Under Gary Gensler’s leadership, crypto and DeFi protocols, including Uniswap (UNI), were heavily scrutinized. Centralized ramps and exchanges were hit first. Binance, Kraken, and Coinbase were sued for millions, sometimes billions of dollars.

The United States Securities and Exchange Commission (SEC) alleged they enabled the trading of unregistered securities and, in some instances, facilitated money laundering. Binance settled for over $4 billion, with Changpeng Zhao stepping down as CEO, while others, like Coinbase, opted to fight.

Yesterday, February 25, the United States SEC officially closed its investigation into Uniswap, one of the world’s largest DeFi platforms. Crucially, the agency decided against enforcement action.

This move is a major victory for DeFi, a vital sub-sector providing liquidity for crypto projects serving users. By dropping the case, the SEC acknowledged that the DEX operates within the law.

Most importantly, it validates its offerings, potentially making UNI one of the best cryptos to buy in 2025.

Uniswap Wins Over SEC: DEX Markets In The Clear?

The probe into Uniswap began in 2021 and escalated with a Wells notice in April 2024. While a Wells notice signals the intention to sue, it doesn’t guarantee a lawsuit, it’s a warning.

The agency claimed Uniswap was operating illegally, engaging in unregistered broker activity, and issuing unregistered securities.

Uniswap Labs, the team behind the decentralized exchange (DEX), countered that its protocol—autonomous, powered by self-executing smart contracts on public ledgers like Ethereum and BNB Chain—didn’t fit the SEC’s accusations. Its decentralized nature, they argued, rendered the agency’s claims inapplicable.

As expected, the Wells Notice against Uniswap sparked debate.

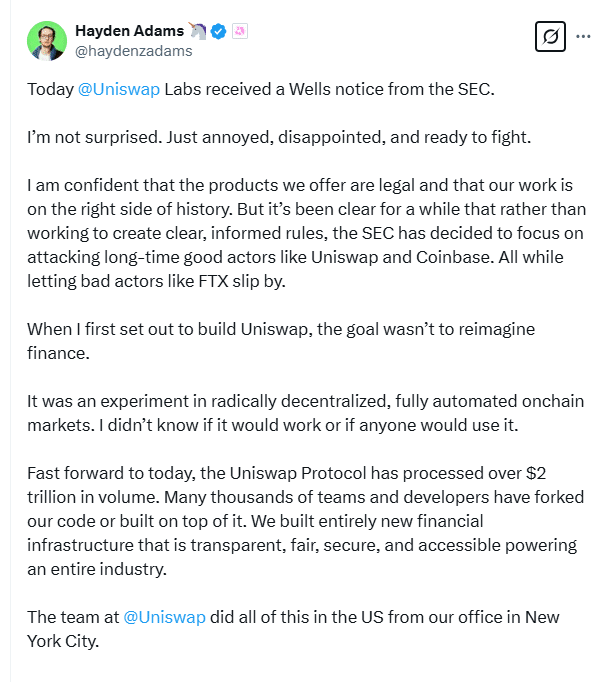

Hayden Adams, the founder of Uniswap, expressed disappointment but said he was ready to fight. He stated on X that the SEC was targeting legitimate projects while overlooking frauds like FTX.

(Source)

The FTX collapse in November 2022 forced crypto prices lower, dragging Bitcoin below $16,000.

After months of pushback—including a 40-page rebuttal from Uniswap—the SEC dropped the case. This confirms that Uniswap operates outside the agency’s regulatory framework, a win for both the protocol and the broader industry.

In Uniswap’s view, the new United States SEC leadership now recognizes that there is a “more effective path to protecting American consumers.”

For DeFi projects under scrutiny, this sets a precedent. With the case collapsing, it suggests that open-source, smart contract-based platforms aren’t legally financial entities.

Past rulings bolster this—like the 2023 Risley v. Uniswap Labs decision, where a judge ruled decentralized protocols like Uniswap fall beyond the SEC’s jurisdiction. Going forward, Uniswap said it is open to dialogue and assisting regulators and lawmakers in “developing clear, sensible laws and rules for new technology like DeFi.”

Wrong Timing? UNI Price Bears Target $7 Bottom

While this “structural” victory is vital, it arrives during a turbulent time for crypto, with bears in control. Bitcoin and the broader market are sliding.

At press time, the total crypto market cap is down 4% to around $2.95 trillion.

Bitcoin is inching toward $90,000, while UNI, the governance token priming Uniswap, is under pressure, retreating to early November 2024 levels.

Having erased most of Q4 2024 gains, UNI risks dipping below $7 in the coming days.

EXPLORE: The History Books Will Remember Crypto 2025: But What’s The Best New Crypto to Buy?

Join The 99Bitcoins News Discord Here For The Latest Market Updates

United States SEC closes case against Uniswap, wrong timing for UNI?

- United States SEC drops case against Uniswap

- Is this a win for DeFi?

- UNI prices under pressure

The post SEC Closes Case Against Uniswap: DeFi Wins, But Is the Market Timing Wrong? appeared first on 99Bitcoins.