The so-called yen carry trade returned to the spotlight after the recent $4,000 cryptocurrency market flash crash, following Japanese government bond yields reaching historic highs. Learn how expectations of rate hikes in Japan affect investments in risk assets worldwide. Yen Carry Trade: How Japan Acts as an Engine for Worldwide Liquidity The yen carry has […]

The so-called yen carry trade returned to the spotlight after the recent $4,000 cryptocurrency market flash crash, following Japanese government bond yields reaching historic highs. Learn how expectations of rate hikes in Japan affect investments in risk assets worldwide. Yen Carry Trade: How Japan Acts as an Engine for Worldwide Liquidity The yen carry has […]

Source link

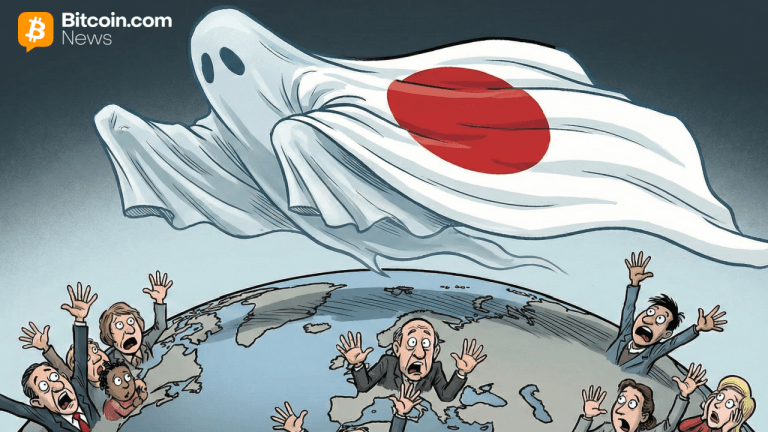

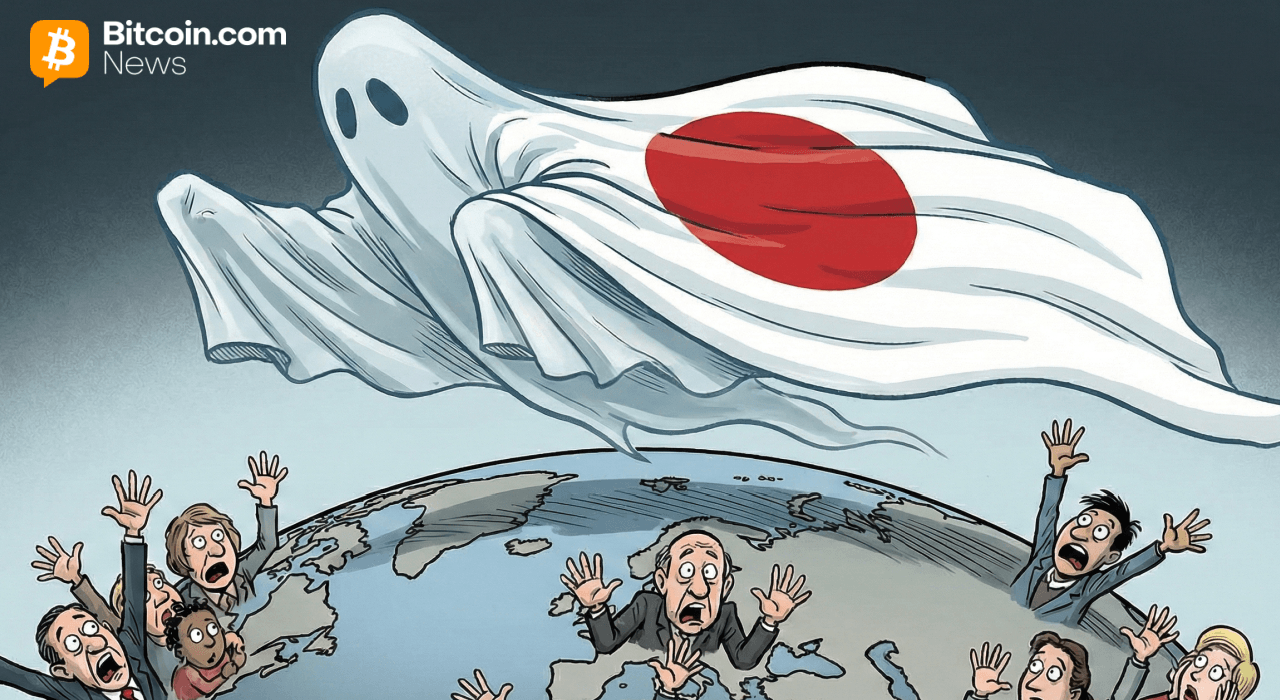

Chain Articles > Blog > Bitcoin > The Yen Carry Trade Explained: How Japan Spooks Crypto and Stock Markets

The Yen Carry Trade Explained: How Japan Spooks Crypto and Stock Markets

posted on

You Might Also Like

NYSE Accelerates Crypto’s Path to Mainstream Capital With Expanding Public Listings

Jack DaviesDecember 16, 2025

NYSE tightened its grip on blockbuster IPOs while opening a clear, regulated route for crypto companies and digital asset products...

Coins.ph: Stablecoins Cut Costs and Speed Up Cross-Border Remittances

Jack DaviesDecember 15, 2025

Disclaimer: This article is for informational purposes only and does not constitute financial advice. BitPinas has no commercial relationship with...

AVAX USDT Battles To Hold $12: Will SEC-Avalanche Crypto Friendship Save AVAX Price?

Jack DaviesDecember 15, 2025

It is hard to believe that less than four years ago, AVAX USDT was trading in the triple digits, at...

What Is MNAV? The Investor’s Guide To Valuing Bitcoin Treasuries

Jack DaviesDecember 15, 2025

mNAV, or market net asset value, is a valuation metric that expresses the real-time economic value of a company’s bitcoin...