The world of meme-coin and on-chain trading has grown rapidly, and traders now rely on specialized tools to find new tokens, analyze market trends, and execute trades quickly. Four popular platforms in this space are Padre, GMGN, Axiom, and Alph.

Although all of them help users trade fast-moving crypto assets, each platform has a different focus, unique features, and specific strengths. The goal is to make everything simple and easy to understand, even if you are new to on-chain trading.

Padre vs GmGn vs Axiom vs Alph: Overview

| Platform | Main Type | Main Interface | Main Focus | Primary Chain Focus |

|---|---|---|---|---|

| Padre | Meme-coin Trading Terminal | Web-based trading terminal | Fast multi-chain meme trading + clean execution | Multi-chain (Solana, Ethereum, BNB, Base) |

| GMGN | Analytics + Trading Assistant | Web dashboard / Mobile / Telegram | Early discovery, smart money tracking, signals | Mainly Solana |

| Axiom | Full DeFi Trading Suite | Web trading interface | Cross-chain trading (spot, perps, yield) | Multi-chain (ETH, Solana & others) |

| Alph | AI-powered Trading & Analytics | Web platform | AI-driven discovery, copy trading, wallet analytics | Multi-chain meme markets |

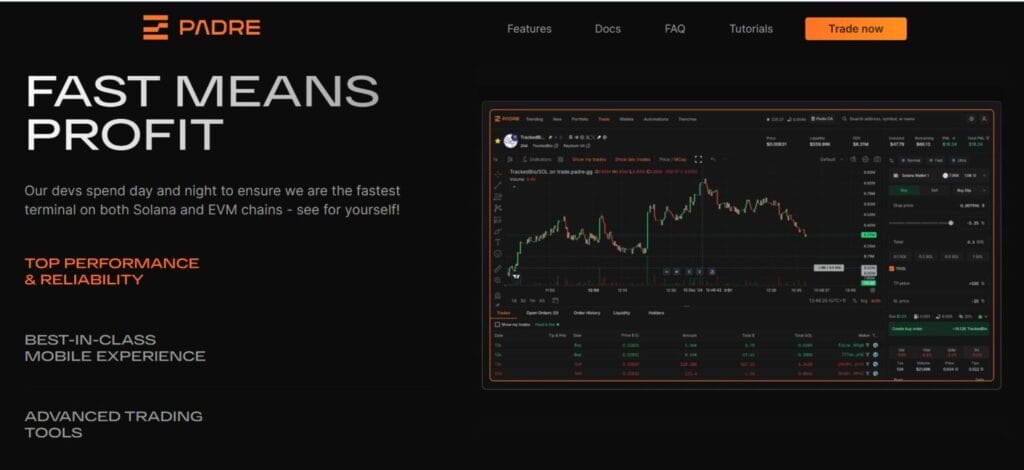

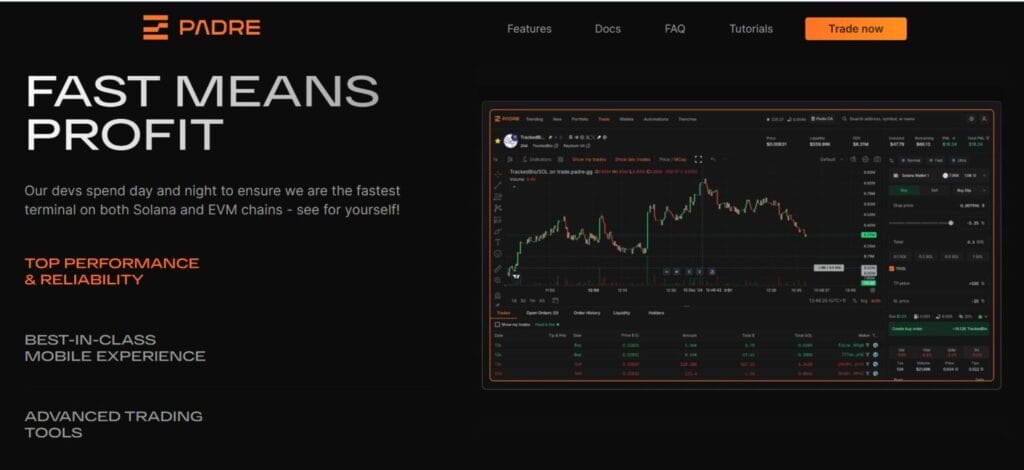

Padre

Padre is a multi-chain cryptocurrency trading terminal compatible with Ethereum, Solana, BNB Chain, and Base. It delivers rapid trade execution, supports advanced order functions such as limit and stop-loss orders, and includes wallet-tracking capabilities. The platform features an intuitive interface, fee cashback for high-volume traders, and a self-custodial model that protects user privacy. Designed to accommodate both novice and experienced traders, Padre prioritizes decentralization, though users should remain mindful of certain transparency considerations.

Key Points

- Padre is a multi‑chain trading terminal built for meme coin trading.

- Padre was founded in 2023. The company behind Padre is based in Guernsey (with headquarters in the United Kingdom).

- Trades on Padre are very fast, with smart‑routing and execution optimised to reduce latency and failed transactions.

- The platform offers advanced order types beyond simple swaps including limit orders, stop‑loss, take‑profit, trailing stops, and auto‑exit strategies.

- Padre offers a fee cashback, traders can get up to 35% cashback via referral/invite codes on trading fees, which benefits frequent/high‑volume traders.

GMGN

GMGN is an on-chain trading platform specializing in meme coins and newly launched tokens across networks such as Solana, BNB Chain, and Base. It provides tools for monitoring tokens and wallets, sniping new token launches, and copy trading, allowing users to mirror the strategies of experienced or “smart money” traders. Built for traders pursuing high-risk, high-reward opportunities, the platform emphasizes speed, early alerts, and automation to help users act quickly without depending entirely on manual research.

