As prediction markets continue gaining global traction, traders are exploring platforms that offer different regulatory frameworks, market structures, liquidity models, and user experiences. While Polymarket dominates in decentralised, high-volume event trading, several strong alternatives cater to audiences seeking regulated environments, experimental governance, sports-focused ecosystems, or decentralised market creation. These alternatives collectively expand the prediction-market landscape by offering diverse event categories, oracle mechanisms, and technical architectures. Whether traders prioritise trustless execution, fiat on-ramps, custom market creation, or automated strategies, the platforms listed here provide compelling avenues for forecasting, speculation, and data-driven decision-making across global events and emerging digital ecosystems.

Top 10 Polymarket Alternatives

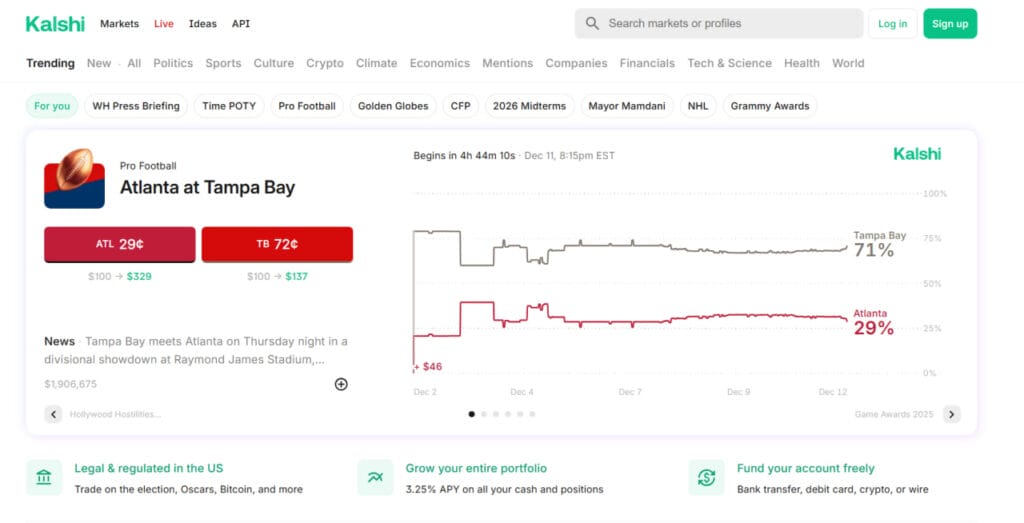

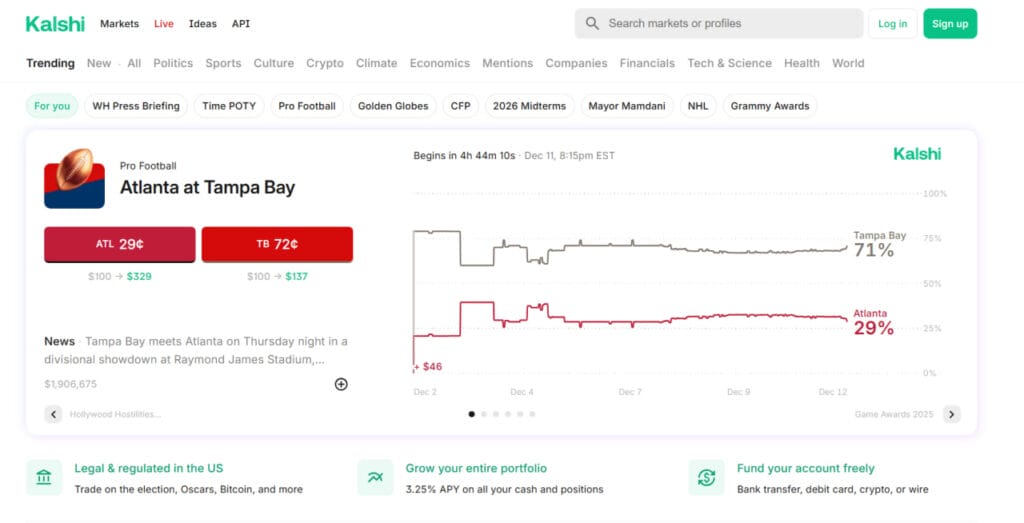

Kalshi

Kalshi is a fully regulated, CFTC-approved event contract exchange designed for traders who want institutional reliability and legal clarity. It specialises in markets covering U.S. politics, market indicators, and real-world events tied to measurable outcomes.

Key Features:

- CFTC Regulation: Operates legally in the U.S. as a regulated exchange, offering high-trust, compliant speculation.

- Economics-Focused Markets: Covers inflation, jobless claims, interest rates, GDP, and other macro indicators unavailable on decentralised platforms.

- Professional Trading Environment: Offers a clean interface, strong order execution, and reliable settlement processes.

