Up to 50:1, Indices: 10:1, Energies: 5:1, Crypto: 2:1.

- Commission Structure– cTrader: $4 per lot (Forex/Metals); Commission-free (Indices/Energies/Crypto), DXTrade: $7 per lot (Forex/Metals); Commission-free (Indices/Energies/Crypto).

- Payout Processing– FX2 Funding guarantees 48-hour payout processing with an additional $100 bonus if this timeframe is exceeded. Payouts can be requested 7 days after the first trade, and the standard payout frequency is every 14 days. An accelerated option is available, offering payouts every 5 days.

How FX2 Funding works: A step-by-step guide

1. Choose Your Challenge

Visit the FX2 Funding website and select a funding program and account size that fits your trading goals. Challenges vary by drawdown rules and profit targets.

2. Pass the Evaluation

Complete the chosen evaluation by meeting the profit target and adhering to the platform’s risk rules (drawdown limits, daily drawdown, etc.). Upon successful evaluation, you unlock a funded account.

3. Trade a Funded Account

Once funded, you trade using FX2’s simulated capital with real market conditions. There is no fixed time limit to complete the evaluation process.

4. Request Payouts

After qualifying, you can request profit payouts:

- Standard: every 14 days starting after the first trade.

- Optional add‑on: every 5 days.

- Profit split defaults at 80/20 and may be increased up to 95% with an add‑on.

5. Optional Add‑Ons and Scaling

FX2 Funding offers add‑ons at checkout (e.g., higher profit split, faster payouts). Accounts may also scale based on performance.

FX2 Funding: Challenge Structure Overview

| Feature | 2-Step Challenge | 1-Step Challenge | 1-Step Pro | Instant Funding (Advanced Level) |

|---|---|---|---|---|

| Evaluation Type | Two phases | Single phase | Single phase | No evaluation |

| Drawdown Type | Fixed | Trailing | Fixed | Fixed |

| Maximum Drawdown | 10% | 6% | 6% | Defined per plan |

| Daily Drawdown | 4% | 4% | 4% | Defined per plan |

| Profit Target | Step 1: 8%Step 2: 5% | Defined in program | Defined in program | No profit target |

| Time Limit | No limit | No limit | No limit | No limit |

| Minimum Trading Days | None | None | None | None |

| Leverage | Up to 1:100 (Forex) | Up to 1:100 (Forex) | Up to 1:100 (Forex) | Up to 1:100 (Forex) |

| Profit Split | 80% standard | 80% standard | 80% standard | 80% standard |

| Payout Timing | Every 14 days (5 days with add-on) | Same | Same | Same |

| Reset Discount | 10% | 10% | 10% | Not applicable |

| Account Sizes | 5K, 10K, 25K, 50K, 100K | Same | Same | Same |

1. Evaluation Types

FX2 Funding provides multiple evaluation formats so traders can choose a structure that fits their risk style and trading approach:

- 2-Step Challenge

Uses a 10% fixed maximum drawdown that applies across both evaluation steps. - 1-Step Challenge

Uses a 6% trailing drawdown, where the drawdown level moves based on account performance. - 1-Step Pro

Uses a 6% fixed drawdown, designed as a more advanced single-step evaluation option.

2. Account Sizes

Traders can select from five available account sizes: 5K, 10K, 25K, 50K, and 100K. All account sizes follow the same core evaluation rules. Profit targets, drawdowns, and limits scale proportionally based on the selected account balance.

3. Core Challenge Rules

FX2 Funding applies a standardized rule set across its challenge programs.

Profit Target

Traders must reach the required profit target using closed trades without violating any rules.

- For the 2-Step Challenge:

- Step 1 requires an 8% profit

- Step 2 requires a 5% profit

For single-step programs, the profit target is defined within the selected program during checkout.

Maximum Drawdown

The maximum total loss allowed during the evaluation is 10% of the starting balance for the displayed programs.

If account equity falls below this level, the challenge is failed.

Daily Drawdown

A 4% daily loss limit applies, calculated on the higher of equity or closed balance.

Breaching this limit on any trading day results in challenge termination.

Leverage

Leverage is determined by instrument type, with up to 1:100 on forex, and lower leverage on other asset classes.

Time Limits and Minimum Trading Days

There is no time limit to complete the evaluation.

There is also no minimum number of trading days, allowing traders to progress at their own pace.

4. Profit Split and Payouts

Once a trader passes the evaluation and moves to a funded account:

- The standard profit split is 80/20 in favor of the trader.

- Optional add-ons at checkout can increase the trader’s share up to 95%.

- Payout requests can be submitted every 14 days after the first trade.

- With a payout frequency add-on, withdrawals can be requested every 5 days.

5. Retry Discount

If a trader fails a challenge, FX2 Funding offers a 10% discount on a retry of the evaluation.

Also, you may read Alpha Capital Review

Support and Community

Community Engagement– FX2 Funding promotes an active trader community, including a presence on Discord, where traders from over 150 countries can connect. This community serves as a place to interact with like-minded traders, share insights, and stay updated on promotions and announcements.

Customer Support Channels and Availability- FX2 Funding provides multiple ways for traders to get assistance:Email, WhatsApp, Live chat and Discord. Traders can connect with the team for questions related to program details, account setup, payouts, or general inquiries. Support is available Monday to Friday, 08:00–20:00 GMT.

Safety and Security

KYC and AML Compliance

FX2 Funding operates in compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) policies. Identity verification is required, particularly before withdrawals can be made.

Verification Procedures

After passing an evaluation, traders must complete KYC verification and sign the trader contract before receiving a funded account. The verification process may take up to 48 hours.

