Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Buying Solana at $148 looked like a mistake, but with strategy and patience, it became a lesson in conviction, not delusion.

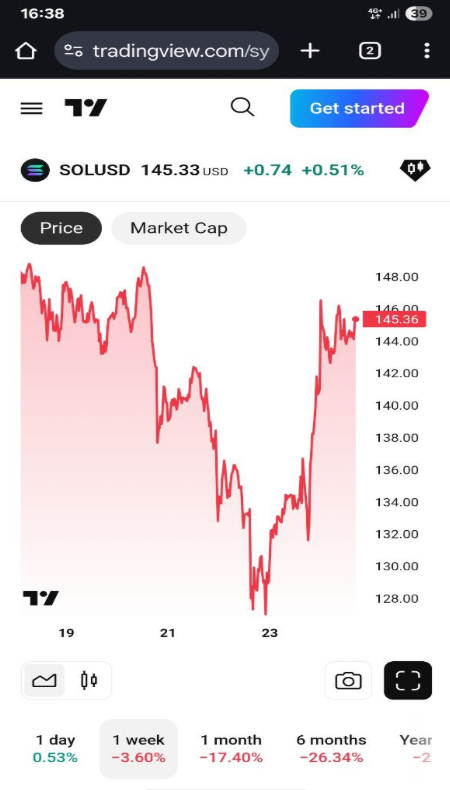

In crypto, there’s a fine line between conviction and delusion. Buying Solana at $148 can be a conviction. But as the price slides to $126, someone may question whether they have just paid for a front-row seat to yet another brutal lesson in volatility.

This is the story of how someone went from red to breakeven — not through luck, but through strategy, patience, and a clear-eyed understanding of the market I was operating in.

The entry: High hopes, higher risk

Imagine an investor who entered SOL at $148 when momentum was strong, when Bitcoin was climbing, Ethereum was regaining dominance, and Solana — with its relentless developer activity and growing DeFi footprint — seemed poised to retest $180 resistance.

The market, however, had other plans.

Within days, macro headwinds took hold. ETF rumors stalled. Traders rotated back into BTC. And Solana, like much of the altcoin market, lost altitude fast. It didn’t pause until it was sitting nearly 15% lower, at $126.80.

The drawdown: Holding, not hoping

The mistake most traders make when facing a red position is treating it like a problem to be solved with emotion. This can be approached with a framework.

As the following questions:

- Has the core thesis changed?

- Is this a liquidity flush or a trend reversal?

- Are there fundamentals that justify staying in the trade?

The answers can be clear.

Solana’s June health report showed a network that hadn’t gone down in nearly 16 months — no small feat considering its past struggles. Governance participation was up. Developer tooling was improving. New protocols were launched.

The recovery blueprint

At $133, the investor averages down. Not recklessly — about 30% more capital. They built a ladder and added again near $127. That brings their average entry to $137.50.

But this isn’t just about chasing breakeven. The drawdown was a wake-up call. It is a reminder of how fragile even the strongest assets can be once they’ve matured. Solana is no longer a moonshot — it’s a blue chip with blue-chip risks.

That’s when they start hunting for asymmetric plays again. Something high-conviction, high-upside and they come across XYZVerse (XYZ).

Why XYZ?

XYZVerse could be where real upside might lie because of the following reasons:

- Early-stage tokenomics with a tight float and aggressive incentive design.

- Backed by a community-first launch with meme culture but layered with real mechanics.

- A clear roadmap to utility and planned integrations in DeFi and gaming.

Last but not least, it is a cheap entry point. Currently, $XYZ is selling at $0.003333, and the team behind the project seems to be closing the presale soon. The team plans to list its token at $0.1. Sounds quite ambitious, yet possible if they manage to raise the necessary funding. So far, they have secured over $14 million.

This gives the same feeling Solana once did — when it was trading under $5 and felt like a crazy idea, but look at it now.

TL;DR: Buying SOL at $148 hurt. Seeing it at $126 felt worse. But managing that drawdown with strategy, not sentiment, was arguably the only way to break even and obtain a better edge moving forward. For interested investors who are still chasing blue chips for 2x returns, that’s fine. But those who are ready to go back to where the exponential plays live — it’s projects like XYZ they should be paying attention to.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.