- Clear, Unambiguous Resolution Rules: Ensures predictable outcomes and eliminates oracle risk.

- API Access for Quant Traders: Enables automated trading strategies and institutional participation using API.

Pricing: Charges per-contract trading fees; no subscription required.

Insight Prediction

Insight Prediction is a centralised prediction market offering fiat deposits, fast settlement, and a curated selection of political, sports, and entertainment markets.

Key Features:

- Fiat-Friendly Access: Allows users to trade without crypto, making onboarding simple for wider audiences.

- Curated Market Selection: Offers high-signal questions with clear rules and frequent updates.

- Centralised Resolution: Ensures consistent, timely settlement without blockchain delays.

- Transparent Dispute Handling: Provides clear channels for feedback or contesting unclear outcomes.

- User-Friendly Interface: Designed for accessibility and fast participation.

Pricing: Small fee applied to trades and settlement.

Zeitgeist (Polkadot)

Zeitgeist is a decentralised prediction protocol built on Polkadot, enabling high-speed, scalable markets with community-driven governance and futarchy capabilities.

Key Features:

- Polkadot-Native Performance: Benefits from fast execution and low fees through parachain integration.

- Custom Market Creation: Users can build their own markets with adjustable parameters and liquidity configurations.

- Futarchy Governance: Supports governance decisions driven by prediction markets, enabling experimental political systems.

- On-Chain Resolution: Ensures transparent, immutable settlement through decentralised verifiers.

- Staking & Incentives: Rewards participation through token-based incentives and network staking.

Pricing: Standard blockchain transaction fees; no subscription cost.

Omen

Omen is a decentralised, open-source prediction market powered by Gnosis conditional tokens. It offers trustless market creation, liquidity pooling, and transparent on-chain settlement with no central authority controlling outcomes.

Key Features:

- Conditional Token Architecture: Enables the creation of combinatorial markets and advanced event logic.

- Fully Permissionless Creation: Anyone can create markets without centralised approval.

- Liquidity Provider Flexibility: Allows LPs to supply liquidity and earn fees.

- DAO-Friendly Governance: Many communities use Omen for decentralised decision-making.

- Transparent On-Chain Settlement: Removes reliance on centralised dispute resolution or custodians.

Pricing: Trading fees set by liquidity providers; gas fees apply.

Azuro

Azuro is a modular prediction-market protocol specialising in sports-based markets. It provides decentralised liquidity pools, oracle integrations, and plug-and-play infrastructure for developers building sports prediction apps.

Key Features:

- Sports-Centric Design: Built specifically for sports outcomes, delivering stable liquidity and reliable odds.

- Liquidity Pool Framework: Uses stable, predictable liquidity engines to support large volumes.

- Developer Toolkits: Provides SDKs for building sportsbooks and betting applications.

- Oracle Integrations: Pulls accurate data from sports feeds for reliable settlement.

- Multi-Chain Expansion: Deployed across several EVM networks for broad accessibility.

Pricing: Protocol usage is free; application-level fees depend on the developer.

Augur

Augur is one of the earliest decentralised prediction markets, built on Ethereum. It allows fully permissionless market creation, decentralised reporting, and unrestricted topic coverage. Despite lower activity today, it pioneered many mechanics used by newer platforms.

Key Features:

- REP-Backed Reporting: Uses the REP token for decentralised dispute resolution.

- Unrestricted Market Topics: No central gatekeeping on what markets can be created.

- Historical Credibility: One of the longest-running decentralised markets, shaping the industry.

- On-Chain Transparency: All trades, disputes, and settlements occur on Ethereum.

- Community Governance: Users influence updates and reporting incentives.

Pricing: Ethereum gas fees; reporting fees vary by market.

BetSwirl

BetSwirl is a decentralised prediction and gaming platform offering simple, accessible markets for entertainment, crypto outcomes, and luck-based prediction mechanics. Its interface focuses on ease of use and fast participation.

Key Features:

- Fast, Simple Prediction Interface: Designed for quick participation without complexity.

- On-Chain Randomness (VRF): Ensures fairness for gaming modules.

- Crypto-Focused Markets: Includes predictions for memecoins, price brackets, and speculative outcomes.

- Community Engagement Tools: Built-in social and competition features.

- Multi-Chain Support: Deploys on multiple EVM networks for easy access.

Pricing: Small commissions are applied depending on the type of prediction.

Gnosis / UMA Conditional Token Ecosystem

This category combines Gnosis Conditional Tokens and UMA’s oracle mechanism, both foundational components in the prediction-market ecosystem. They enable developers and DAOs to create custom markets with flexible logic, transparent settlement, and decentralised reporting.

Key Features:

- Modular Market Architecture: Developers can build unique prediction platforms tailored to use cases.

- Optimistic Oracle Resolution: UMA’s oracle resolves outcomes through decentralised verification.

