In its newest bitcoin acquisition act, Japanese funding agency Metaplanet has hit its goal of 10,000 Bitcoin (BTC) – a purpose it set for 2025 however achieved in simply six months.

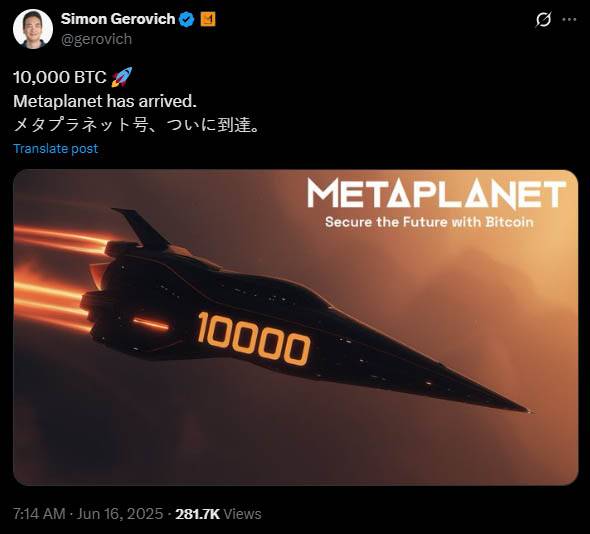

With this newest purchase of 1,112 BTC value roughly $117.2 million, the corporate has now surpassed U.S.-based big Coinbase, which holds round 9,267 BTC, and is now the ninth largest public bitcoin holder on the planet. CEO Simon Gerovich announced:

“Metaplanet has acquired 1,112 BTC for ~$117.2 million at ~$105,435 per bitcoin and has achieved BTC Yield of 266.1% YTD 2025. As of 6/16/2025, we maintain 10,000 BTC acquired for ~$947 million at ~$94,697 per bitcoin.”

Metaplanet began shopping for bitcoin in April 2024. Since then it has constructed its treasury by a sequence of purchases. The corporate’s bitcoin-first technique consists of elevating capital by bonds and fairness to fund extra bitcoin shopping for.

Simply earlier than hitting 10,000 BTC, the Japanese agency announced the issuance of $210 million in zero-interest bonds. These bonds, the 18th Collection, have been issued to EVO FUND and mature on December 12, 2025. The corporate stated these funds will probably be used to purchase extra bitcoin.

This newest buy was a part of the “210 Million Plan” which has helped Metaplanet increase large sums to purchase extra bitcoin.

As a part of this plan, the corporate additionally did a ¥770.9 billion (~$5.4 billion) fairness increase by the issuance of 555 million shifting strike warrants, the biggest ever public capital increase for bitcoin in Asia.

The market is responding properly to the agency’s technique. On the day of the announcement, its inventory rose 22% to shut at 1,895 yen. Yr-to-date, Metaplanet’s inventory is up 430%, outperforming many main Japanese firms.

Metaplanet’s efficiency can also be supported by its proprietary metric referred to as “BTC Yield”—a measure of the rise in BTC holdings relative to the corporate’s totally diluted shares. BTC Yield is 266.1% YTD and is creating shareholder worth.

With the 2025 goal achieved, Metaplanet goes even larger. The corporate is now concentrating on 210,000 BTC by the top of 2027 which is 1% of the entire bitcoin provide. To do this, they should purchase 200,000 extra BTC within the subsequent 18 months.

The phases of the brand new targets embody accumulation of 30,000 BTC by the top of 2025, and 100,000 BTC by the top of 2026.

Metaplanet is on the identical path as Technique, the U.S. firm led by Michael Saylor that began company bitcoin accumulation.

Metaplanet’s large strikes come as extra firms worldwide are including bitcoin to their company treasury.

Over 150 public firms now maintain over 800,000+ BTC, value over $100 billion. Current additions embody Mercurity Fintech Holding and K33, each of which have introduced new bitcoin-focused initiatives.