Key Points

- GMGN is an on-chain trading platform focused on meme tokens and newly issued assets across multiple blockchain networks.

- The platform formally launched and became publicly available in 2024.

- It provides real-time token discovery and sniping, allowing users to quickly spot and trade newly launched tokens.

- Although GMGN provides security checks, it does not guarantee safety. Even “safe‑looking” meme tokens can crash or turn out poorly.

- Success depends heavily on market timing, token‑distribution analysis, liquidity, and luck, not just on using a tool.

- Due to their speculative and volatile nature, meme coins and new token launches should only be approached with risk capital.

Also, you may read GMGN vs Ave.ai

Axiom

Axiom is a web-based crypto trading platform that combines trading, analytics, and asset management into one interface. It allows users to trade, discover tokens, track wallets, and use leveraged trades without needing multiple tools. Axiom is non-custodial, meaning your crypto stays in your wallet, and is designed for fast, flexible trading, especially in volatile markets like meme-coins or new token launches.

Key Points

- Axiom is a non‑custodial crypto trading terminal built for meme coin and DeFi traders.

- It launched in 2024 and is backed by Y Combinator, which gives it more credibility among new crypto platforms.

- The platform supports both spot trading (swaps) and perpetual (perp) / margin trading via integration with a perp exchange (e.g., Hyperliquid), so you can trade with leverage if you want.

- There is no native token for Axiom instead, the platform uses a fee + reward/rebate model rather than a complicated tokenomics.

- Axiom is unregulated (like many DeFi platforms) — while its founders are public and it has reputable backing, it doesn’t have formal regulatory licensing, so users bear responsibility and risk themselves.

Alph

Alph.ai is a technology platform designed to help businesses use artificial intelligence more easily, without needing great technical skills. The platform focuses on making data analysis, prediction, and automation accessible to non-experts. Users can upload their data, build machine-learning models, and generate insights through a clean, guided interface. Alph.ai aims to speed up decision-making, reduce manual work, and help teams turn raw information into meaningful action. It is often used in industries such as finance, retail, logistics, and operations, where understanding data quickly is important.

