According to its latest filing with the US Securities and Exchange Commission (SEC), Goldman Sachs has significantly increased its bitcoin ETF investments and is now holding over $1.5 billion. It has also reported an additional $760 million exposure to bitcoin ETF options.

The bank has been steadily buying more and more of the bitcoin ETFs and, showing growing institutional interest in bitcoin.

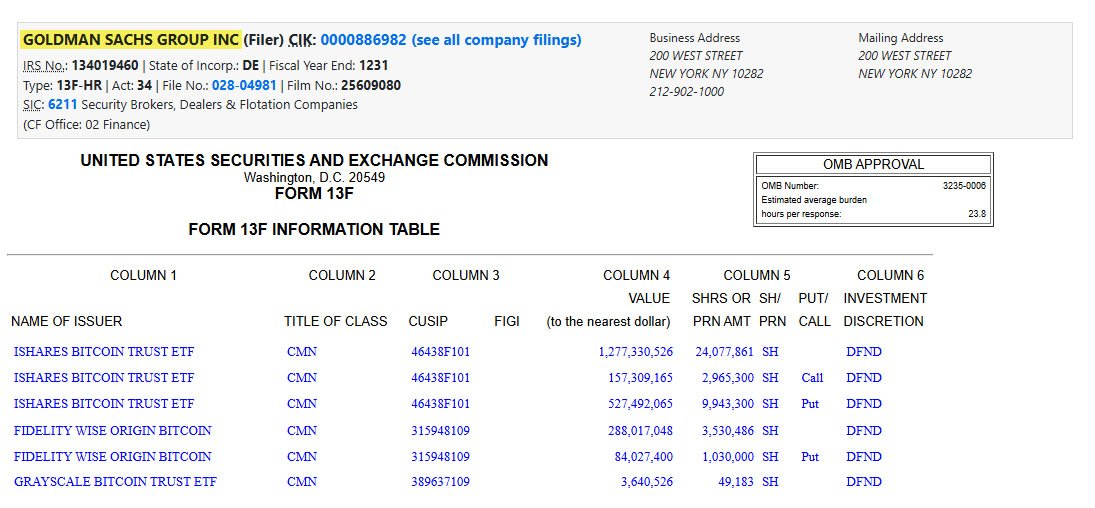

As of December 31, 2024 Goldman Sachs had $1.56 billion in these investment vehicles, up from $710 million in the previous quarter. That’s an increase of over 120%.

Most of Goldman’s Bitcoin ETF investment is in BlackRock’s iShares Bitcoin Trust (IBIT) where it holds 24.07 million shares worth around $1.27 billion. That’s an 88% increase from the previous quarter.

It also holds $288 million in Fidelity’s Wise Origin Bitcoin Trust (FBTC), a 105% increase from the previous quarter.

Related: Goldman Sachs Becomes 2nd-Largest Institutional Holder of BlackRock’s IBIT

Goldman Sachs is also using options trading. It has a total of $760 million in options, $527 million in IBIT put options and $157 million in IBIT call options. This allows the bank to hedge risks while playing the market.

It also closed its positions in smaller ETFs like ARK 21Shares’ ARKB, Bitwise’s BITB, Invesco Galaxy’s BTCO and WisdomTree’s BTCW. This suggests a more concentrated approach, favoring the largest and most liquid bitcoin investment products.

Goldman Sachs increased its bitcoin position during extreme market volatility. During this period, bitcoin rose to an all-time high of $109,000 just before the US Presidential inauguration.

According to Apollo, the total market cap of bitcoin ETFs is now over $114 billion with BlackRock’s IBIT leading the pack at $56.5 billion in assets under management.

Despite being involved in Bitcoin, Goldman Sachs CEO David Solomon is still being cautious about digital assets.

In a recent interview, Solomon called bitcoin an “interesting speculative asset” but said it doesn’t threaten the US dollar. He also said the bank can’t hold bitcoin directly. “If the regulatory structure changes, we would evaluate that,” Solomon said at the Reuters Next conference.

Goldman’s bitcoin exposure is part of a broader trend of institutional adoption. Other big banks like Morgan Stanley and Bank of America are also buying bitcoin ETFs for their clients.

Goldman’s latest move means Wall Street has flipped on bitcoin investments. The firm’s bitcoin ETF positions and options trading indicate they’re taking a measured approach to digital assets.

With regulatory talks ongoing and institutional demand up, the bitcoin investment landscape is changing fast. Goldman may not own bitcoin itself but its growing ETF positions mean institutional involvement is starting to gain traction.

As BlackRock’s head of digital assets said “Bitcoin adoption is still in its early stages,” but with big players like Goldman Sachs getting in, institutional investments could increase in the future.