- DAO Decision Systems: Used for futarchy, treasury allocation, and governance signalling.

- Programmable Event Logic: Conditional tokens allow complex, multi-outcome scenarios.

- Backbone for Multiple Protocols: Many prediction platforms rely on this infrastructure.

Pricing: Gas fees and oracle fees apply; no platform subscription.

Kash Bot

Kash Bot is an automated prediction-market trading bot enabling hands-free participation. It analyses trends, executes strategies, and interacts with markets based on user-defined parameters or automated logic, making it a lightweight alternative to traditional trading platforms.

Key Features:

- Automated Execution: Places trades based on conditions, trends, or user-defined logic.

- Cross-Market Compatibility: Works across multiple prediction platforms.

- Beginner-Friendly Setup: Simple onboarding with prebuilt strategies.

- Hands-Free Trading: Ideal for users who want passive or semi-automated participation.

- Performance Tracking: Monitors success rates and adjusts strategies accordingly.

Pricing: Basic features are free; premium automation tiers may require a subscription.

Limitless Exchange

Limitless Exchange is a decentralised trading platform offering high-frequency, automated, and real-time prediction exposure through advanced liquidity mechanisms. Its interface is optimised for rapid speculation and market efficiency.

Key Features:

- High-Frequency Trading Support: Designed for rapid speculation and fast-moving markets.

- Innovative Liquidity Engine: Ensures deep, dynamic liquidity for stable pricing.

- Decentralised Settlement: No central authority controls market outcomes.

- Category Diversity: Includes markets spanning crypto, sports, politics, and more.

- Trader-Focused Interface: Built for speed, technical users, and rapid decision-making.

Pricing: Trading fees apply; no subscription required.

Comparison Table

| Tool | Best For | Core Strength | Unique Feature | Pricing |

|---|---|---|---|---|

| Kalshi | Institutional & regulated traders | CFTC-regulated event contracts | Legally compliant forecasting markets | Per-contract trading fees |

| Insight Prediction | Casual traders & fiat users | Easy fiat access & curated markets | Decentralised market creators | Small fee on trades |

| Zeitgeist | Decentralized market creators | Polkadot-based scalable markets | Futarchy + on-chain governance | Standard blockchain fees |

| Omen | Decentralized PM users | Permissionless market creation | Gnosis conditional token architecture | LP-set fees + gas costs |

| Azuro | Sports prediction developers | Sports-focused liquidity framework | Developer-ready prediction infrastructure | Protocol is free; app fees vary |

| Augur | Decentralized purists | Ethereum-based permissionless markets | REP-driven dispute resolution | Gas + reporting fees |

| BetSwirl | Casual & entertainment predictors | Simple, fast prediction gameplay | Fusion of gaming + prediction markets | Small platform commissions |

| Gnosis / UMA Ecosystem | Developers & advanced builders | Modular market infrastructure | Oracle + conditional token toolkit | Gas + oracle verification fees |

| Kash Bot | Automated traders | End-to-end trading automation | Hands-free strategy execution | Free tier; premium automation options |

| Limitless Exchange | Active speculators | High-speed decentralized trading | Deep liquidity engine for rapid execution | Trading fee model |

Prediction markets have expanded beyond Polymarket, offering traders ecosystems tailored to regulation, decentralization, sports specialization, governance experimentation, or automated strategies. Kalshi provides institutional stability, while platforms like Omen and Zeitgeist empower community-driven, trustless ecosystems. Tools such as BetSwirl and Limitless Exchange enable rapid participation, and developer frameworks like Gnosis/UMA support custom market creation. Automated tools like Kash Bot introduce new ways to trade without constant monitoring. Collectively, these ten alternatives offer broad diversity for traders seeking flexibility, innovation, and different risk profiles across global forecasting markets.

Frequently Asked Questions (FAQs)

What makes these platforms strong alternatives to Polymarket?

They offer varied advantages, including regulation, decentralization, sports-focused markets, customizable market creation, or automated trading tools, allowing traders to choose platforms that match their strategy and risk preferences.

Are these alternatives suitable for beginners?

Yes. Platforms like Insight Prediction and BetSwirl are beginner-friendly, while others like Omen, Zeitgeist, and Kalshi cater to experienced traders seeking technical, decentralized, or regulated environments.

Do these platforms support automated trading?

Kash Bot and Limitless Exchange offer automation features, enabling hands-free trading, strategy execution, and real-time reaction to market movements without constant manual monitoring.

How do decentralised alternatives differ from centralized ones?

Decentralized platforms rely on oracles, on-chain settlement, and open market creation, while centralized platforms provide easier onboarding, clearer resolution, and simpler user experience.

Are these prediction markets safe to use?

Safety depends on each platform’s structure—regulated markets like Kalshi offer compliance, while decentralized platforms prioritize transparency and self-custody. Users should review security, liquidity, and resolution policies.