Key Points

- Alph is a decentralized AI-powered crypto trading platform that helps users discover high-potential tokens and execute trades with integrated analytics and wallet tools.

- Alph officially launched in 2024, establishing itself within the decentralized finance ecosystem and securing strategic funding.

- The platform uses Multi-Party Computation wallet technology to avoid single-point key storage and reduce security risks.

- Its main offerings include AI-driven token discovery, smart-money tracking, advanced wallet analytics, rapid decentralized trade execution, and cross-chain trading tools accessible via web and Telegram.

- Alph is best suited for active crypto traders, especially meme-coin users, who need fast execution and AI-driven analytics.

Also, you may read 8 Best No-Code Machine Learning Tools

Padre vs GmGn vs Axiom vs Alph: Fees Structure

Padre

- On the official site of Padre, the publicly stated platform fee is “up to 1% per transaction.”

- That means for every successful trade (buy or sell) on Padre, there is a platform fee of up to 1%.

- On top of the platform fee, you also pay normal on-chain costs like gas, slippage, and any priority/MEV fees, depending on the network.

GMGN

- GMGN charges a flat 1% handling fee per transaction.

- No monthly subscription fee for platform access.

- Additional on-chain/network costs (e.g., SOL priority fees or gas fees) apply, which are separate from platform trading fees.

Axiom

- Axiom uses a tier-based trading fee system that generally ranges from about 0.95% to 0.75% net per trade.

- There is no subscription fee, but blockchain gas or priority fees still apply.

- Higher trading volume unlocks lower fees and higher cashback rewards.

Alph

- Users pay on-chain fees (gas, slippage, liquidity costs) inherent to executing trades on decentralized networks; these are not set by Alph.ai but by the blockchain.

- There are referral, commission, and rebate programs with multi-level rewards that can reduce effective costs, but no clearly published, authoritative standard per-trade fee rate is available.

Padre vs GmGn vs Axiom vs Alph: Security Information

| Platform | Custody Model | Private Key Handling | Primary Security Measures | Main Security Risks / Notes |

|---|---|---|---|---|

| Padre.gg | Non-custodial | User-controlled, encrypted (Turnkey infrastructure) | Multi-sig wallets, anti-MEV protection, encrypted passphrases, transaction simulation | No widely published third-party audit; relies on underlying infrastructure security |

| GMGN.ai | Mixed (depends on wallet / bot use) | Wallet-dependent (Telegram or external wallets) | Contract risk checks (honeypot, rug, liquidity scans) | High phishing risk via fake bots; security depends heavily on user behavior |

| Axiom Trade | Non-custodial | User retains full key control | Air-gapped key management, MEV protection, private transaction routing | Limited public detail on audits; security largely tied to non-custodial design |

| Alph.AI | Non-custodial | MPC (no single complete private key) | Multi-Party Computation, keyless wallet architecture | Newer platform with limited long-term security track record |

Conclusion

Padre, GMGN, Axiom, and Alph serve different types of on-chain traders: Padre focuses on fast, professional-grade execution. GMGN emphasizes early token discovery and high-risk strategies, while Axiom provides a broad, all-in-one DeFi trading suite. Alph offers AI-driven analytics and automated insights. The best choice depends on whether a trader prioritizes execution speed, discovery, versatility, or intelligent decision support.

Frequently asked questions (FAQs)

Which platform is best for beginners?

Axiom and Padre are generally more beginner-friendly due to their clean interfaces and all-in-one or execution-focused design, while GMGN and Alph require higher risk awareness.

Which platform is best for meme-coin trading?

Padre and GMGN are the most meme-coin–focused, with Padre excelling in execution and GMGN in early discovery and sniping.

Which platform is best for AI-driven trading?

Alph is the strongest option for AI-powered discovery, analytics, and copy trading.

Can users trade on multiple blockchains with these platforms?

Yes, Padre, Axiom, and Alph support multi-chain trading, while GMGN is primarily focused on Solana.