Disclaimer: This article is for informational purposes only and does not constitute financial advice. BitPinas has no commercial relationship with any mentioned entity unless otherwise stated.

📬 Get the biggest crypto stories in the Philippines and Southeast Asia every week — subscribe to the BitPinas Newsletter.

From the US Stock Market to crypto liquidations, from the US SEC to Hong Kong, we’re tracking today’s most important crypto and AI stories as they unfold. This article will be updated throughout the day.

6:00 am: U.S. Stock Market Loses $1.11 Trillion Amid Macro Turmoil

U.S. equities suffered a staggering $1.11 trillion loss in market value today as surging inflation expectations and new trade tariffs sparked investor panic, sending the Dow down 1.2%, the S&P 500 off 1.6%, and the Nasdaq sliding 2.2%.

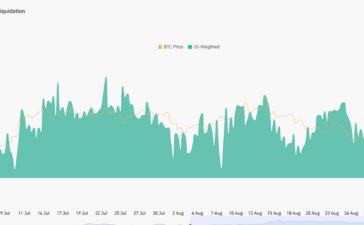

7:00 am: $946.93 Million Liquidated in 24 Hours Amid Broad Crypto Selloff

Nearly $947 million in crypto positions were liquidated over the past 24 hours, according to CoinGlass data, as market volatility intensified and Bitcoin slipped below $114,000. A total of 175,735 traders were rekt, with long positions accounting for $713.51 million and shorts for $92.39 million.

The largest single liquidation order occurred on Binance’s ETHUSD perpetual pair, valued at $13.79 million. ETH led liquidations with over $309 million, followed by BTC at $221 million and SOL at $50 million.

- PancakeSwap, PEPE, XRP, DOGE, and BNB were also affected. Bybit and Binance were the most impacted exchanges, processing $99.02 million and $62.74 million in liquidations respectively.

- Despite the selloff, overall 24-hour trading volume surged nearly 40% to $418 billion, while open interest fell 3.22% to $185 billion.

8:00 am: Saylor Says Strategy Could Hold 7% of All Bitcoin

Strategy co-founder Michael Saylor said the firm could eventually own as much as 7% of Bitcoin’s total supply, up from its current stake of over 3%, equivalent to 628,791 BTC worth $72 billion.

In an interview with CNBC, Saylor emphasized that while Strategy is not aiming to monopolize the asset, a 3–7% share of the 21 million total supply is a realistic goal. “We wouldn’t want to own all of it. We want everyone else to have their piece,” he said.

Strategy, formerly known as MicroStrategy, began its Bitcoin accumulation strategy in 2020 and has since become the largest corporate holder of BTC. Saylor reaffirmed that even an 80–90% BTC price correction wouldn’t force the company to sell.

This article will be updated throughout the day: U.S. Stock Market Loses $1.11 Trillion Amid Macro Turmoil | BitPinas Live Crypto Updates | Aug. 02, 2025

What else is happening in Crypto Philippines and beyond?