Payout Guarantees and Processing

FX2 Funding guarantees fast payout processing as a core part of its offering. Payouts are processed within 48 hours, and the firm has never missed a payout. Traders can request payouts regularly after fulfilling program requirements, with options for standard or accelerated payouts.

Terms and Conditions Disclosures

FX2 Funding monitors accounts for compliance and reserves the right to request additional verification, including video interviews, to ensure the integrity of accounts. Failure to comply with verification may result in account suspension or termination.

FX2 Funding vs Fundedfast: Which Prop Firm Fits You Best?

| Feature / Criterion | FX2 Funding | FundedFast |

|---|---|---|

| Company Focus | Prop firm offering funded accounts with simple evaluation programs and real payouts. | Prop firm offering funded accounts with challenges and scalable capital. |

| Founded / Branding | Trusted since 2022; emphasis on ethics and transparency. | “One chance can change everything” with simple challenge entry. |

| Account Sizes (Examples) | Up to $400 K capital. | Accounts from $3 K to $400 K. |

| Profit Split | Default up to 80%; can increase to up to 95% with add‑on. | Up to 90% profit share on funded accounts. |

| Evaluation Structure | Multiple evaluation types (1‑Step, 1‑Step Pro, 2‑Step, Instant Funding). | One‑Phase and Two‑Phase challenge options. |

| Profit Target Approach | Profit targets and drawdowns vary by program. | Pass challenge by meeting profit target while respecting risk limits. |

| Scaling Capital | Offers scaling based on performance and add‑ons. | 5‑Level Scaling Plan—capital increases up to 2.5× as milestones are hit. |

| Payout Frequency | Payouts can be requested every 14 days; optional every 5 days with add‑on. | Weekly payouts implied; details from main site show scaling and funded account payouts. |

| Leverage | Offers leverage such as 1:100 for forex; varies by instrument. | Up to 1:200 leverage advertised. |

| Trading Platforms | cTrader and DXTrade platforms supported. | Challenges use platform interface (details on challenge pages). |

| Community | Active Discord community (7 000+ members) and global reach. | Official Discord community and trader networking. |

| Support | Customer support via live chat, WhatsApp, email (Mon–Fri). | Support and community engagement noted, including networking and learning. |

| Challenge Costs | Evaluation fees shown within program tables; add‑on costs apply. | Challenges start as low as $49. |

| Minimum Time Limits | No time limits to complete evaluation. | Challenges also show unlimited time period. |

| Geographic Restrictions | Does not offer services to U.S./Canada residents. | Services subject to jurisdictional restrictions. |

| Compliance & Security | KYC/AML compliance required before funded account access. | KYC verification is required after passing the challenge for funded accounts. |

| Key Selling Point | Up to 95% profit retention with quick payouts and diverse programs. | Up to 90% profit share with scalable account through multi‑level plan. |

Also, you may read FundedFast: A Quick Analysis

Who Should Consider FX2 Funding?

Ideal Candidates

- Experienced traders lacking personal capital

- Traders seeking to scale their account sizes progressively

- International traders in supported countries

- Traders comfortable with no time limits and no minimum trading days

Less Suitable For

- Novice traders who need educational support

- Risk-averse traders uncomfortable with daily drawdowns and maximum drawdown limits

- Passive traders who cannot maintain the minimum 30-day activity requirement

- Residents of the United States, Canada, or OFAC-designated countries (excluded due to geographic restrictions).

Also, you may read Is HyroTrader Worth It? An In-Depth Review

Partnership and Affiliate Programs

- Program Purpose: The FX2 Funding Affiliate Program allows partners to earn recurring commissions by referring new traders to FX2 Funding.

- Who Can Join: Suitable for trading influencers, educators, group administrators, and anyone who can drive clients to FX2 Funding.

- Commission Structure: Up to 20% revenue share for referred clients. 15% commission on the first 50 traders referred. 20% commission for each referral after the first 50.

- Earning Rules: Affiliates earn on revenue generated from clients they refer. $100 minimum commission payout threshold. Affiliates can request payouts instantly once they reach the minimum, with no limits on the number of requests.

- Referral Credit: Affiliates receive credit when a user creates an account through the affiliate’s referral link or code.

- Program Positioning: FX2 Funding promotes this as one of the most competitive affiliate commission structures in the industry, emphasizing long‑term earnings from referred clients.

Also, you may read Top 10 Crypto Affiliate Programs – Earn Passive Income

Conclusion

FX2 Funding is a trader-centric platform offering competitive scaling, progressive profit splits, and reliable payout processing. The platform is ideal for experienced traders looking to access capital without personal financial risk. With refunds on evaluation fees, diverse platforms, and a global reach (150+ countries), FX2 Funding offers a great deal of flexibility to traders at all levels.

Success on the platform depends on trader discipline and strategy. FX2 provides the infrastructure and funding, but profitability remains the trader’s responsibility.

Who is the founder of FX2 Funding?

FX2 Funding was co-founded by David Dombrowsky, alongside co-founders Jacob Scott and Yoel Bender, with a mission to build a transparent and trustworthy prop firm focused on funded trading challenges and profit payouts.

What brokers and liquidity providers does FX2 Funding use?

FX2 Funding aggregates pricing and liquidity from multiple third-party brokers and liquidity providers. The composition of these providers may change, but this multi-source approach is intended to offer competitive pricing and execution without reliance on a single provider.

What trading products are available?

You can trade financial products streamed by FX2’s liquidity providers. This typically includes forex pairs and CFDs for indices, commodities, metals, and cryptocurrencies—subject to availability on the platform you use.